滔搏(06110.HK):規模優勢、科技賦能、品牌效應鑄就滔搏護城河,給予“買入”評級,目標價11.96港元

機構:廣發證券

評級:買入

目標價:11.96港元

核心觀點:(本文如無特殊説明,貨幣單位均為人民幣)

滔搏擁有全國最大的運動鞋服零售網絡。滔搏是中國最大運動鞋服零售商、耐克中國第一大經銷商、阿迪全球第一大經銷商,18年中國市佔率15.9%居第一,收入325.6億元,06-18年CAGR28.8%,其中80%+為耐克/阿迪。模式直營為主,截至19年9月25日直營店數佔比81%。

規模優勢、科技賦能、品牌效應鑄就滔搏護城河。(1)規模優勢:體現在終端門店總數第一(截至19年9月25日直營及經銷門店10329家),優質地段獲取能力(龐大數據帶來的篩選能力),業主分成制帶來租金優惠(19H1租金費率10.97%),強經銷商管控(掌握庫存/銷售數據),資金優勢及O2O庫存打通。(2)科技賦能:線下實時分析消費者行為不斷微調經營策略,線上通過高附加值會員制(如國際足球明星見面會)等強化消費者粘性。(3)品牌效應:體現在18年耐克/阿迪廣告費均過百億元,遠超其他運動品牌,並簽約了我國最受歡迎的籃球/足球頭部賽事的官方合作和頭部球隊/球員。如NBA官方合作只簽約了耐克;18屆世界盃32支球隊阿迪簽約12支,耐克簽約10支。三大護城河帶來18年滔搏存貨週轉102天,零售店均380萬元/年,均穩居業內第一。

借鑑FootLocker發展歷程。從收入增速角度,滔搏可能進入穩健增長期。借鑑FL的發展,我們認為(1)滔搏與品牌商的合作有望強化;(2)滔搏併購和電商提升空間較大;(3)FL復甦期由坪效提升主導,指引滔搏未來增長主線。

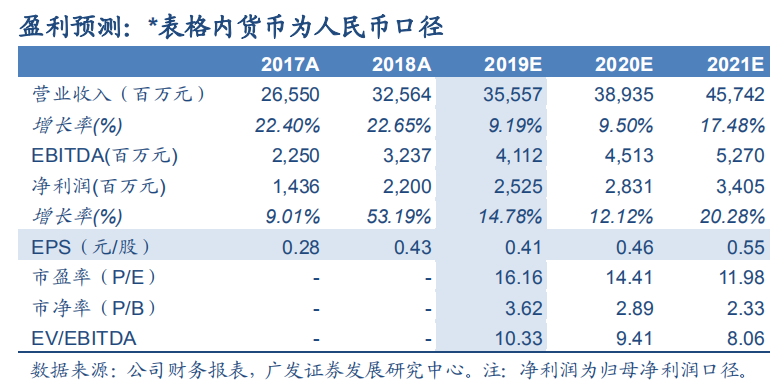

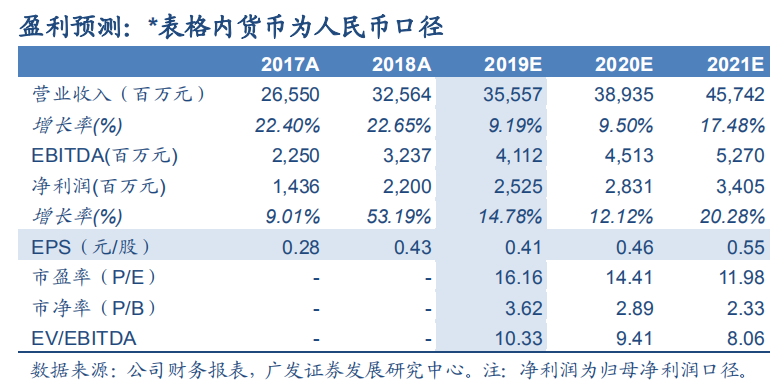

19-21年EPS為0.41/0.46/0.55元/股。預計19-21年滔搏收入355.6/389.4/457.4億元,YOY+9.2%/9.5%/17.5%;歸母淨利潤25.3/28.3/34.1億元,YOY+14.8%/12.1%/20.3%。使用DCF估值法,滔搏合理價值為11.96港元/股,首次覆蓋,給予“買入”評級。

風險提示。消費升級低於預期,疫情打擊線下消費等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.