剛剛,大資金狂買千億市值龍頭股!什麼情況?

作者:費天元

來源:中國基金報

今日早盤,A股市場風格顯著分化。

指數層面,三大股指雖集體高開,但走勢迥異:上證指數維持紅盤運行,截至午間收盤上漲0.13%;創業板指則高開低走迅速翻綠,截至午間收盤跌幅接近1%。

三大股指早盤表現

個股層面,海螺水泥、海天味業等多家千億市值公司獲資金搶籌,股價齊創歷史新高。而部分小市值公司股價遭遇重挫,包括ST板塊再現跌停潮,天廣中茂等瀕臨退市公司同樣遭遇跌停。

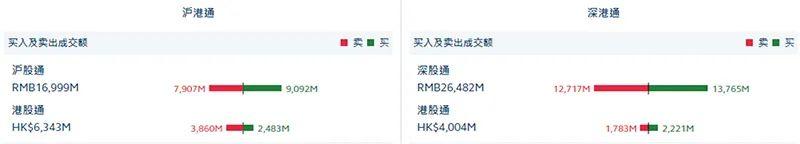

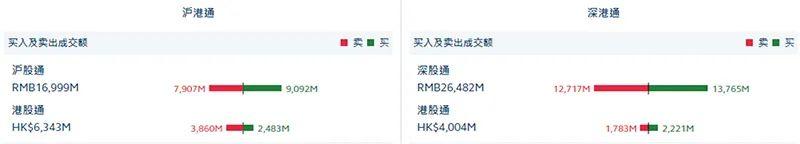

資金層面,北向資金繼續大規模進場,半天淨買入額達22.33億元。

北向資金早盤流向

研究機構普遍認為,創業板註冊制試行、外資投資額度放開等一系列政策落地,標誌着中國資本市場制度建設日益完善。A股投資者將更願意看到更多優秀的公司走向前台,與其一起成長。A股定價也將更加價值化、更加長期化,優質資產與劣質資產的價格差異會更加明顯。

4只千億市值龍頭齊創歷史新高

今日早盤,有4只總市值達千億規模的龍頭公司股價刷新歷史新高,分別是海螺水泥、海天味業、三一重工、中公教育。

海螺水泥今日早盤最高觸及62.87元(前復權價格,下同),超越3月初高點再創歷史新高,今年以來累計漲幅達到13.91%。

海螺水泥日線走勢

在海螺水泥的等帶動下,水泥板塊今日早盤大幅領漲。申萬水泥製造行業整體漲幅達到3.12%,青松建化、金圓股份收穫漲停,上峯水泥、寧夏建材等漲幅超過4%。

水泥板塊早盤表現

太平洋證券最新研報認為,在穩經濟背景下,地產投資拉動的需求具有韌性,基建催化將貫穿全年,帶來新的需求增量,水泥供需格局穩中向好,價格彈性十足。當前主要水泥企業估值在6倍至8倍,估值仍處低估區間,隨着國內流動性寬鬆,板塊整體估值或抬升,行情有望貫穿全年。

值得關注的是,上述4只早盤股價刷新歷史新高的千億市值公司,多為北向資金的重倉股,且近期均獲外資持續加倉。自4月份北向資金恢復淨流入以來,外資重倉股普遍大幅反彈,A股市場風格也明顯偏向價值。

統計顯示,北向資金最新前20大重倉股,4月以來平均漲幅高達12.06%,顯著跑贏同期上證指數,其中有中國國旅、五糧液、立訊精密等區間漲幅均超過20%。

北向資金前20大重倉股 4月以來股價表現

優質資產籌碼有望集中

興業證券首席策略分析師王德倫認為,創業板註冊制落地,部分投資者可能擔心公司供給造成市場資金壓力。但在逐步正常化、常態化的IPO情況下,市場適應能力明顯增強。

王德倫強調,相比於以往,目前的A股市場投資者反而更願意看到更多優秀的公司走向前台。近期中芯國際計劃選擇科創板上市,創業板實施註冊制等即是最好的註解。

西南證券策略團隊表示,外資投資限額取消正式落地,標誌着我國資本市場對外開放取得新進展,A股定價將更加價值化、更加長期化。外資偏好於佈局全行業龍頭股,看重盈利能力和業績的穩定性,且持股較為集中,對優質資產形成了價格支撐。

西南證券認為,放眼未來,除外資之外,A股未來增量資金還包括銀行理財、社保基金、企業年金、保險資金等,這些資金的共同特點是評價體系更為中長線,大量籌碼將在優質資產上集中,優質資產與劣質資產的價格差異會更加明顯。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.