在歐美股市經歷“黑色星期三”,海外市場一片慘淡的情況下,A股卻“風景這邊獨好”,走出了逆勢翻紅行情。

其中白酒板塊更是集體爆發,截至收盤,金徽酒、瀘州老窖漲停,ST捨得漲逾5%,五糧液漲4.2%,金種子酒、山西汾酒漲3%,貴州茅台漲0.7%。今世緣、順鑫農業等多股跟漲。

數據來源:同花順

數據來源:同花順

全天A股白酒板塊成交金額超過330億元,其中主力資金淨流入超過17億元。個股中,五糧液主力流入達12億元,瀘州老窖主力流入4.5億,在兩市全部個股中分別排名第一、第四位。白酒行情之火熱可見一斑。

數據來源:同花順

數據來源:同花順

業績驅動,績優股受追捧

10月以來,白酒概念指數累計漲近20%,能保持如此強勁的上漲勢頭,與業績因素密切相關。

近期各大酒企紛紛披露三季度業績,在昨日晚間4家發佈三季報的白酒公司中,酒鬼酒和瀘州老窖第三季度淨利潤分別大幅增長419%和52.6%。業績驅動下,瀘州老窖今日高開後快速漲停封板。

具體看4份財報數據,其中瀘州老窖、酒鬼酒業績同比均大幅上升。瀘州老窖淨利潤最高,第三季度營收39.6億元,同比增長14.5%;淨利潤16億元,同比增長52.6%;前三季度營收和歸母淨利潤分別為116、48.2億元,同比增長1.1%、26.9%。利潤大幅超出預期;

瀘州老窖財務摘要(萬元):

數據來源:IFinD

數據來源:IFinD

酒鬼酒淨利潤增幅最大。第三季度營收4億元,同比增長56.4%;淨利潤1.5億元,同比增長419%;前三季度實現收入11.3億元、同比增長16.5%,歸母淨利3.3億元、同比增長近80%。營收和淨利潤均超出預期;

古井貢酒與ST捨得業績同比略有下滑。古井貢酒前三季度營收80.7億元,同比下滑1.6%;歸母淨利15.4億元,同比下滑11.7%;第三季度營收25.5億元,同比增長15.1%;淨利潤5.1億元,同比增長3.9%;

古井貢酒財務摘要(萬元):

數據來源:IFinD

數據來源:IFinD

ST捨得前三季度營收17.6億元,同比下降4.3%;歸母淨利潤3.1億元,同比增長2.6%。

第三季度營收7.4億元,同比增長18.4%;淨利潤1.5億元,同比增長24.9%。

另外,今日五糧液股價漲逾4%、現報250元創歷史新高,盤中市值一度超過9800億元,逼近萬億大關。五糧液將於今日盤後發佈三季報。

分化加劇,中低端酒承壓

從以上數據來看,白酒股三季度業績整體改善,但內部分化加劇,高端寡頭格局愈演愈烈。其中業績表現較好的酒鬼酒、瀘州老窖的共同特點,是受其高端品牌化策略驅動。由於高端白酒由於在宴請、送禮場景中具有需求粘性受疫情影響較小,價格堅挺,幾家酒企通過在定價上跟隨茅台、五糧液等高端白酒政策,實現系列產品利潤增長。

而此前公佈三季度業績的伊力特和口子窖,前三季度淨利潤均大幅。伊力特第三季度營收3.6億元,同比下降36%;淨利潤0.6億元,同比下降44%;口子窖前三季度營收26.9億元,同比下滑22.5%;歸母淨利潤8.6億元,同比下滑33.4%。

口子窖財務摘要(萬元):

數據來源:IFinD

數據來源:IFinD

與古井貢酒、捨得等酒企類似,之所以業績表現較差,主要是因為受疫情影響收入減少所致。由此可見,中低檔白酒的抗風險能力相對較弱。另外疊加營銷力度加大,銷售費用增加,但高端品牌系列發力仍舊不足,造成淨利潤同比下滑的局面。

展望白酒企業四季度發展趨勢,從三季報數據來看,各大酒企業績表現環比均有提升,除受中秋國慶傳統銷售旺季影響外,亦表明疫情影響正逐步緩解。

即將進入春節旺季,預計終端需求將進一步改善,後續銷售將恢復正常水平。在2020年低基數下,2021年核心酒企業績值得期待。但同時也要注意行業競爭加劇、海外疫情擴散等風險。

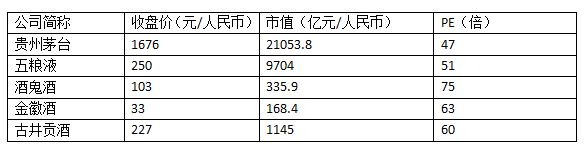

從估值角度分析,截至今日收盤,捨得、口子窖、伊力特等酒企估值均在30倍以下;然而酒鬼酒、金徽酒、古井貢酒PE分別達到75倍、63倍、60倍,在估值方面已經超過了行業頭部酒企,達到較高水平,表明市場炒作情緒相對較高。

重點公司估值情況:

近期A股許多白馬股遭遇閃崩,在白酒行業集中度不斷提高,業績表現分化的情況下,需要警惕部分個股出現透支未來成長性,業績不及預期的風險。