康希諾生物-B(06185.HK):國際一線新型疫苗陣營的新星,MCV4上市在即,給予“增持”評級,目標價106.26港元

機構:國金證券

評級:增持

目標價:106.26港元

投資邏輯

疫苗市場天花板高,公司有國內稀缺的專業團隊,或將受益且超越行業增速。(1)全球疫苗市場至2030年將達千億美元。中國疫苗產業僅不到20年時間,民企正快速崛起中。(2)2000年以來,全球新批16款創新疫苗已佔總市場份額53.7%。而領導者的專業背景與國際化經驗、視野和信息,是創新疫苗企業保持國際化可持續競爭力的要素。(3)康希諾4位聯合創始人團隊以及公司高層,來自疫苗研發、抗感染以及疫苗生產與銷售的國際與國內頂尖平台賽諾菲巴斯德、阿斯利康、輝瑞旗下惠氏、諾華以及中生集團,研發、生產與銷售皆創立於高起點。(4)公司已申請科創板發行,若成功,或將增添資本助力。

國際領先的疫苗研發實力:埃博拉疫苗註冊獲批、新冠病毒疫苗獲批臨牀。(1)公司全球首個埃博拉病毒疫苗Ad5-EBOV於2017年在中國獲批藥證;公司的非複製型病毒載體。(2)根據公司最新公告與科創板問詢回覆,其針對新冠病毒的腺病毒載體疫苗經過動物實驗並獲批進入臨牀。(3)公司在研PBPV全價(可覆蓋98%菌型)非血清型肺炎球菌疫苗為潛在全球創新疫苗。

中國首個MCV4上市在即,十年一劍磨礪成。(1)公司擁有1項新藥批件、4大重磅候選疫苗品種、13個適應症的16個在研管線以及16項國內專利和2項境外專利。(2)MCV4腦膜炎球菌結合疫苗大概率2020年獲批上市,估計產品峯值人民幣20-30億元,此類疫苗行業平均毛利在90%上下。目前中國二類苗市場快速發展,獨家品種上市後銷售增長較快。(3)2020年開始,公司大概率將步入營收與淨利從無到有的上升通道。豐厚在研重磅(詳見正文)儲備與已有7000-8000萬劑年產能與募投新產能,將確保公司長遠的可持續盈利高增長。在銷售團隊搭建、冷鏈運輸以及可追溯質量系統的構建上都已佈局。

盈利預測與投資建議

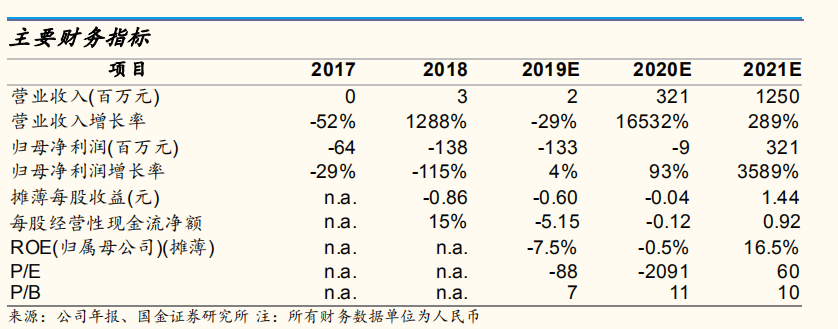

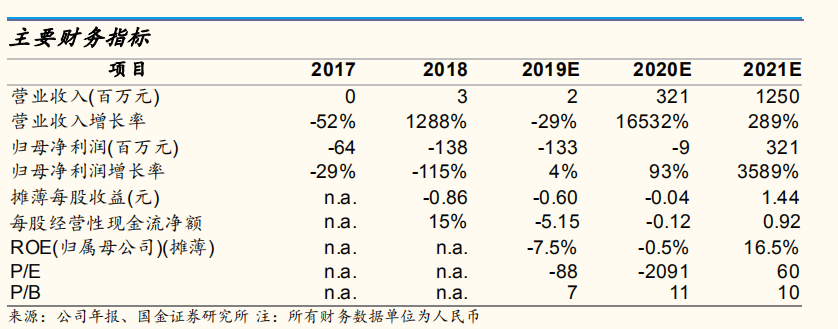

預計公司2019/20/21年營收人民幣193萬元、3.21億元、12.50億元,歸母淨利潤人民幣-1.44億元、-2100萬元、3.11億元(人民幣);我們給予公司未來6-12個月港幣106.26元目標價位,相當於70x2021年PE。建議從行業稀缺性的角度配置。給予“增持”評級。

風險

公司短期估值過高的風險。

公司獲批新上市產品商業化進程不達預期的風險。

疫苗類產品本身個性化差異較大可能帶來的相關安全事件的風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.