靴子落地跌加晶圓供不應求,芯片或開啟新一輪行情

z11月9日,A股芯片個股紛紛異動拉昇,截止發稿時,創業板捷捷微電、同益股份、兆日股份、澄天偉業漲停,4只個股漲幅超10%、主板斯達半導體、立昂微、新潔能漲停,超20只個股漲幅超5%。芯片ETF漲幅近4%,放量成交逾千億。

從盤面來看,前段時間醫藥、新能源等行業持續被機構資金抱團推高,近段時間這兩個熱門行業調整資金流出,去流入新的市場主線。

另一方面芯片已經調整小半年,芯片ETF從7月中旬高點1643.07點,調整至最低1255點附近,回撤最高近20%。

外圍環境改善成為此次芯片行情主要原因,11月初美國總統競選靴子落地,拜登上台既有可能取消近幾年中美貿易戰當中的給中國貿易關税。

科技芯片作為中美貿易衝突的主戰場,尤其是對華為的封鎖一直在持續。在美國總統競選靴子落地疊加拜登上台,外圍環境有望改善,芯片迎來行情。

另外一點,芯片市場8寸晶圓供需失衡再現,2020年10月,晶圓代工產能緊張加劇,交

期由正常的兩個月延長到了四個月。為了確保拿到足夠的產能,不少IC設計廠商已經開始預定 2021年的產能,部分長單甚至下到了2021年第二季度。同時,華潤微三季度以來8寸晶圓製造產線滿載,整體產能利用率在90%以上。

華虹半導體的8寸晶圓製造產線全部滿負荷運行。聯電的8寸晶圓製造產能已滿載至 2021年下半年,並且2020年下半年已針對新追加投片量的訂單漲價10%,在2021年第一季還會再調漲 8寸晶圓代工價格,其中,已經預訂的產能將調漲5-10%幅度,後續追加投片量的訂單,則以漲價後的價格再調漲1-2成左右幅度。

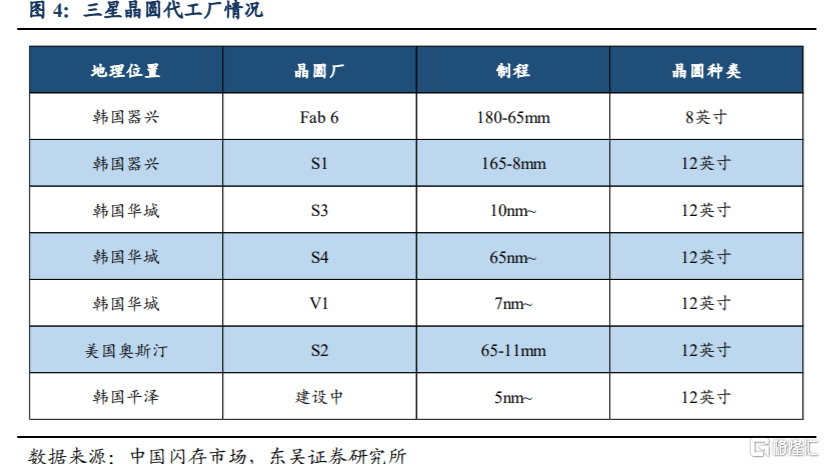

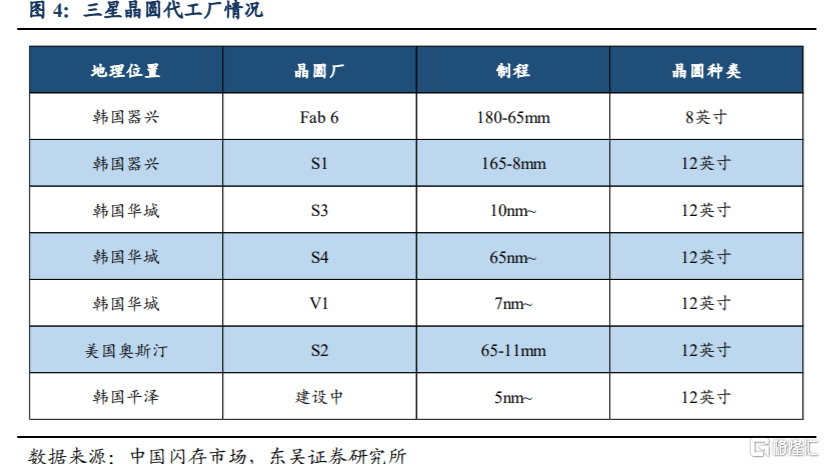

三星則表示針對8英寸產能供不應求的局面正考慮針對旗下的8英寸晶圓廠進行自動化擴建投資,以提高生產效率。

而且,隨着8寸晶圓製造產能供應不足,8寸晶圓代工廠也開始篩選新訂單和調整產品組合,優先生產電源管理IC、CIS、MCU等高毛利率產品。

而毛利率相對偏低的產品(MOSFET、顯示驅動IC等)在搶單中較為弱勢,除非客户加價購買產能,否則可能面臨產品交期延長甚至砍單,此類產能排擠效應和由此導致的漲價缺貨行情延着MOSFET、LCD 顯示驅動IC、電源管理IC進行傳導,並且目前已經推動MOSFET 和 LCD 顯示驅動 IC 的價格上行。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.