乾了這杯酒!茅台股價站上1800元,再創新高,接下來是誰?

作者:徐蔚

來源:上海證券報

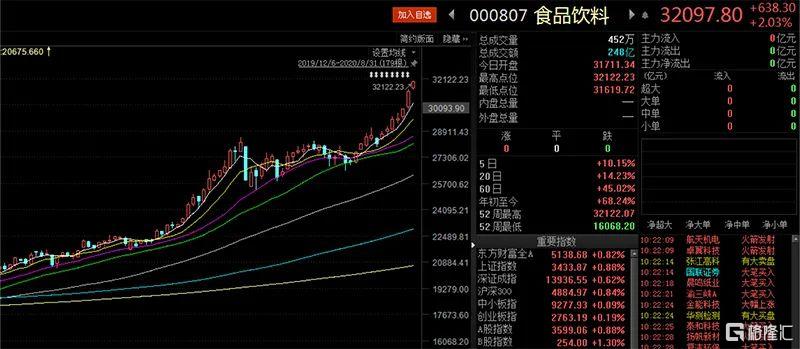

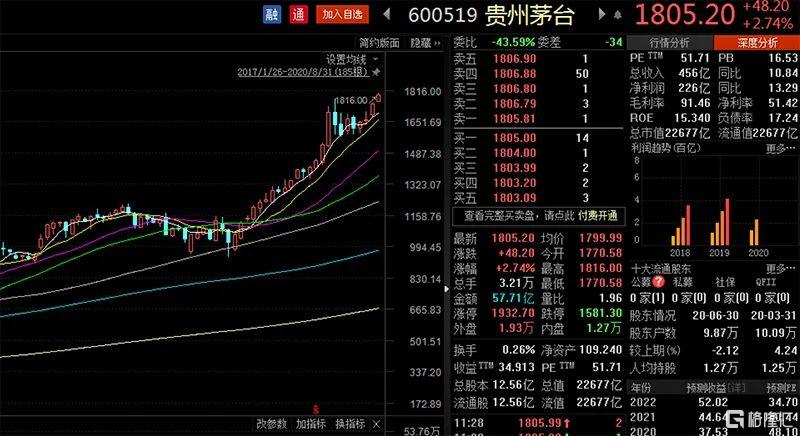

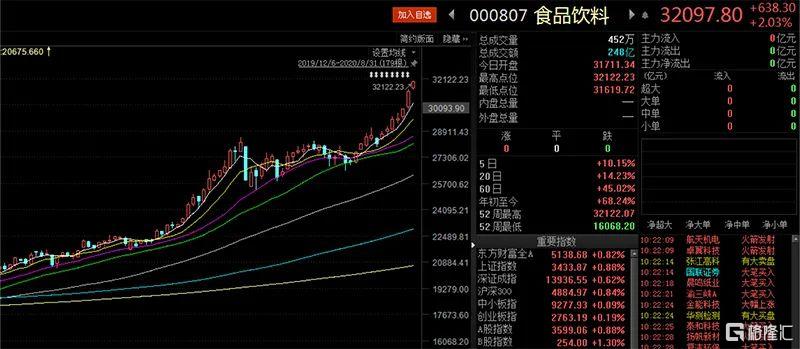

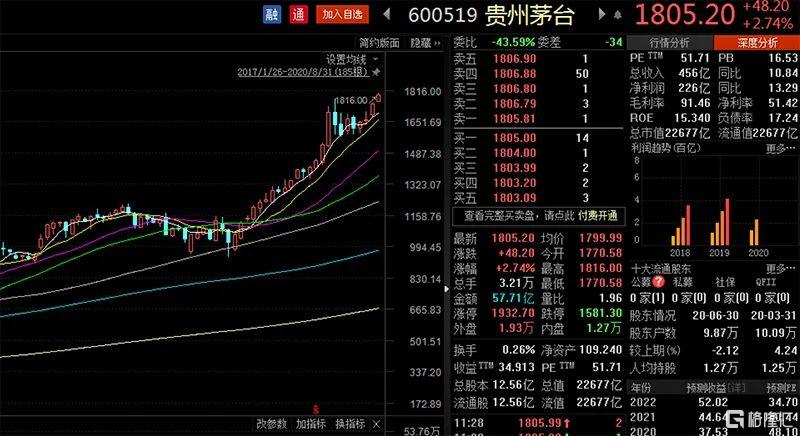

又創新高了!今日早盤,貴州茅台高開高走,盤中大漲超3%,站上1800元大關,再創歷史新高。與此同時,食品飲料指數漲逾2%,刷新前高。

截至中午開盤後,滬指漲0.84%,報3432.88點;深證成指漲0.66%,報13942.02點;創業板指漲0.31%,報2766.19點。

白酒板塊7個交易日連漲

早盤,白酒股集體拉昇走高,酒鬼酒一度漲停,截至午間收盤,口子窖、捨得酒業、金徽酒等漲逾5%。貴州茅台股價盤中一度觸及1816元,再創歷史新高。

今年下半年以來短短兩個月,貴州茅台股價已經從1500元漲至1800元。

7月1日,貴州茅台股價突破1500元/股。7月6日,貴州茅台收盤報1600元/股,市值破2萬億元。7月7日,貴州茅台股價突破1700元/股。8月31日早盤,貴州茅台股價突破1800元/股,今年以來累計漲超50%。

近期,白酒股陸續披露半年報,貴州茅台等龍頭酒企依然實現了營收和淨利潤的穩步高增長,反映出行業分化加快以及行業集中度進一步擴大。

Choice數據顯示,目前滬深兩市共有18只白酒概念股,早盤17只白酒股上漲,板塊整體漲幅超過2%。

中信建投表示,上半年酒企清庫存控發貨,下半年加快發貨進度,疊加需求回暖,業績確定性逐季改善。由於今年上半年的低基數,白酒將會迎來4個季度的業績向好。至少從未來一年的維度看,白酒行業將維持高景氣。

消費還能上車嗎?

食品飲料行業現在還能投資嗎?已經在車上的到底要不要下來?這是很多投資者近期反覆提及的問題。

申萬宏源證券副總經理、研究總監、首席策略分析師王勝表示,從半年報披露數據來看,業績最超預期的是消費行業,大眾消費尤其突出,其次是以白酒為代表的可選消費,背後的邏輯是產業集中度提高和國產替代。

下半年以來,市場對龍頭白馬股估值較貴的討論不斷增加,那麼,這些資產為何能夠持續上漲?在王勝看來,有一個因素是:外資流入對市場影響非常深刻。

“現在A股是開放市場、全球定價,隨着外資不斷進入A股市場,估值中樞也在發生系統性變化。龍頭公司估值的提升,相當於打開了估值系統的天花板,其他股票也會補漲,整個證券市場估值中樞逐步上移。所以,貴有貴的道理,這是投資者結構發生變化的結果。”王勝表示。

接下來熱點板塊是誰?

從今日早盤走勢來看,成交量小幅增大,市場總體氛圍不錯。除了白酒股,熱點板塊全面開花。

盤面上,數字貨幣概念股開盤表現強勢,飛天誠信、科藍軟件、漢威科技等漲幅較大。券商股盤中拉昇,華安證券一度漲停,國金證券、廣發證券等漲幅靠前。軍工板塊持續走高,航天科技、航天晨光相繼封板。

資金接下來會選擇哪個方向?

中信證券預計,A股在9月將開啟一輪中期上漲,驅動上是增量資金入場而非存量資金博弈,行業層面上是全局性的,行業內分化會加劇。配置上要淡化風格切換思維,強化對順週期與高彈性品種的配置。具體建議方面,繼續聚焦3條主線:受益於弱美元、商品/能源漲價和全球經濟修復的週期板塊;受益於經濟復甦和消費回暖的可選消費品種;絕對估值低且已經相對充分消化利空因素的金融板塊。另外,可以開始配置調整已基本到位的科技龍頭。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.