攻略 | 中概股扎堆赴港二次上市,申購新股?還是提前買入美股?

總 結

①收益率:以往案例顯示,港股招股期間,美股的同期收益率與港股首日收益率相近或更高。

②買賣成本:港股申購存在1.0077%的費率(中籤成本),此外還有融資成本(申購成本);uSMART美股的傭金費、平臺費最低爲1.5美元/筆。

③中籤率:網易、京東一手中籤率爲8%、10%;美股可直接買賣,不存在運氣偏差。

④融資情況:港股打新的融資申購堪比春運搶火車票;美股可直接融資交易,融資抵押率高達60%,也可以起到以小博大的槓桿效應。

⑤長期走勢:港股美股可互換,兩市股價長期走勢趨同,不存在AH股般的溢價偏差。

案例展示

截至目前,已有3家中概股赴港二次上市。總體而言,一手中籤率越來越低,從阿裏巴巴的80%驟降至網易的8%。

若以港股招股至上市爲統計期間,美股的收益率略勝一籌(若考慮到港股的申購成本、中籤成本,美股的同期收益率更佳)。

美股同期收益率:因港股招股前已有招股價流出,故美股的同期收益率統計以招股前一個交易日爲統計起點。例如,京東港股的招股至上市日期爲:6月8日-18日,美股同期的統計區間爲:6月5日-18日。

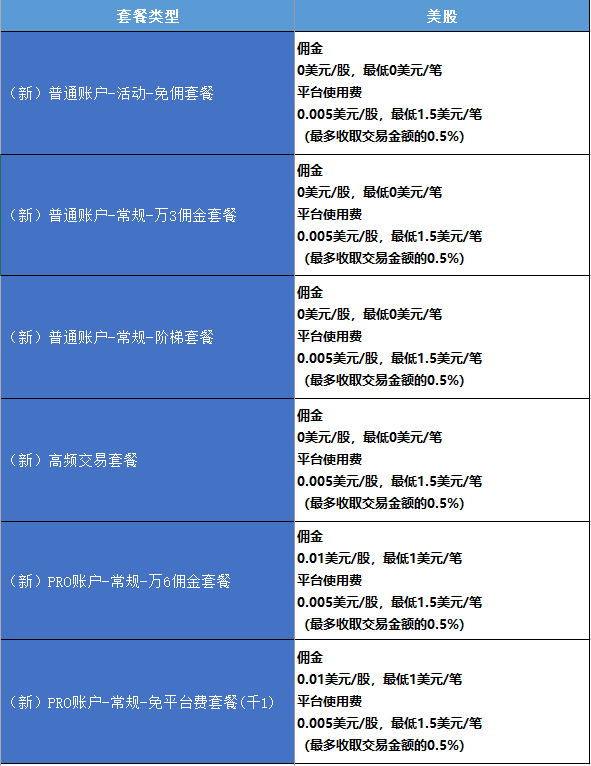

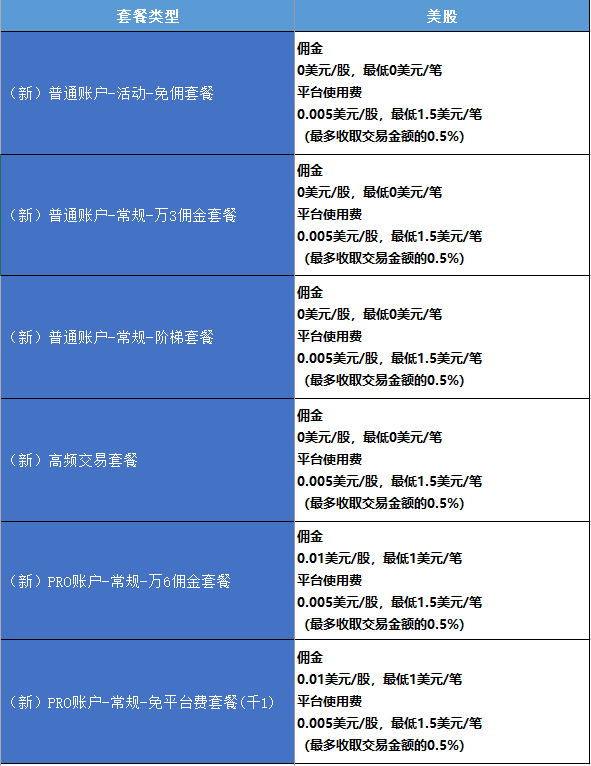

uSMART美股交易優勢

1、買賣成本:最低只需要1.5美元/筆

以下爲uSMART美股交易的新收費標準:

注:由於註冊時間以及套餐的不同,用戶請以“個人中心-我的傭金”說明爲準。

2、支持盤前盤後時段交易:投資快一步

由於港股盤後清算的原因,故美股的實際盤前盤後交易時段以交易頁面爲準。

3、支持融資交易,融資抵押率高達60%

阿裏巴巴美股的融資抵押率高達60%,也就是說買入一手價格爲1萬美元的阿裏巴巴,您最少的本金可以是4千美元。

百勝中國美股的融資抵押率爲50%,也就是說買入一手價格爲1萬美元的百勝中國,您最少的本金可以是5千美元。

注:不同股票的融資抵押率存在差異,實際抵押率請以個股行情頁的說明爲準。

申購港股新股的優勢

1、交易時間更方便:港股的交易時段爲9:30—16:00,不用熬夜盯盤。

2、有望納入港股通、恆生系列指數等:有望吸納被動、主動的投資資金,形成港股領漲美股的效應。

風險提示:以上爲歷史數據和公開資料的展示,不構成投資建議,歷史表現不代表未來走勢。股市有風險,投資需謹慎。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.