光大證券:三根陰線是否能改變信仰?

作者 | 格隆匯小編

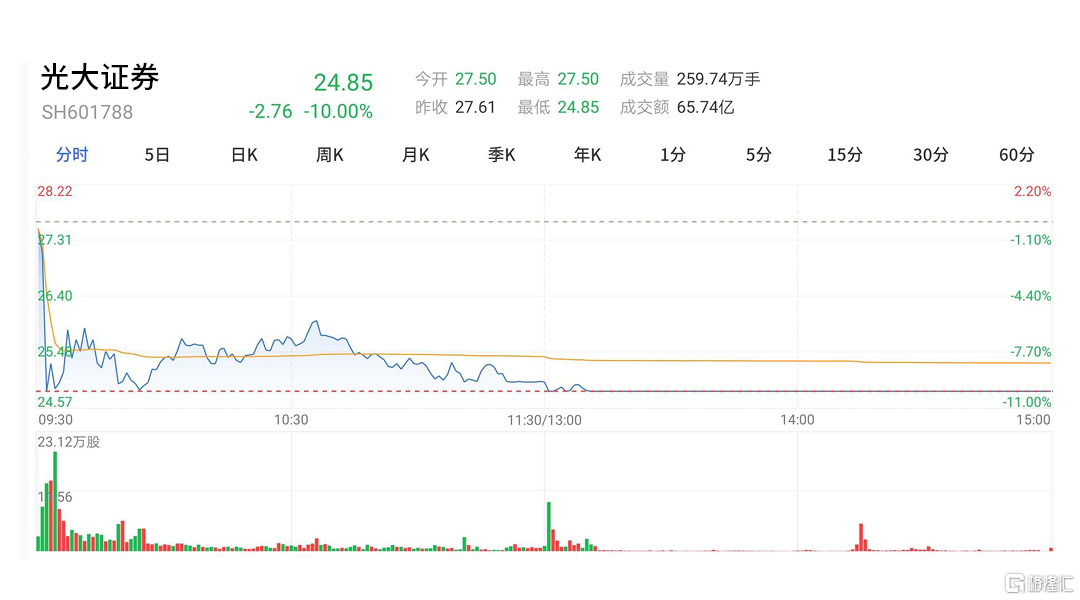

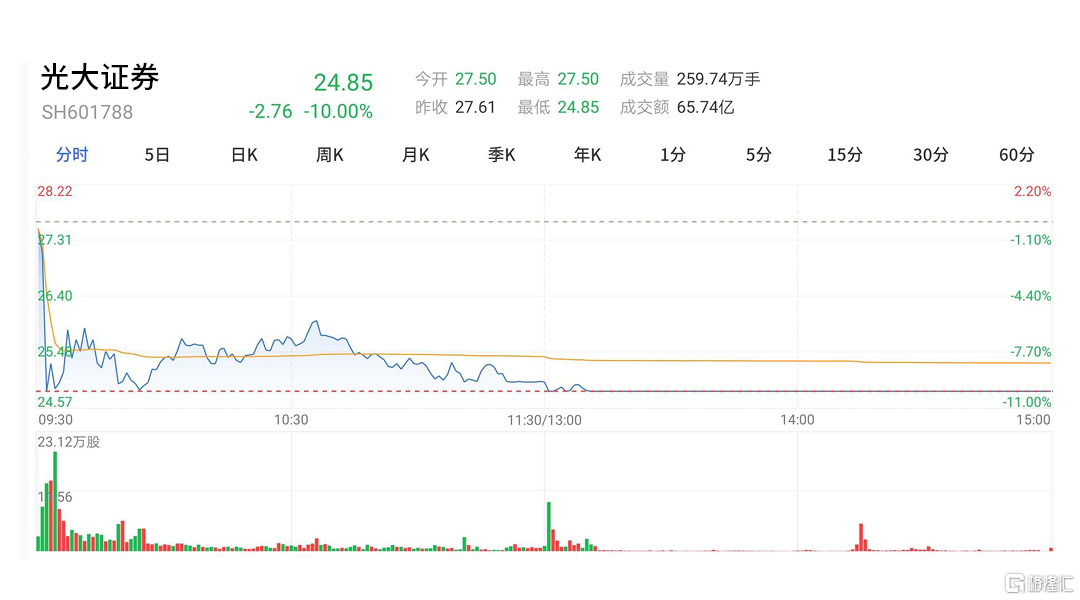

上半月初券商板塊大漲的時候,光大證券是領頭羊。下半月券商板塊開始下跌時,光大似乎也是最能抗的。然而再能抗也頂不住大盤的風向,光大證券在今早開盤時,領了一個跌停板。

圖:格隆匯APP光大證券今日走勢

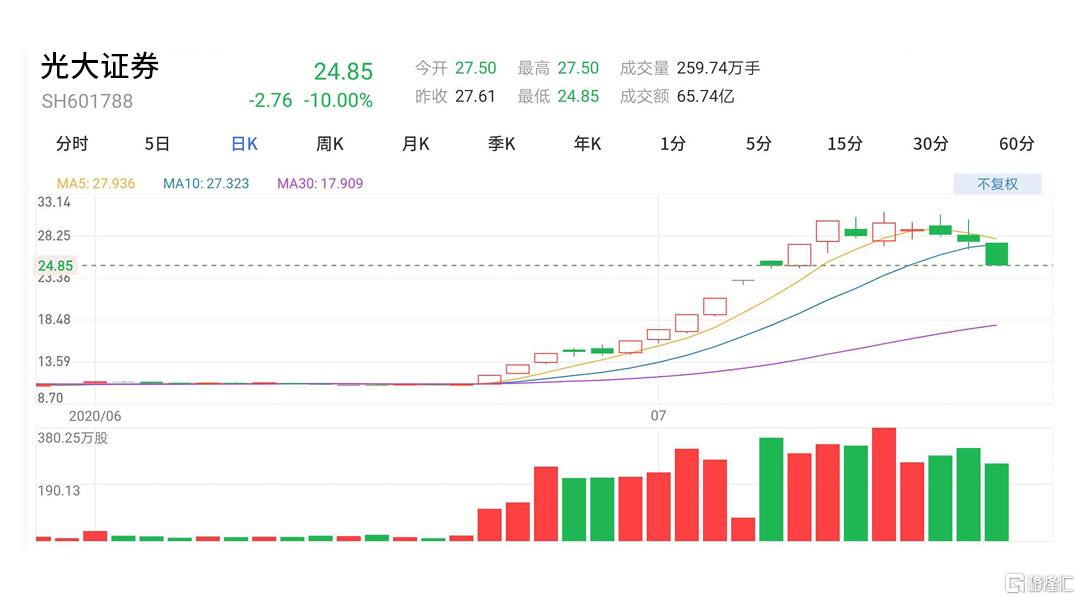

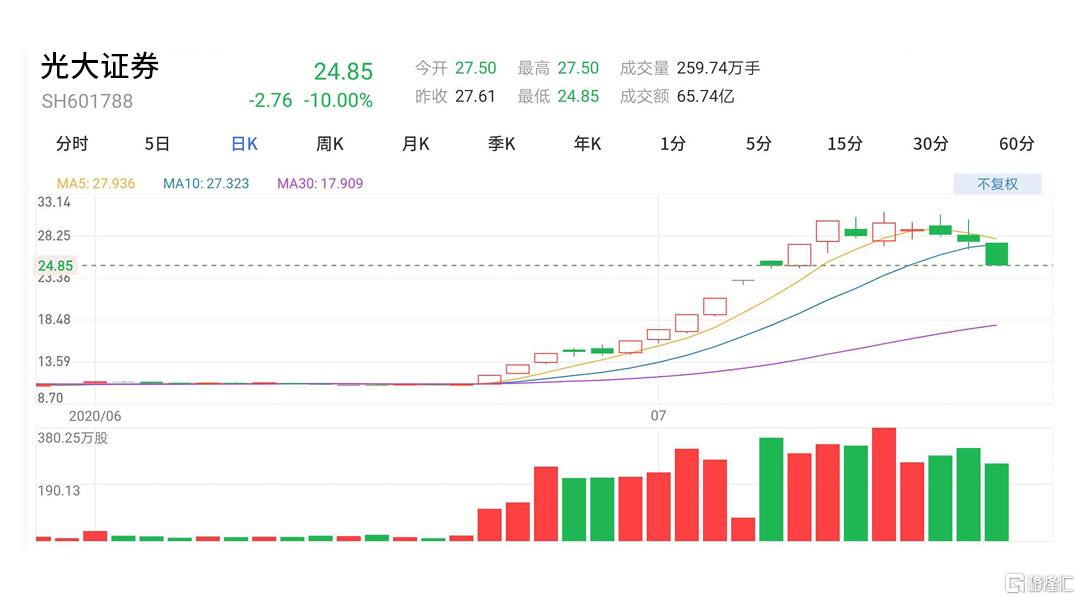

券商板塊的爆發時常見於牛市初期,被視為大牛市開啟的信號,理所當然,在 7月牛市之中,券商被列入投資收益最高的板塊之一,而光大證券更是以超過150%漲幅,從板塊內眾多大牛股中脱穎而出。然而明顯,一週前光大證券上漲動能耗盡,股價轉而開始下行。

圖:格隆匯APP光大證券日線圖

牛市常用 “三根陽線改變信仰” 形容牛市初期散户入場時候的瘋狂。

而從今天往前推,光大證券已經連續吃下三根陰線,盤面上如此,讓人不禁想問:至今還沒出貨的人,是否也應該改變過去的信仰?

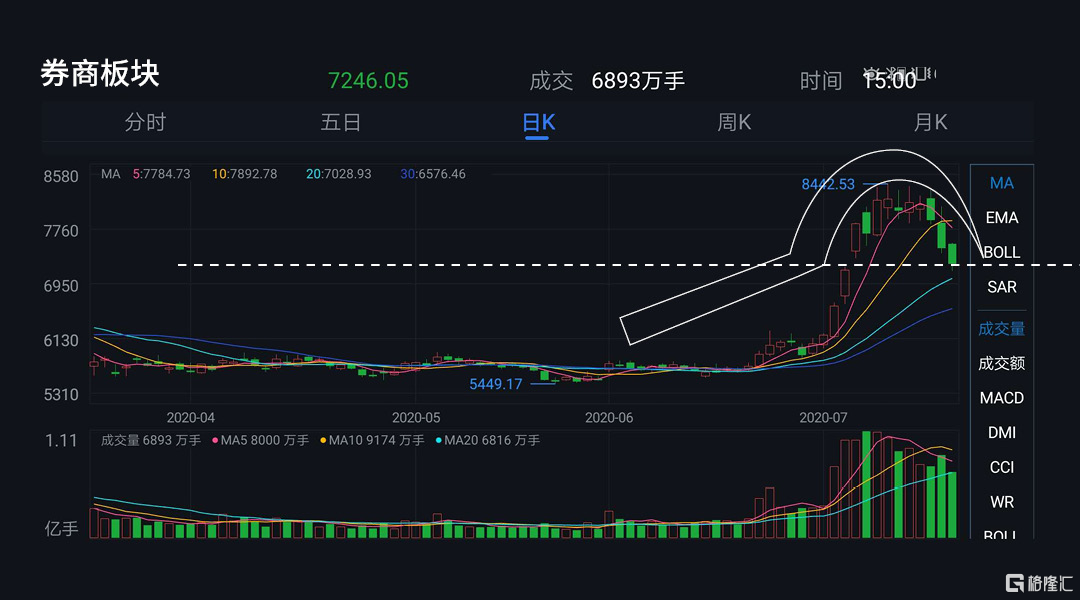

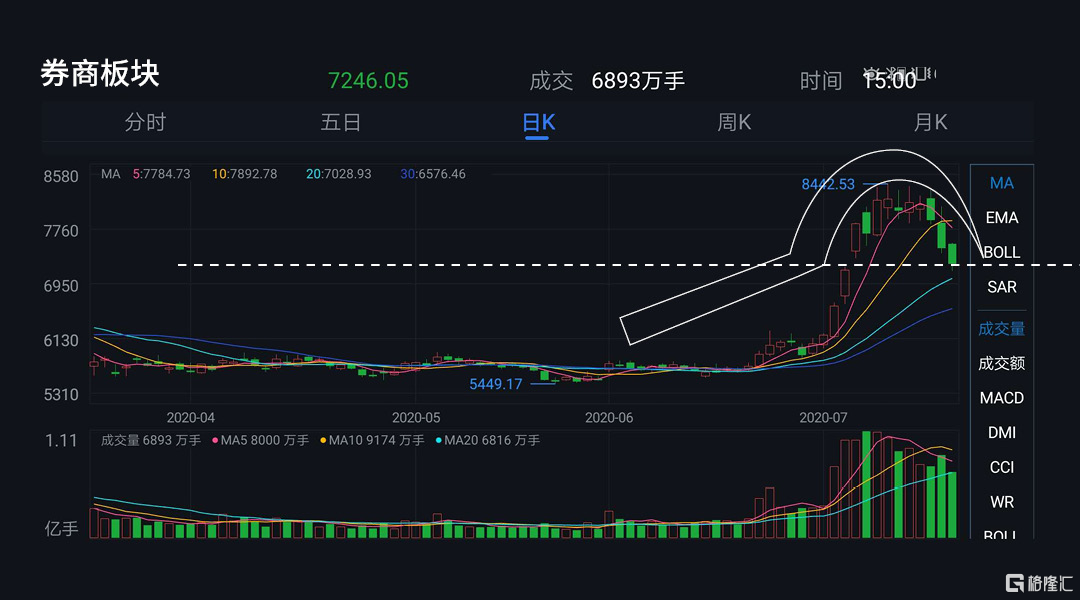

在討論該問題前,我們先理一理券商板塊上漲的成因。

1、傳言:銀行獲批證券牌照當時各種猜想喧囂塵上,其中最知名的即是中信建投和建投的傳言合併。中信跳出來闢謠,但是越闢謠,股價卻越是瘋漲!

2、牛市:券商多頭行情帶動了其他板塊,最終才形成涵蓋近乎所有板塊的大牛市。而市場預期牛市帶來的成交量,進一步形成對券商股業績的超高預期。

所以這一輪券商板塊的上漲邏輯是什麼?

一半謠言,另一半是牛市本身。

然而時至今日,兩市成交量雖保持在一萬億之上,但是縮量也十分明顯,大盤經歷連續兩天下跌,今日尾盤勉強翻紅。可以肯定經過幾天的下跌,市場信心已經略有動搖,而早前傳聞的“券商與銀行合併”也遲遲沒有新的消息。

時至今日,抬眼一望,券商板塊繁榮景象早已不再,本月股價上漲最厲害的光大證券也吃了跌停板。板塊走勢圖像是一把鐮刀的形狀,鋒鋭的刀尖抵着高位吃進股票的投資人。

圖:鐮刀和韭菜

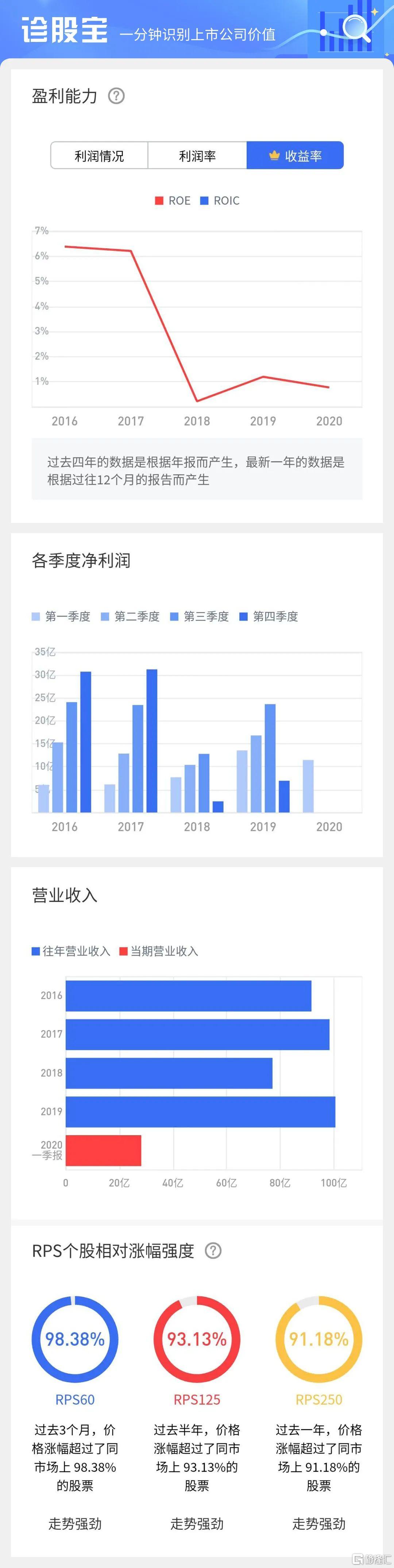

撇開謠言,公司能撐起什麼樣的估值,最終還是要回歸公司基本面。當潮水滿溢時,大家可以暫時不在意底褲穿沒穿,但這並不意味着,退潮時,裸泳的能逃過資本市場的清算。所以潮水退卻時,投資人更應該回歸理性,以更客觀的角度判斷手上的牌。

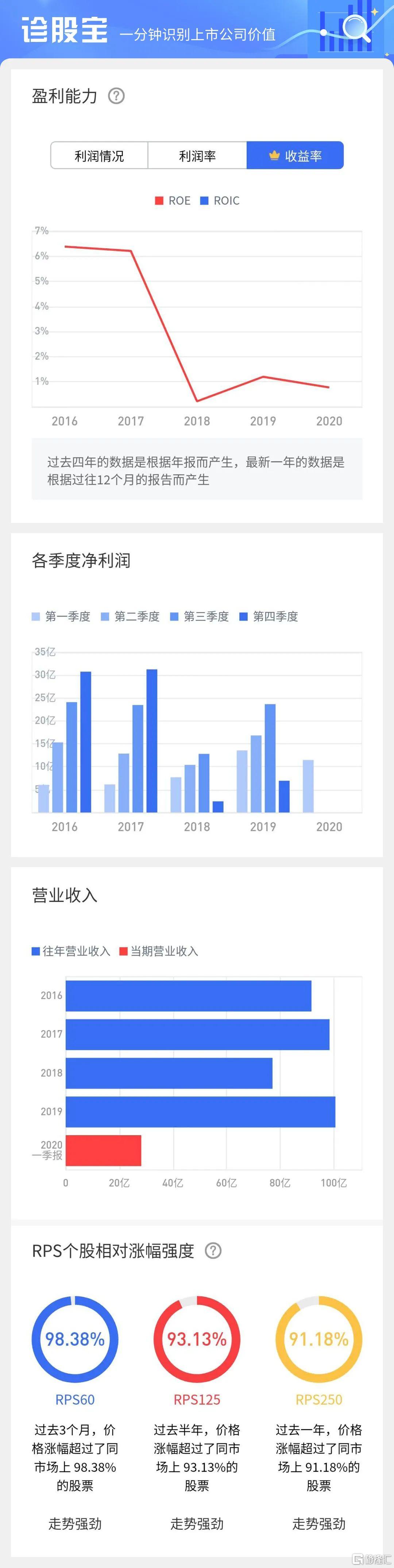

今天讓我們用數據的角度看光大證券成色幾何。當下的光大證券值得持有嗎?打開診股寶,我們跳過過程,先看結果:

總結

診股寶給出結論,目前暫無投資亮點。此外,即便當前光大證券股價自高位31.10元回調20%至今日24.85元,目前動態市盈率仍高達323.22倍,估值超越十年間97%的時間,處於歷史高位。

資金面,北向資金持股1.43%,機構持股0.68%,最近90日僅3家機構給予評級,機構對光大興趣缺缺。股價經過一週回調,目前券商板塊公司普遍估值仍偏高,投資人應即時警惕板塊繼續向下修正的風險。

免費診斷更多股票?認準格隆匯-診股寶

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.