兩日跌停!“炒期大王”秦安股份承認失手,賬户最大虧損額或近8億

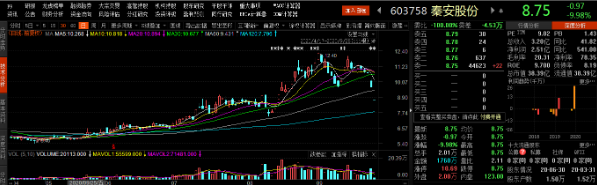

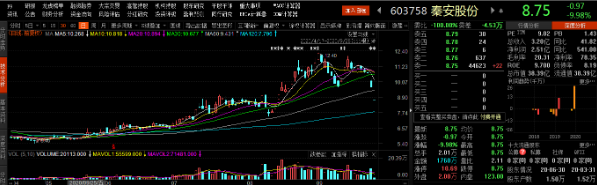

9月25日,“炒期大王”秦安股份延續昨日頹勢,開盤即跌停,股價跌至8.75元。

數據來源:Choice

而究及原因,主要是基於自身炒期貨出現鉅虧所致。

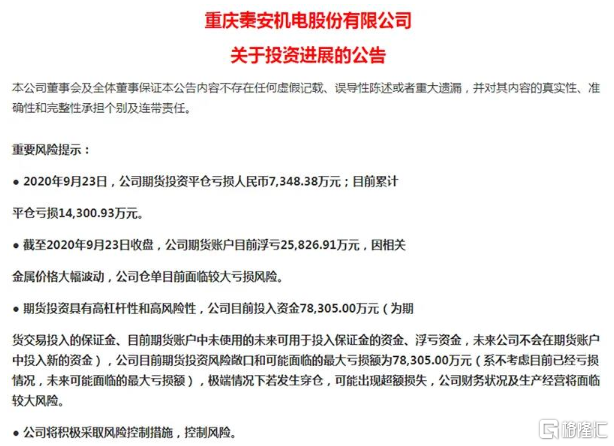

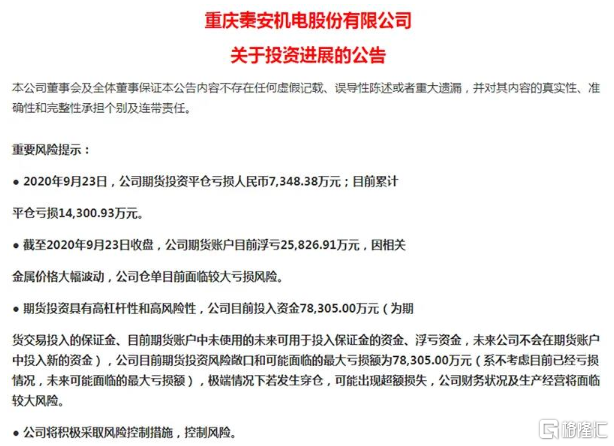

圖片來源:官方公告

秦安股份主要從事於汽車零部件生產、銷售,產品主要面向以整車(機)製造企業為主的乘用車及商用車整車市場。

而比起專心搞事業,秦安股份選擇“走捷徑”去加入期貨市場,參與期貨投資,主要投資鋁、鋅、銅、黃金等期貨品種。

自4月15日以來,公司一共拉了23次期貨平倉的盈虧清單。其中,前21次平倉均錄得正收益,累計收益超過7.6億元,是其去年全年淨利潤的6.5倍,可以説是賺得盆滿缽滿。

而得益於期貨投資帶來的甜頭,今年上半年公司扣非前淨利潤實現大幅扭虧。

今年上半年,秦安股份實現營收3.2億元,實現歸屬於上市公司股東的淨利潤2.51億元。扣除非經常性損益事項後,淨利潤為125.23萬元,實現扭虧(去年同期公司扣非淨利潤為-6299.07萬元)。其中,2020 年上半年公司期貨平倉及浮動收益合計2.54億元(含税)、賣出對公黃金積存收益936萬元(含税)以及本期收到政府補貼增加3131萬元(含税)所致,非經常性損益大幅增加。

然而好景不長,由於近期貴金屬價格波動劇烈,公司倉單連續面臨較大虧損風險。

9月23日晚間,秦安股份公告稱,9月12日至9月22日,公司根據對已建倉期貨的後續價格走勢判斷,對前期建倉的期貨投資合約進行部分平倉,平倉虧損6952.55萬元,佔公司2019年度經審計淨利潤的58.93%,平倉虧損將計入公司2020年度損益。

9月24日晚間,秦安股份繼續表示,9月23日公司對前期建倉的期貨投資合約進行部分平倉,平倉虧損7348.38萬元,佔公司2019年度經審計淨利潤的62.29%,平倉虧損將計入公司2020年度損益。而這是公司連續第二次公佈平倉出現大額虧損,兩次平倉累計虧損超過1.4億元。

截止目前,公司期貨賬户浮虧2.58億元,而根據公司投入資金情況,公司目前期貨投資風險敞口和可能面臨的最大虧損額為7.83億元,如發生極端穿倉情況,可能出現超額損失。

就目前來看,隨着近期有色金屬價格連續盤整,秦安股份期貨賬户的虧損或將進一步擴大,進而或使得公司財務狀況及生產經營直接面臨較大風險。

而這也將為所有企業敲響警鐘,公司需要注重風險管理,可以以保值為基礎去通過一些金融工具為自身增值,但不適合抱有絕對的投機心理,畢竟一不留心在過度追求較高利潤率期貨等的過程中,反而或為自身帶來較大的經營風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.