【中泰宏观】10月外贸点评:疫情错位,出口延续高增

作者:梁中华 李俊

来源:中泰宏观

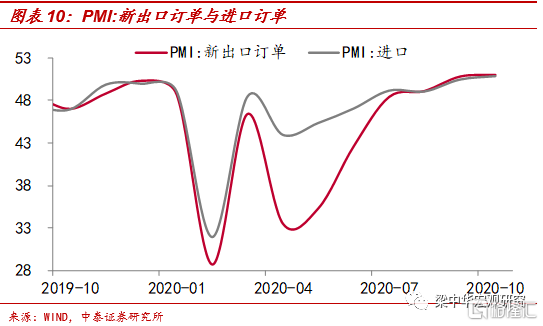

1、出口持续超预期。

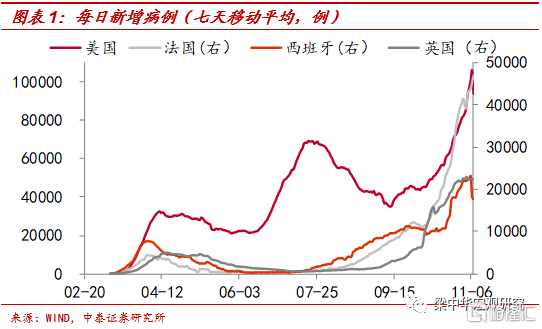

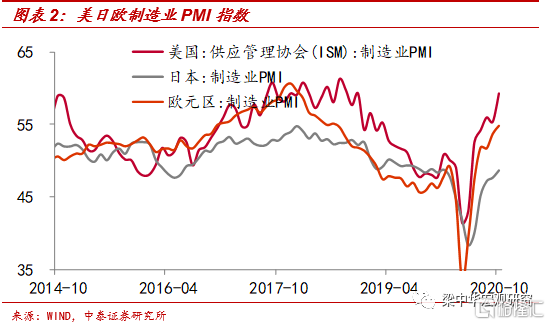

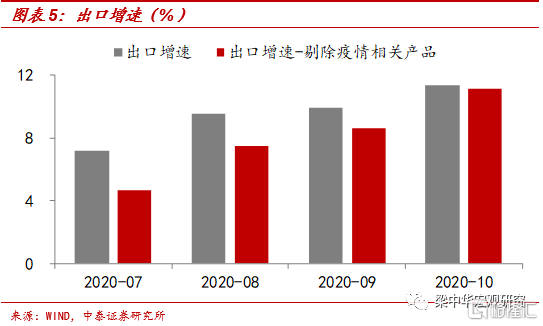

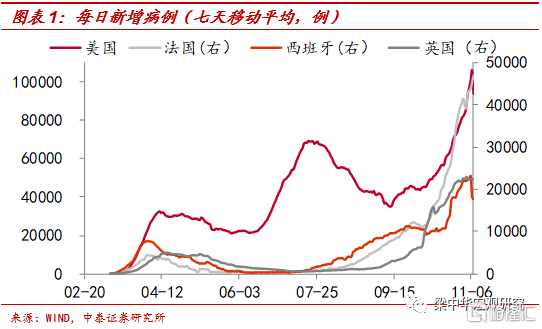

10月我国以美元计价的出口同比增速扩大至11.4%,超市场预期,较9月份再度上升1.5个百分点。出口的持续高增,主要与海内外疫情再度失控、供应链受到影响有关,当前欧洲疫情仍在持续爆发,多国每日新增病例创新高,英国、德国、法国等均重启封锁措施;而美国近一周新增病例也超10万,远高于第二波疫情,第三波疫情再度袭来。此外,海外复工也在持续推进,也加大了对我国产品的需求。

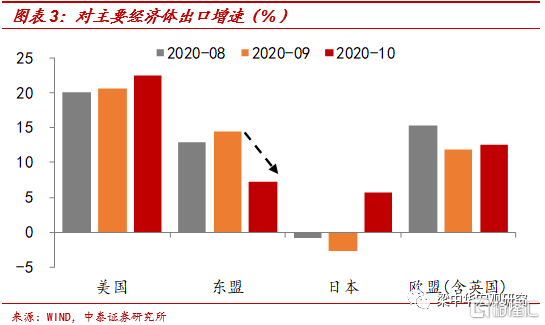

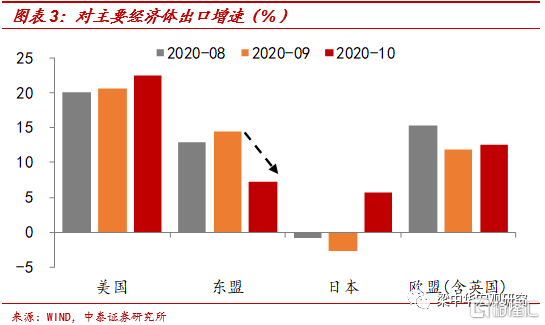

分国别来看,10月对主要经济体出口增速存在明显分化,对美国出口增速扩大至22.5%,较上月上升1.9个百分点,为18年2月以来新高,是主要贡献;对欧盟(包含英国)出口增速扩大至12.6%,较上月上升0.7个百分点,贡献也较大;对东盟出口增速回落至7.3%,较上月下滑7.1个百分点。而对日本出口增速由负转正至5.7%,较上月大幅上升8.4个百分点。

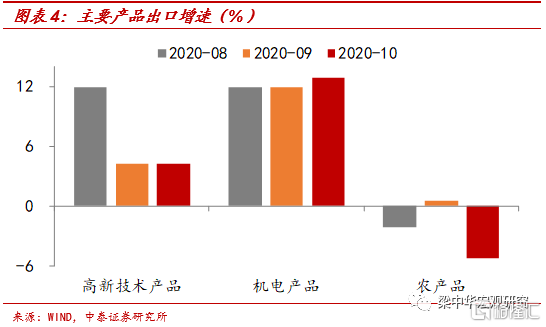

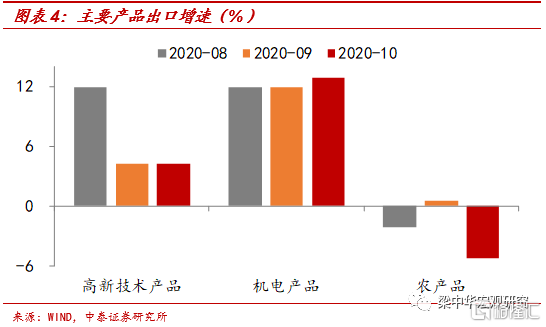

分产品来看,10月主要产品出口增速同样分化明显,机电产品出口增速为12.9%,较上月上升1.0个百分点;高新技术产品出口增速为4.2%,基本较上月持平;而对农产品出口增速则转负至5.2%,较上月下滑5.7个百分点。

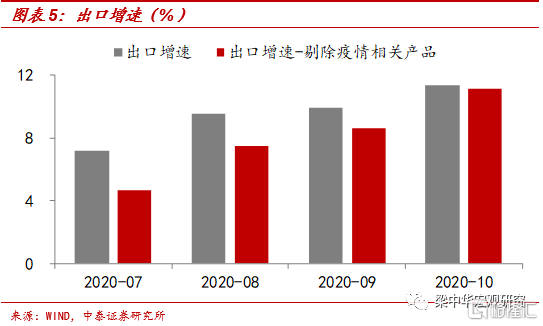

同时,我国疫情相关产品出口增速再度放缓,但仍有一定贡献,如10月医疗仪器及器械出口增速仍高达30.0%,较上月基本持平;纺织纱线、织物及制品出口增速回落至14.9%,如果剔除这些产品,10月出口增速为11.1%。

2、进口涨幅收窄。

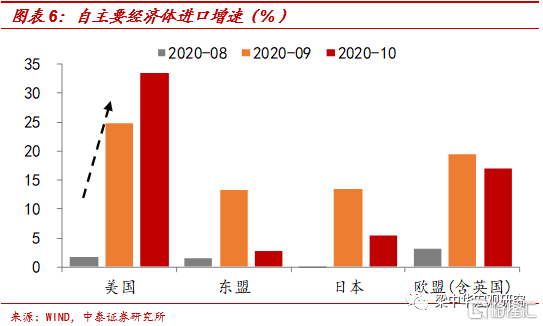

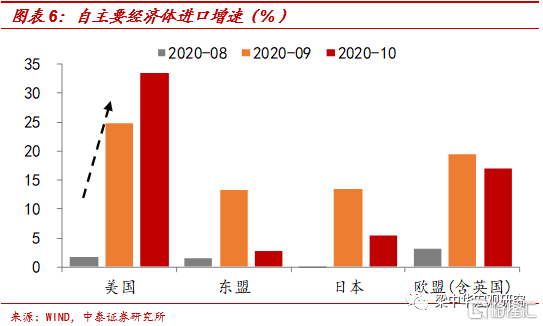

10月我国以美元计价的进口增速大幅回落至4.7%,较9月下降8.5个百分点。从美国进口增速仍在扩大,从上月的24.8%上升至33.4%,是主要贡献,这或与中美第一阶段贸易协议有关;而从其他经济体进口增速均在回落,尤其是自东盟进口增速回落了10.5个百分点。

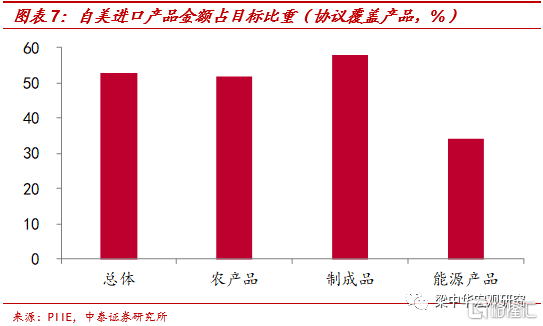

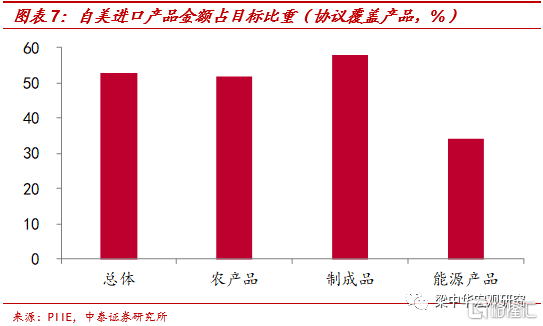

据PIIE测算,前9月我国自美进口协议中覆盖的产品金额占目标的5成多,其中农产品51.6%,制成品57.8%,能源产品34.3%,且10月农产品进口增速也高达增长22.3%。

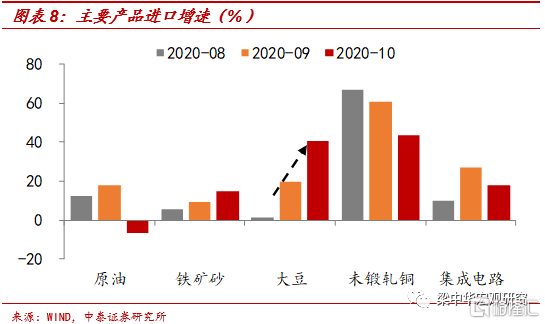

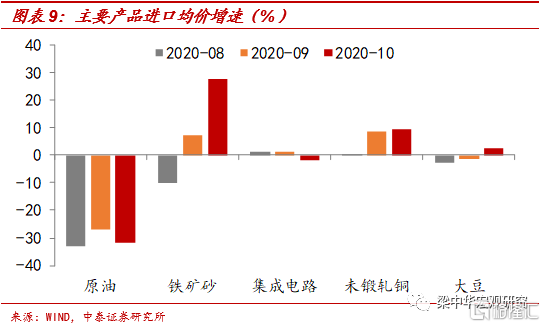

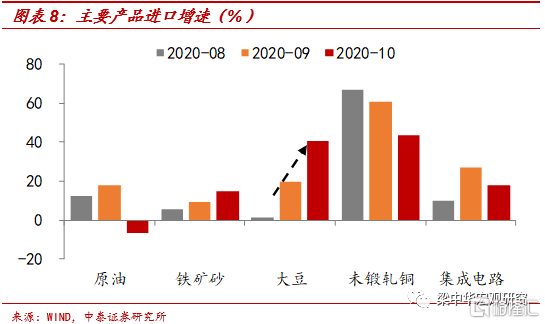

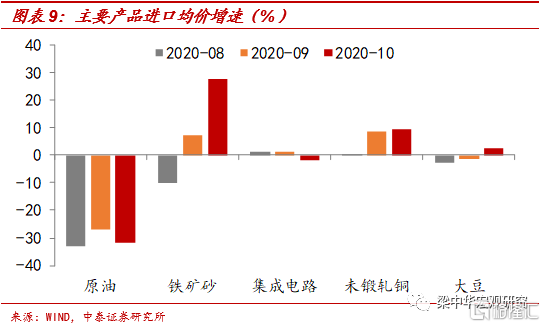

分产品看,原油4255.8万吨,同比转负至-6.5%,较上月下滑24.0个百分点,进口均价同比跌幅扩大至-31.5%;铁矿砂10674.2万吨,同比增速扩大至15.0%,进口均价为120.0美元/吨,同比大幅反弹至27.6%;集成电路485.1亿个,同比增速收窄至18.0%;未锻轧铜61.8万吨,同比增速收窄至43.8%,进口均价同比扩大至9.4%;大豆868.8万吨,同比增速扩大至40.6%,较上月上升了21.2个百分点。

3、疫情错位,出口仍有支撑。

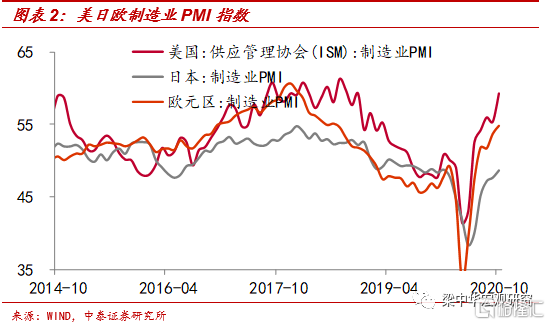

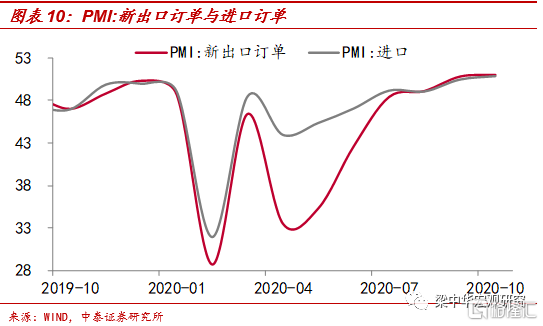

往前看,海外疫情依旧严峻,欧美疫情再度失控,每日新增病例仍在创新高,尤其是欧洲多国重启了封锁措施,海外经济恢复或继续放缓,对我国外需仍有拖累。此外,美国大选结果仍未揭晓,美国财政刺激方案谈判以及英国脱欧谈判等均陷入僵局,对我国外需也有一定干扰。

由于我国与海外疫情错位,复产复工较快,而海外产业链恢复尚需时日,所以外部对我国产品的进口需求会边际增加,对我国出口仍有较大支撑。

风险提示:疫情扩散,政策变动,贸易问题,全球经济降温。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.