小熊電器前三季度淨利翻倍,四季度能否延續高增長?

今日,小熊電器股價一度暴跌5%,最終收跌3.55%,收盤126.97元/股。不過,從2月春節開市以來,股價一度暴漲300%,到目前為止也累計上漲逾200%。

今日小熊電器股價表現明顯要弱於蘇泊爾、九陽股份等同行,也明顯跑輸大盤其原因之一是昨晚發佈的三季度業績預告。

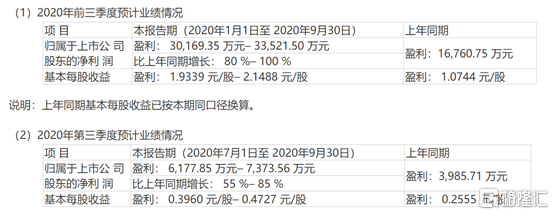

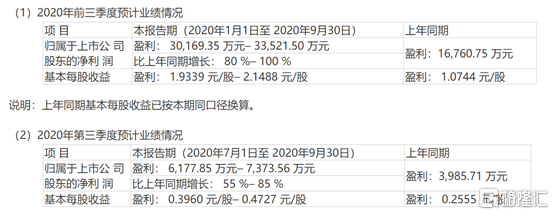

據公告顯示,預計公司前三季度歸母淨利潤約3.02億元~3.35億元,同比增長80%~100%,業績變動主要原因是公司銷售收入增長,毛利率有所上升,銷售費用率同比下降等。

(來源:小熊電器公告)

公司前三季度業績表現亮眼,但三季度增速僅為55%-85%,較二季度110%的增速有所下滑,稍稍不及市場此前特別樂觀的預期。

業績逆勢增長 市場期望居高不下

小熊電器成立於2006年3月,是一家以酸奶機、煮蛋器、電熱飯盒、加濕器等創意小家電為主的公司。公司於2019年8月正式掛牌中小板,上市以來業績和股價表現都較為亮眼,是小家電行業的一匹黑馬。

2017-2019年,小熊電器營收同比增速分別為56%、24%、32%,歸母淨利潤同比增速分別為105%、26.6%、44.6%。

(來源:Wind)

2020年上半年,家電行業同樣遭遇疫情的衝擊,但是小熊電器卻逆勢大幅增長,營收增速高達44.5%,歸母淨利潤增速更是將近100%。

究其原因,上半年人們都居家辦公生活,線下飯店商鋪關門,人們對宅家做飯的需求上升,因此對於廚房家電的需求量也大增;另外,疫情對於物流的影響相對較少,甚至疫情期間人們消費都是依靠線上購物平台,這對於主要銷售渠道都在線上的小熊電器來説無疑又是一項利好。

不過,二季度以來,中國新冠疫情已經基本得到控制,大部分人不再宅家隔離,對於小家電的需求有所減弱。因此,小熊電器三季度增速也下來一些,增速僅為55%-85%。

行業發展持續繁榮,四季度能否延續高增長?

小熊電器這些年能夠大幅增長,也取決於小家電市場規模的快速增長。據數據統計,2019年中國小家電市場規模達4015億元,2012~2019年短短7年時間,年複合增長率高達13.3%,遠遠高於傳統白色大家電的增速。

其中,小家電行業的洗碗機、電飯煲、料理機線上渠道零售額同比分別增長了39%、13%及20%,可見市場對於小家電尤其是線上渠道的需求仍在高速增長。

同時,小熊電器又是近幾年崛起具備互聯網營銷的小家電黑馬。2019年,線上銷售佔總銷售額規模高達90%以上。

後疫情時代,小熊電器仍然具備維持高增速的基礎。接下來,四季度還有雙11全球購物節,全年業績高增速仍然有保障。

不過,市場對於小熊電器高增長早有所預期,估值也到了高位水平。據Wind,d當前動態PE仍然高達50.2倍,較7月超過80倍的估值有所回落,但仍然處於估值中位數水平以上。橫向對比,也比蘇泊爾35倍,九陽股份41.7倍要高不少。

總而言之,小熊電器業績仍有較好的表現,不過鑑於估值的情況,對於投資仍需謹慎。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.