李寧(02331 HK):20 財年 1 季度略超預期,復甦領先同業 ,維持買入評級,目標價29.73港元

機構:招銀國際證券

評級:買入

目標價:29.73港元

我們仍然很看好李寧,主要是因為:1)20財年1季度公司表現領先同業,4月上旬顯著復甦,以及2)營運資金管理穩健(我們相信庫存水平健康並且可控)。因此,我們重申買入評級,並將目標價微調至29.73港元,基於30倍21財年預測市盈率,不變。

20財年1季度零售業流水堅挺,略超預期並領先同業。李寧今年1季度的零售流水同比下跌高雙位數,略好於招銀國際證券估計的21%下跌,表現比安踏(低20%下跌),寶勝(25%下跌)和Kappa(高20%下跌)堅挺,僅次於FILA(中單位數下跌)。

電子商務強勁,彌補了批發和直接零售的疲軟。我們認為公司1季度表現略超預期的原因是強勁的電商銷售。電商業務在今年1季度仍有低雙位數同比增長,僅由去年四季度的低四成增長略為下滑。公司主要壓力來自直接零售/批發管道,兩個管道的銷售去年4季度分別錄得高雙位數/四成低位數增長,但今年1季度則下跌了中三成/高雙位數。

沒有公佈20財年1季度同店增長數據,但可以理解。李寧未有公佈今年首季同店增長數據,我們相信在新冠肺炎疫情下部份門店曾經暫時關閉,會影響營業門店的數字基礎,因此此項數據的意義確實不大。

20財年4季度訂貨會的銷售增長將在中期業績時公佈,我們並不擔心這次的表現。部份投資者或對公司暫停公佈訂貨會銷售數字表示憂慮,但我們對此並不太擔心,原因是:1)訂貨會只是推遲舉行(通常在3月下旬舉行),由此未有相關數字,2)去年第四季以及今年春節的冬季服裝銷售穩健,售罄比率高。

20財年1季度約有200家門店關門,但對銷售和淨利潤影響有限。李寧在今年首季關閉了224家門店(自營零售/批發業務門店分別26家/198家),對比去年第四季下跌了3.5%。我們對此並不擔心,因為:1)這些門店一般業績不佳,通常錄得虧損,平均門店銷售比較低;2)公司在20財年,仍預計李寧核心品牌淨增加20-30家新門店。

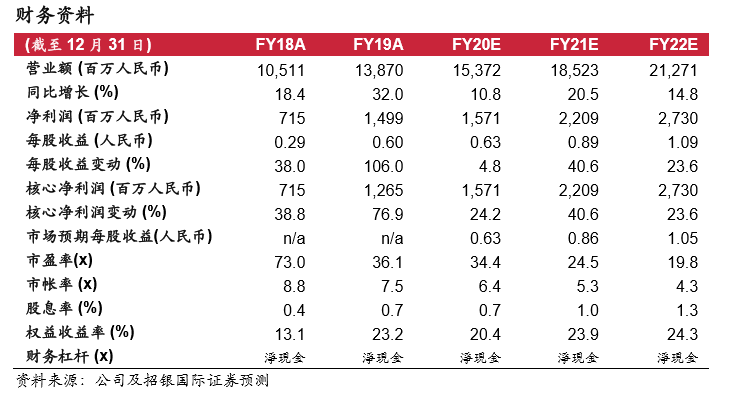

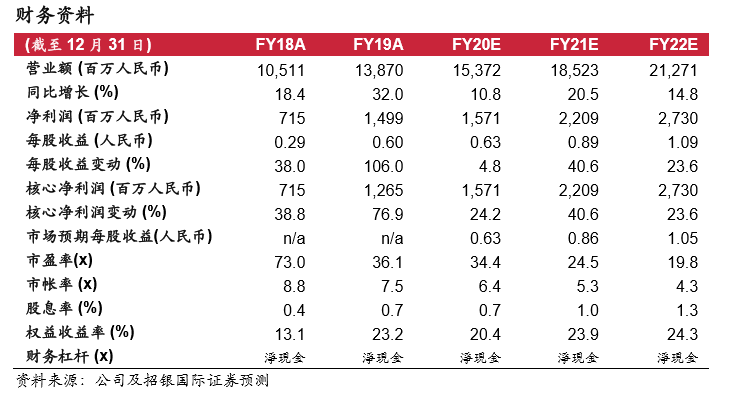

維持買入評級,上調目標價至29.73港元。我們維持買入評級,目標價微調至29.73港元,維持30倍21財年預測市盈率,不變,亦預期調整後的3年淨利潤複合年增長率為31%。公司目前估值為25倍21財年預測市盈率,估值十分吸引。我們將20/21/22財年每股盈利預測調整-4.0%/+0.3%/+0.8%,以反映今年首季批發業務有所改善/直接零售疲弱。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.