都市麗人(02298.HK):中期業績受疫情影響承壓,電商表現相對突出,維持“中性”評級

格隆匯 09-02 09:27

機構:光大證券

評級:中性

◆上半年業績承壓,除電商外各業務均同比下滑

公司 20 年上半年營業收入 13.33 億元、同比降 39.7%,經營虧損 1.09億元,歸母淨利潤虧損 1.31 億元,EPS-0.06 元。收入下滑主要為費用率提升幅度較大。

收入分拆來看,加盟(收入佔 38%)、直營(32%)、電商(29%)、原材料銷售(1%)收入分別同比-52.7%、-40.7%、+18.1%、-82.4%。疫情影響下電商業務表現相對較好、實現正增長,且佔比同比提升 14PCT。

線下門店方面,20 年 6 月末公司合計門店數量 5457 家、較年初減少8.6%,其中直營店、加盟店分別為 1032 家(較年初-18.7%)、4425 家(-5.9%)。

◆費用提升幅度較大,存貨週轉放緩但應收賬款週轉加快,現金流好轉

公司毛利率為 48.7%、同比提升 7.7PCT,預計與業務結構變化、控制營業成本、原材料價格下降、向海外銷售已全額計提的存貨等因素有關;期間費用率為 58.7%、同比升 18.8PCT,其中銷售/管理/財務費用率分別同比+12.6/+4.7/+1.6PCT,銷售費用剛性、降幅小於收入;管理費用同比增3.4%主要為費用剛性及諮詢費增加。

存貨週轉天數 187 天、同比增加 17 天,應收賬款週轉天數 38 天、同比減少 27 天。經營淨現金流為 2.94 億元、相比去年同期的-2.62 億元現改善。6 月末賬上現金 8 億左右。

◆短期零售逐步恢復,預計下半年環比改善

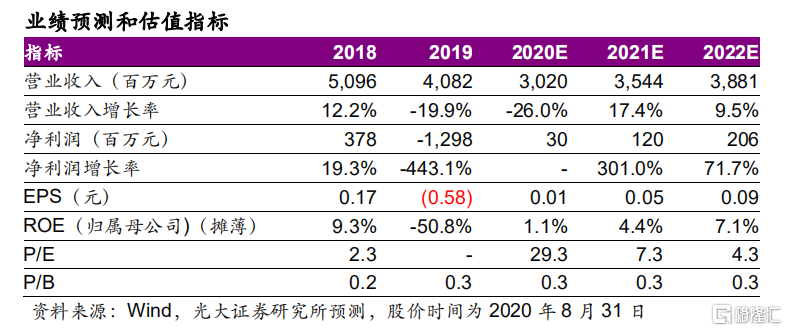

公司銷售主要受國內疫情影響,5~6 月零售恢復到至去年同期約 84%,同時下半年公司將繼續拓展電商渠道、加大存貨消化力度、優化終端渠道、精簡 SKU、供應鏈柔性化、數字化轉型、精細化控費增效等,預計下半年業將較上半年改善。考慮疫情和宏觀經濟環境的不確定性,下調 20~21年、新增 22 年 EPS 為 0.01/0.05/0.09 元,維持“中性”評級。

◆風險提示:疫情影響超預期致國內終端消費持續疲軟;費用控制不當;庫存積壓。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.