8月上市新股已有破發,多公司離發行價僅一步之遙

隨着新股發行量的增加,新股上市後的表現也出現巨大分化,部分公司上市首日即巔峯,與此同時,隨着新股發行的常態化,市場對新股的炒作也更加趨於理性。

新股上市未滿月即破發

8月13日,凱賽生物在科創板掛牌上市,當天高開低走,截至收盤上漲3.32%,隨後十多天震盪下跌,截至9月3日收盤,股價報收於113.83元,較133.45元的發行價跌幅超過10%。

資料顯示,凱賽生物是一家以合成生物學等學科為基礎,利用生物製造技術,從事新型生物基材料的研發、生產及銷售的高新技術企業。公司目前實現商業化生產的產品主要聚焦聚酰胺產業鏈,為生物基聚酰胺以及可用於生物基聚酰胺生產的原料,包括DC12(月桂二酸)、DC13(巴西酸)等生物法長鏈二元酸系列產品和生物基戊二胺,是全球領先的利用生物製造規模化生產新型材料的企業之一。

從公司業績表現來看,2018年和2019年連續兩年業績增速放緩,與此同時,公司發行市盈率較高,也是股價下跌的一個重要原因。

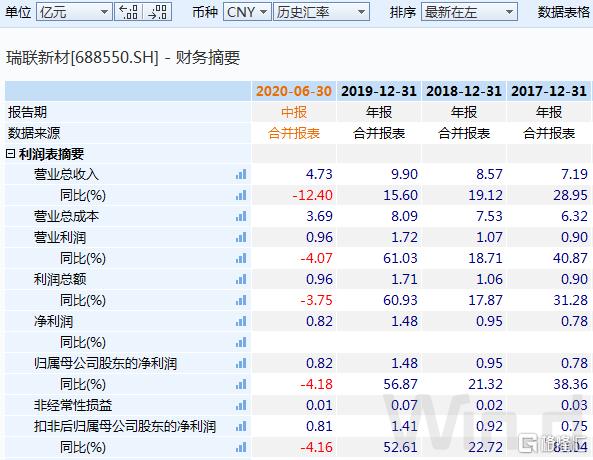

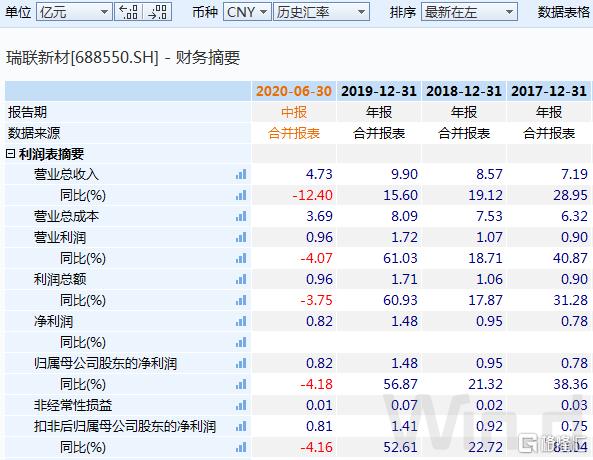

同樣瀕臨破發的還有瑞聯新材,公司發行價為113.72元,9月2日在科創板掛牌上市,當天同樣是高開低走,漲幅僅11%,9月3日,股價大幅下跌逾9%,相對發行價漲幅也已經縮窄至1%。

資料顯示,公司是一家專注於研發、生產和銷售專用有機新材料的高新技術企業,主要產品包括OLED材料、單體液晶、創新藥中間體,用於OLED終端材料、混合液晶、原料藥的生產,產品的終端應用領域包括OLED顯示、TFT-LCD顯示和醫藥製劑。

公司近年業績保持穩步增長,亦同樣存在估值偏高的擔憂。

除上述兩家公司外,今年以來上市的新股中,還有15家公司漲幅小於30%,近一個月上市的新股佔比過半。部分公司當前市盈率已經偏高,或有進一步下跌可能。

IPO數持續高位

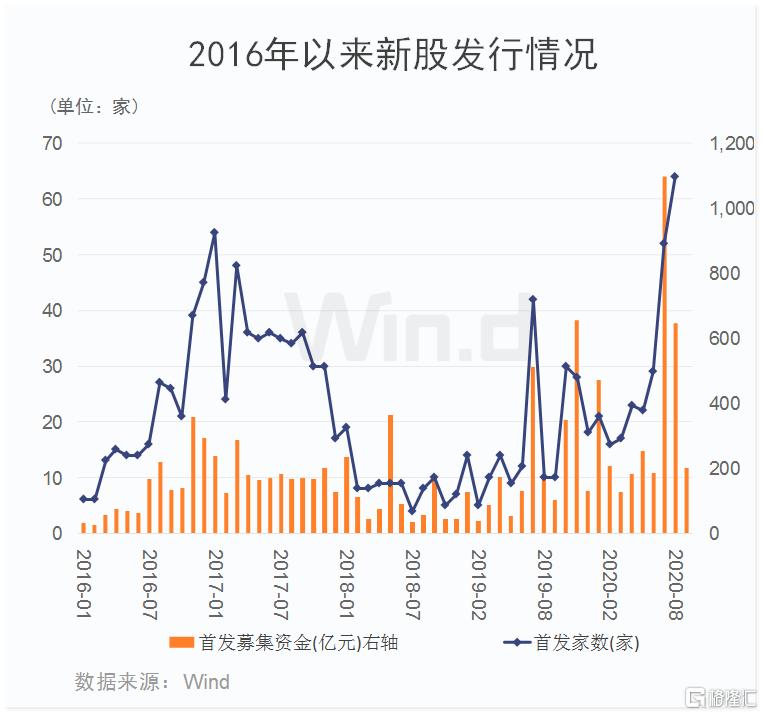

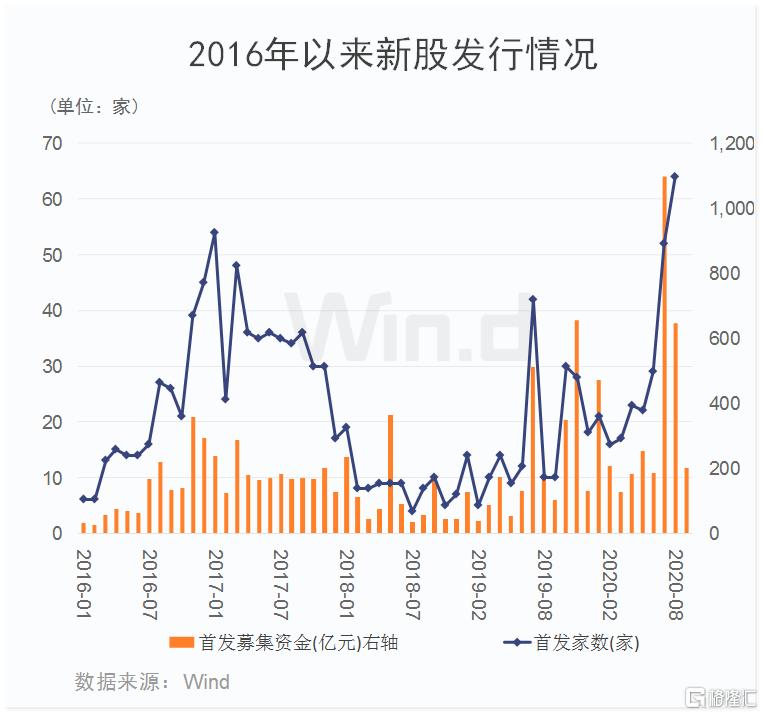

7月份有52只新股發行,募資金額超過1000億元;8月份有64只新股發行,單月發行數創歷史新高,同時募資金額超500億元;從當前發行節奏來看,9月份並未有放緩跡象。

事實上,自2016年新股發行重啟以來,新股發行呈現較大波動,前一個發行高峯是2016年下半年至2017年底,2019年下半年以來,新股發行進入新一輪高峯。

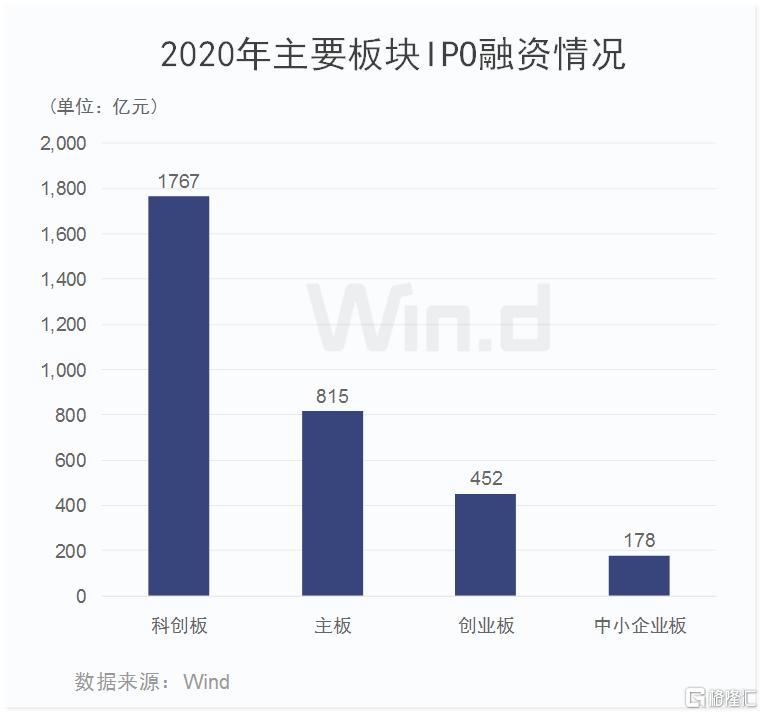

科創板募資額大幅領先

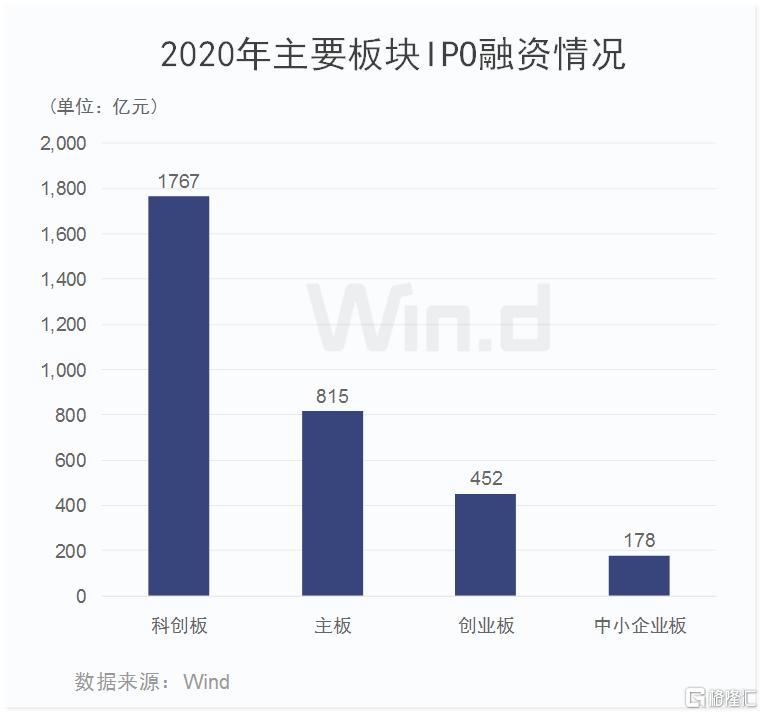

從今年以來各板塊首發募資金額來看,累計募資超3200億元,其中,科創板募資1767億元,位居首位;主板募資815億元緊隨其後;創業板和中小企業板募資金額靠後。科創板募資金額大幅超過主板+創業板+中小企業板。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.