【光大宏观】美联储谨慎,货币易松难紧

作者:光大宏观张文朗、刘政宁

美联储6月议息会议维持政策利率不变,符合预期,同时宣布维持当前的购债速度不变。美联储对下半年美国经济的看法偏谨慎,对失业和通胀前景的担忧超出市场预期。鉴于此,不仅加息不会很快到来,美联储还可能进一步控制收益率曲线,以支持经济复苏。

美联储谨慎,货币易松难紧,股和债都受益。首先,美联储对经济偏谨慎的看法打消了市场对货币政策收紧的担忧。其次,收益率曲线控制的预期降低了债券利率的上行风险。第三,市场不会完全相信美联储的谨慎判断。只要美联储还在宽松,宏观数据在边际改善,短期内风险资产就能获得支撑。

正文

维持政策利率利率不变,符合预期。美联储在货币政策声明中指出,疫情给美国社会和经济带来了巨大创伤,失业率高企、总需求疲弱、通胀低迷是未来的主要挑战。在没有看到失业率持续下降之前,美联储将维持政策利率在当前的水平不变。

维持当前的购债速度不变,但表示将适时调整计划。美联储将继续购买美国国债、居民住房抵押债券、以及商业地产抵押债券,以维护金融市场的稳定。但美联储也指出,会在适当的时候调整资产购买计划。我们认为,如果美联储是以金融市场稳定为调整的依据,那么最快将在7月暗示放缓购买资产的速度。

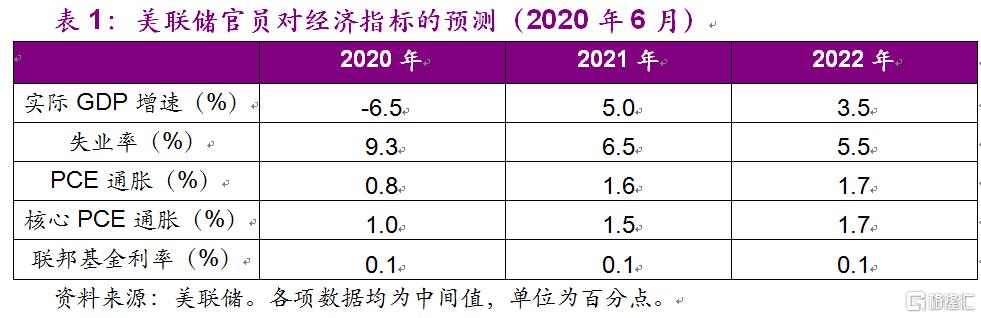

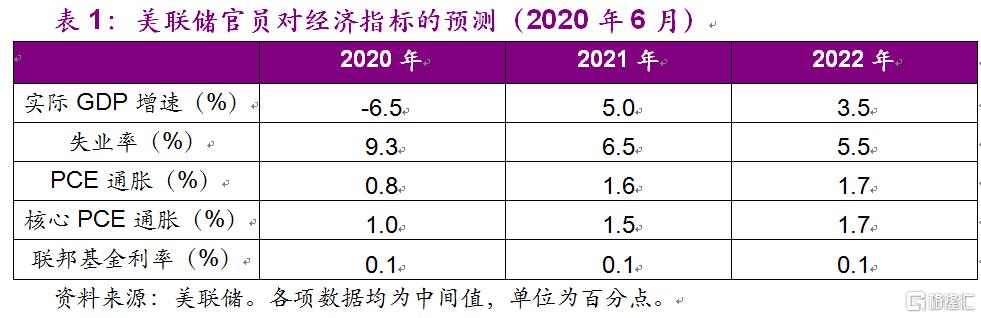

宏观数据预测:美联储对下半年美国经济的看法偏谨慎。美联储认为今年第四季度的GDP同比增速为-6.5%,失业率将高达9.3%,PCE通胀和核心PCE通胀分别只有0.8%和1%,远低于2%的政策目标(表1)。如此低的通胀预测超出了市场预期,这也说明美联储更加担心的是通缩,而不是通胀。

货币政策指引:不排除控制收益率曲线,加息最快要到2022年。鲍威尔表示会继续使用前瞻指引和购买资产的方式支持经济复苏,并暗示美联储正在讨论收益率曲线控制(yield curve control)的可能性。另外根据点阵图的信息,没有任何官员认为今年之内会加息,最早的加息时点也要到2022年,也就是两年后。

鲍威尔的态度:整体偏鸽,谨慎中带着希望。鲍威尔表达了对失业问题的担忧,尤其担心疫情过后会有许多人无法回到原来的工作岗位,从而导致失业率居高不下。但另一方面,他认为政府为应对疫情而采取的纾困措施非常得力,这将有助于经济复苏。他还认为,在必要的情况下财政应该发挥更大作用,以弥补美联储只能借贷、不能支出的“缺陷”。

对市场的影响:美联储谨慎,股和债都受益。首先,美联储对经济偏谨慎的看法打消了市场对货币政策收紧的担忧。其次,对收益率曲线控制的预期会给债券利率带来压制,尤其是中短端利率,上行的风险将大大降低。因此,我们认为短期内美债收益率大幅上行的可能性较低,这与中国4月以来的国债利率上行不一样。

第三,市场不会完全相信鲍威尔所担忧的失业问题。至少从上周公布的5月非农数据来看,社交隔离解除后的复工进度比预期更好。随着复工的推进,6月的就业数据或将继续改善,短期内很难引发市场的担忧。对美股而言,只要美联储还在宽松,宏观数据在边际改善,就能获得支撑。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.