【興證宏觀】6月PMI數據點評:生產穩步推進,價格明顯回暖

作者:王涵 盧燕津

來源:王涵論宏觀

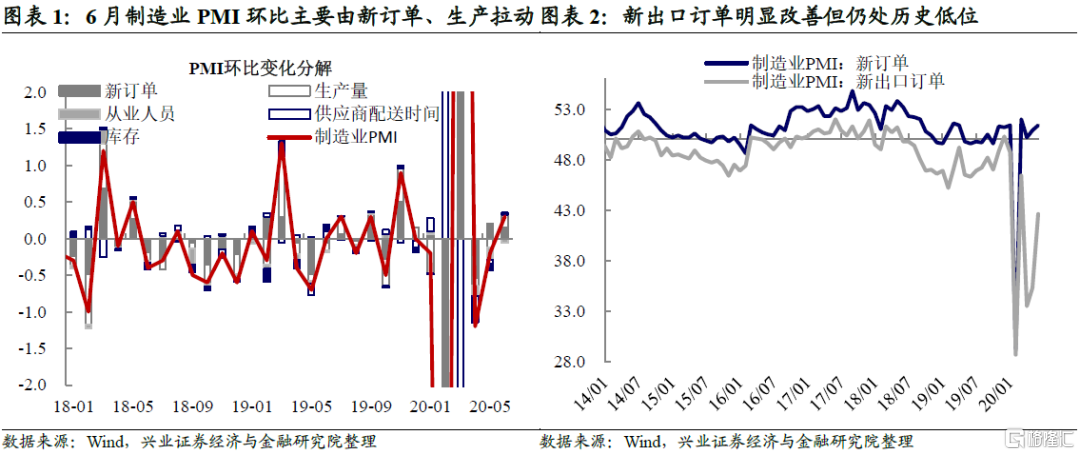

事件:6月製造業PMI由上月的50.6升至50.9,高於市場預期中值50.4;非製造業PMI由53.6升至54.4。我們認為:

PMI回升,國內經濟活動進一步恢復。6月製造業PMI和非製造業PMI持續位於擴張區間,且較上月均有不同程度回升。其中,更多是不可貿易品的非製造業PMI持續強於製造業PMI,指向國內經濟活動進一步恢復。

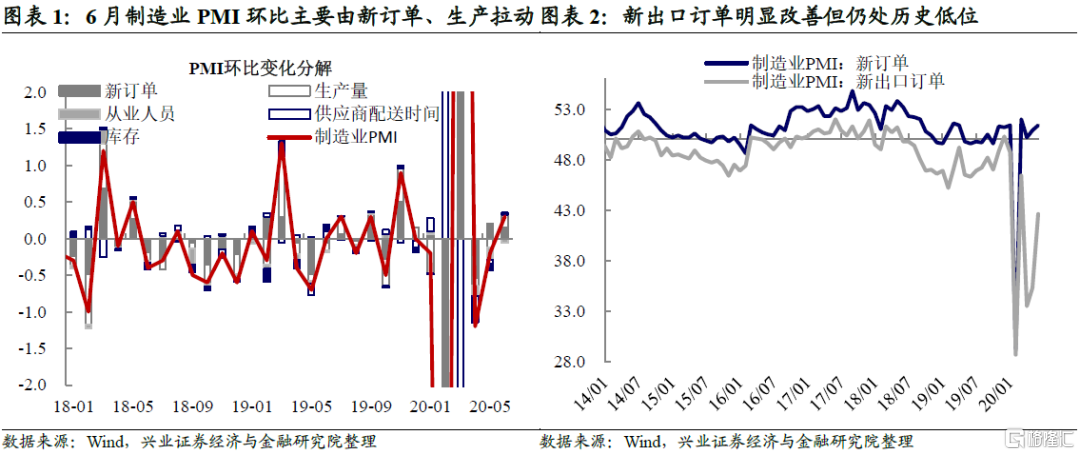

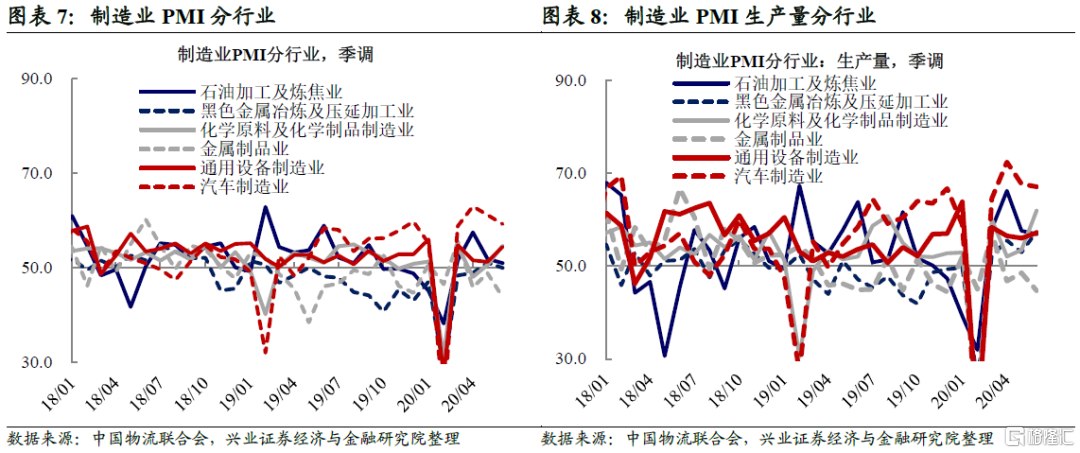

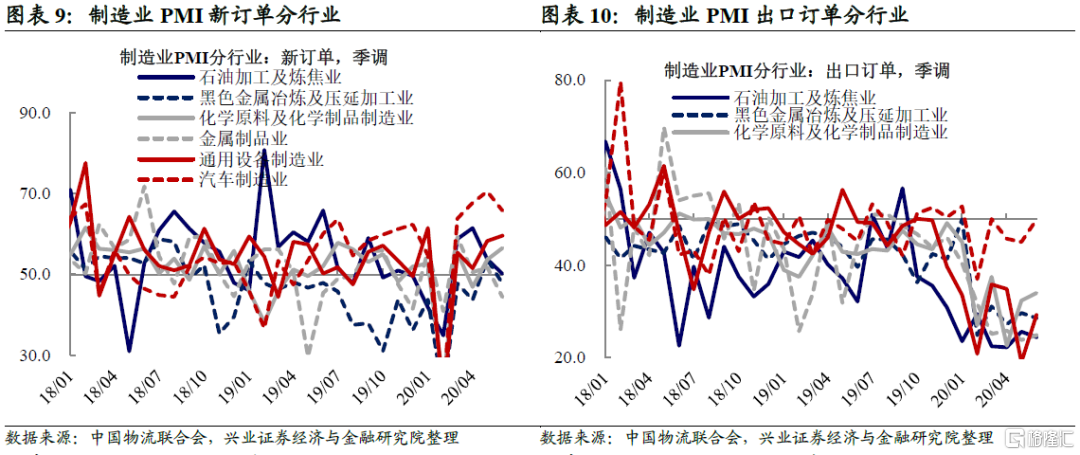

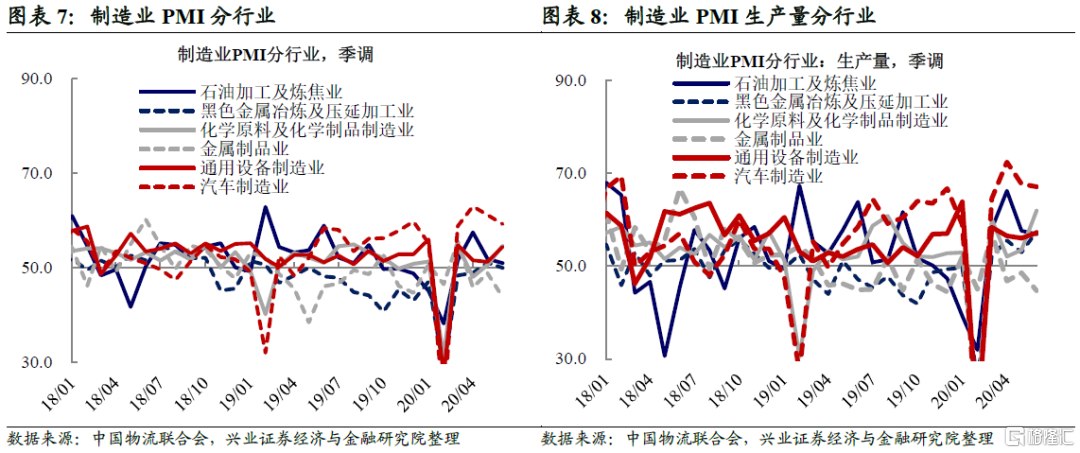

6月製造業PMI在擴張區間加速,行業繼續分化。6月製造業PMI由50.6升至50.9,自今年3月以來持續位於擴張區間。從五大構成分項看,新訂單、生產量、原材料庫存回升,從業人員回落,供應商配送時間保持不變。相比5月,15個製造業細分行業中,8個行業製造業PMI回升,7個回落。

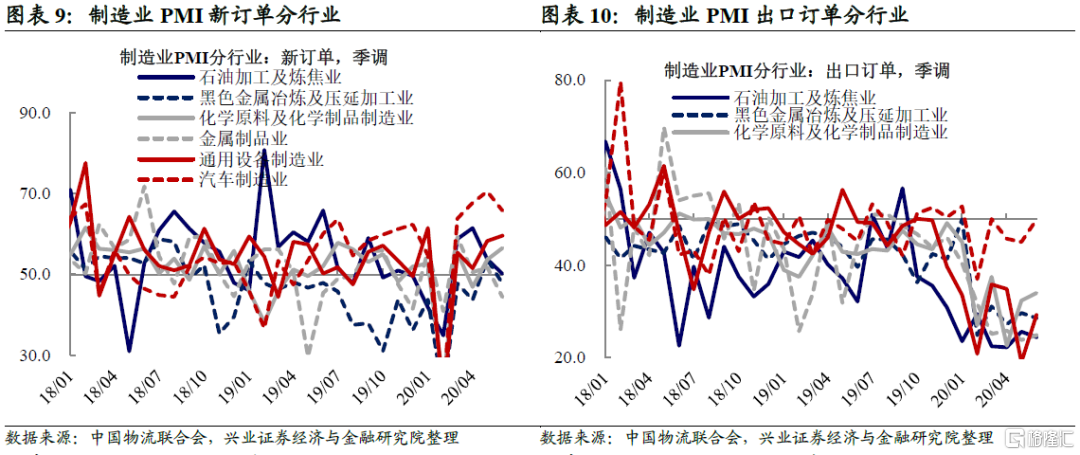

新訂單、生產改善,指向內需繼續恢復。6月製造業PMI新訂單由50.9升至近5個月高點51.4,生產由53.2升至53.9,均為連續4個月處於擴張區間,指向內需繼續恢復。相比5月,15個製造業細分行業中,7個行業新訂單回升,同時,8個行業生產回升。

新出口訂單低位回升,出口壓力仍存。6月新出口訂單由35.3升至42.6,但仍處於歷史較低水平。相比5月,15個製造業細分行業中,12個行業新出口訂單回升。儘管全球各國皆已開啟復工進程,但考慮到美國復工進程受遊行、疫情風險局部上升等影響,需求的改善繼續慢於供給的恢復,同時大選臨近美國政客“甩鍋”動力上升,中美關係或面臨較大的不確定性,或為後期出口造成一定壓力。

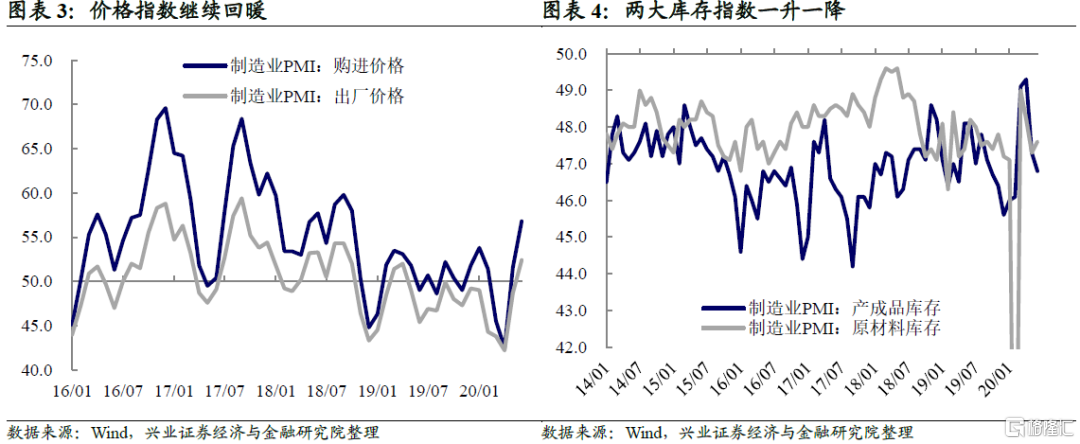

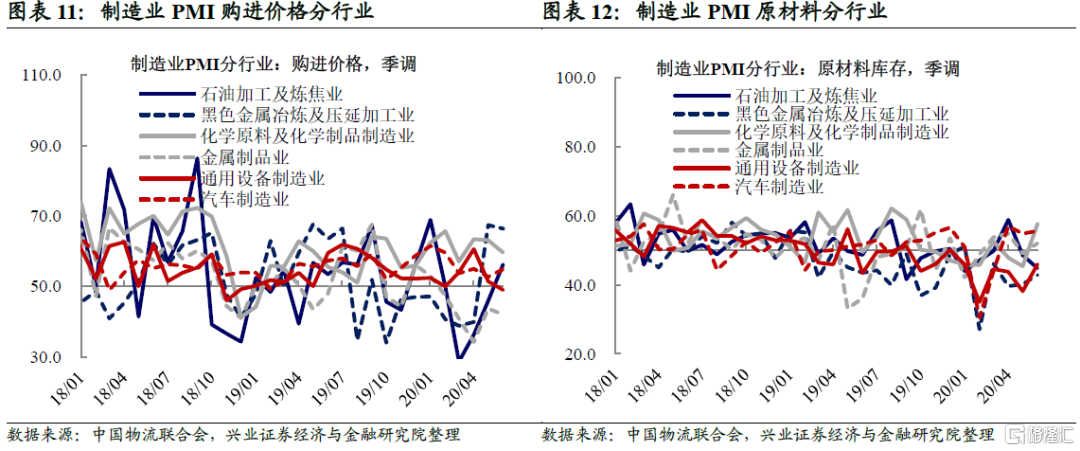

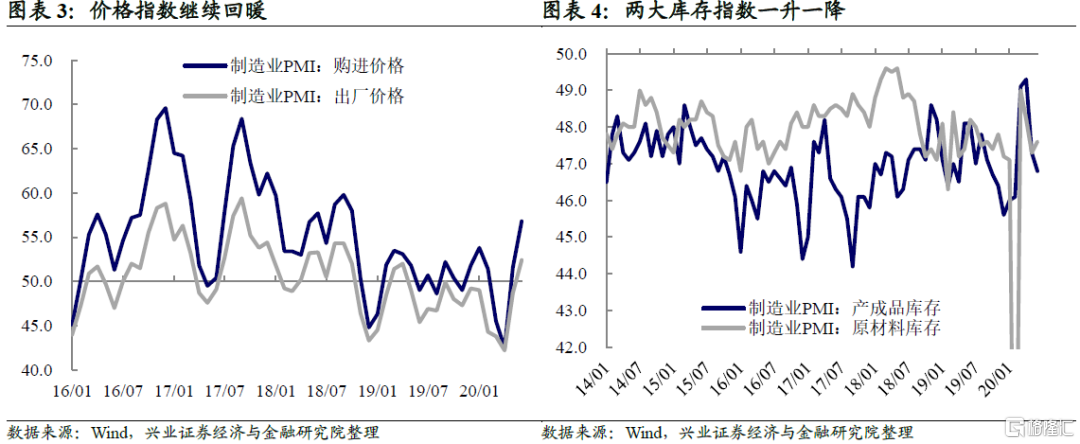

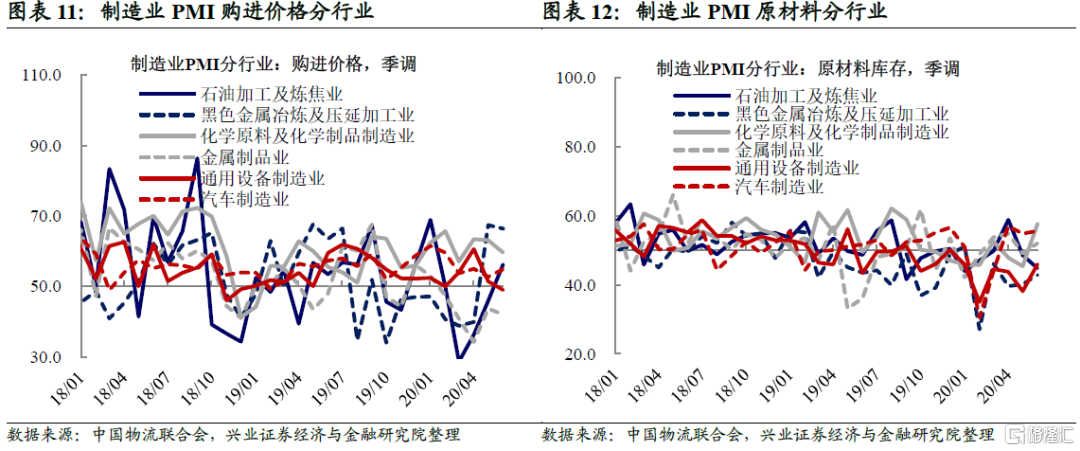

價格指數明顯改善,PPI有望觸底回升。6月製造業PMI兩大價格指數均有所回升,繼購進價格在5月進入擴張區間後繼續升至2018年10月以來的高點56.8,出廠價格也由5月的48.7升至52.4。截至6月,PPI環比已連續4月為負但降幅收窄。考慮到前期主要的價格拖累因素油價自5月中旬開始趨勢回升,疊加國內生產平穩推進,預計PPI有望觸底回升。

庫存指數一升一降,企業補庫意願提升仍有待觀察。6月製造業PMI原材料庫存由47.3升至47.6,仍處歷史較低水平,產成品庫存由47.3降至46.8,其中,15個行業中11個行業原材料庫存回升,7個行業產成品庫存回升。

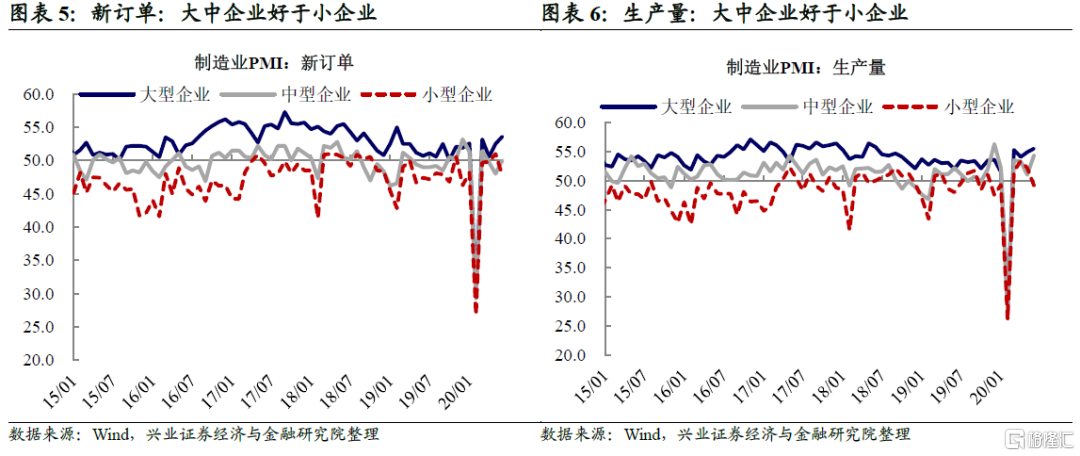

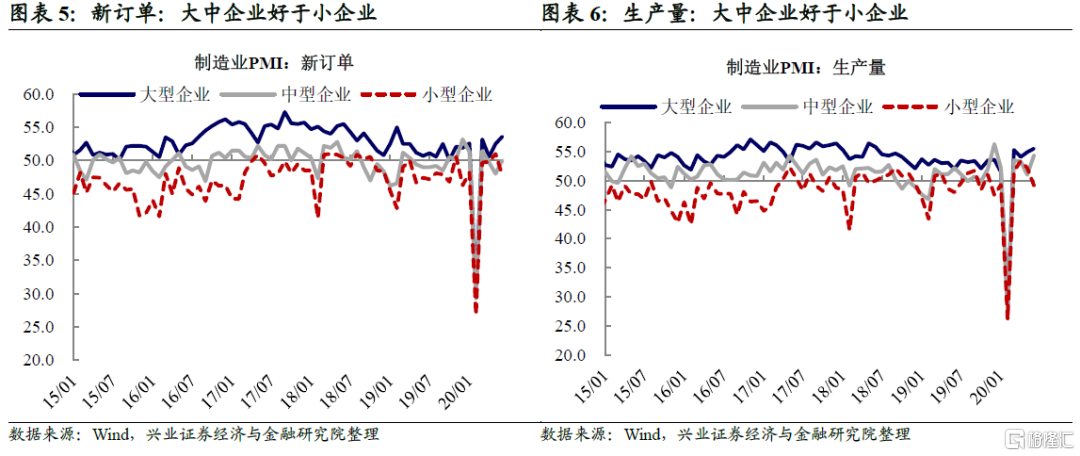

大中企業改善好於小企業。6月,從新訂單、新出口訂單、生產三分項來看,大中企業改善均好於小企業。

往後看,經濟向好趨勢不變。疫情防控常態化下,國內經濟活動有序恢復。而海外經濟受疫情局部風險上升影響可能擾亂節奏但恢復趨勢不變,有助於部分緩解前期對外需的擔憂。同時,貨幣政策總量適度且重在“提高寬鬆效率”,也有助於經濟向好趨勢不變。

風險提示:二次疫情爆發,地緣政治風險,國內外經濟、政策形勢超預期變化。

風險提示:二次疫情爆發,地緣政治風險,國內外經濟、政策形勢超預期變化。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.