美國創紀錄的儲蓄率利好未來消費?

格隆匯 06-05 22:10

來源:智堡

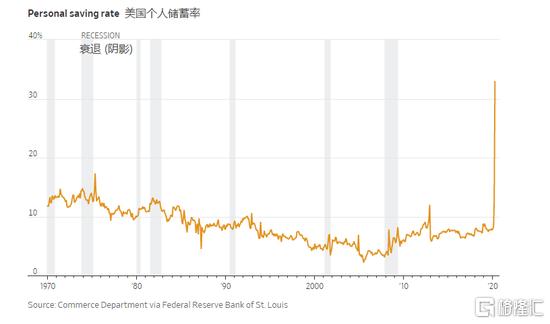

根據美國經濟分析局的數據,截至2020年4月,美國個人儲蓄率從3月份的12.7%飆升至33%的歷史高點。此前的最高紀錄是1975年5月時的17.3%,當時正處於20世紀70年代的滯脹時期。(圖1)

不過,4月份高達33%的儲蓄率並不是美國家庭行為長期變化的一部分。這只是對短暫事件的一種非常具體的迴應。除了2008年全球金融危機後的短暫時期外,私人部門儲蓄率在截至2019年的30多年裏一直低於10%,不斷下降的人口增長正永久性地降低趨勢儲蓄率。

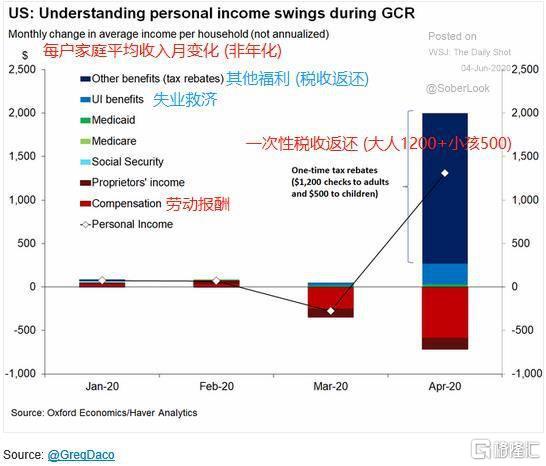

毫無疑問,失業保險和一次性的政府刺激支票暫時抵消了工資報酬的下降,並提高了居民收入 (圖2: Oxford Economics)。這是推動儲蓄率升至33%的主要因素。

一些評論人士認為,私人儲蓄大幅增長提高了家庭財富,減輕了未來收入的不確定性,支持以後更多的消費。如果供給端限制仍持續存在,消費支出的增加可能會導致未來通脹上升。

但是,創紀錄的個人儲蓄率其實並不能反映出整體財富的變化。首先,它沒有考慮有多少人已經推遲了支付租金、抵押貸款、信用卡欠款及其他債務。當寬限期過去,這些人終究還是要償清這些欠款的,屆時儲蓄率可能會下降。

其次,它也沒有考慮投資的價值。在危機期間,股市跌了不少。儲蓄率可能會告訴你這個月收入的33%被存起來了,但事實上,由於市場下跌以及401 (k) 養老金計劃或房子等資產價值的變化,此前“存”下來的錢比上個月少了很多。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.