國慶狂攬票房40億,影視股開市仍遇冷

今年國慶檔票房再創佳績,創國慶檔史上第二高票房。據貓眼數據統計,國慶假期首日票房7.42億,8天總票房39.5億。具體而言,排名前二的電影合計貢獻了八成票房,分別是票房18.7億元的《我和我的家鄉》和票房13.8億元的《姜子牙》。《奪冠》以3.6億元的票房排名第三。雖然國慶檔電影在票房表現上可圈可點,但其背後出品方在股市中的表現卻不盡如人意。

數據來源:貓眼專業版

數據來源:貓眼專業版

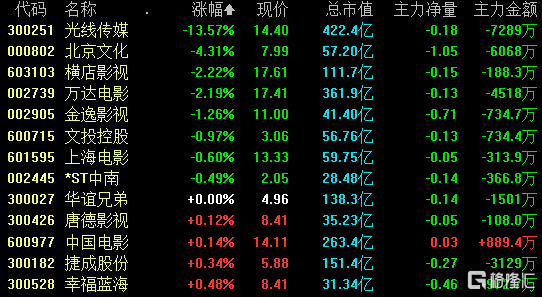

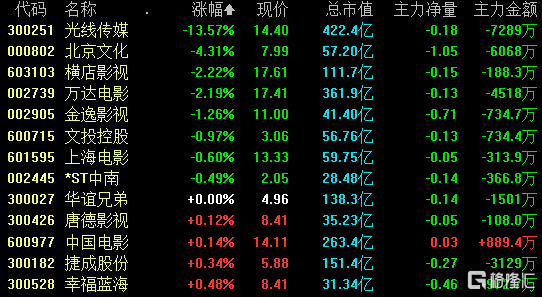

節後開市第一天,A股電影板塊14股上漲,8股下跌。其中《姜子牙》出品方光線傳媒開盤急速跳水,兩分鐘跌逾16%,收跌13.6%;北京文化高開低走低,收跌4.3%;橫店影視、萬達電影跌逾2%,上海電影、金逸影視等跟跌。與國慶檔電影相關的A股上市公司,只有幸福藍海和中國電影分別小幅上漲0.48%、0.14%。

數據來源:同花順

數據來源:同花順

港股方面,參與出品多部國慶檔電影的阿里影業收跌3.3%;歡喜傳媒全天低位震盪,收跌0.7%。

受利好出盡的因素影響,國慶檔電影出品方股價齊跌的情況並不意外。2019年被稱為“史上最強國慶檔”,但在節後首日,A股影視板塊仍然收跌2.67%,23家影視類上市公司股價下跌,僅6家公司上漲。其中上海電影跌停收盤,幸福藍海、北京文化、中國電影、萬達影視、光線傳媒、華誼兄弟、金逸影城和橫店影視跌幅均超過5%。

今日光線傳媒之所以大跌居前,主要是受口碑發酵影響。上映初期,《姜子牙》以“封神宇宙”、“神話宇宙”等名義與《哪吒》、《大聖歸來》捆綁營銷,取得首日超2億、總票房13.8億的好成績。但因劇情拖沓等因素,電影后期口碑分化,使其並未能按照《哪吒》票房軌跡一路走高,反而被《我和我的家鄉》反超,最終居於國慶檔票房第二位。

國慶檔冠軍《我和我的家鄉》最終斬獲13.5億票房,並在口碑方面位居首位,豆瓣評分7.4,高於7.3分的《奪冠》和7分的《姜子牙》。貓眼評分9.3,同樣高於《姜子牙》8.4分,《奪冠》9.1分。從國慶檔票房數據和過往經驗可以得出,影片本身的高質量和“自來水”式口碑已成高票房主要因素。

在業績方面,兩部高票房電影均在很大程度上為出品方緩解了壓力。光線傳媒上半年營收2.6億元,同比下降78%;淨利潤2057萬元,同比下降逾80%。北京文化上半年現營收564.85萬元,同比下降91%,淨虧損6429.83萬元。和《八佰》拯救處於退市邊緣的華誼兄弟類似,業績承壓的影視公司需要高票房及時“止血”,已成後疫情時代行業共識。

目前,國內疫情形勢趨於穩定,各上市公司項目儲備豐富。下半年,中國電影出品的《金剛川》10月底上映;春節檔有萬達電影出品的《唐人街探案3》。明年光線傳媒的《堅如磐石》、《深海》;北京文化的《封神三部曲》預計上映。

展望未來,天風證券研報稱,20年國慶檔在疫情影響仍未完全消除的情況下,7天票房恢復至去年同期八成,説明行業正在加速復甦。結合前期《八佰》取得30億票房,再度驗證市場觀影熱情和對優質內容的認可,頭部影片票房集中度繼續提升。抗美援朝70週年主旋律影片《金剛川》定檔10月25日,有望接力國慶檔,繼續推動10-11月電影市場表現。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.

數據來源:貓眼專業版

數據來源:貓眼專業版 數據來源:同花順

數據來源:同花順