洋河股份事件點評:持續調整拖累業績,疫情拉長調整期

作者:薛玉虎

來源:虎哥的研究

事件描述

2月28日,公司發佈19年業績快報,營收總收入231.1億元,同比-4.3%,歸母淨利73.42億元,同比-9.5%。

方正觀點

1、轉型調整期,業績繼續放緩在預期內:19年公司業績下滑,其中Q4單季度公司收入20.13億元,同比-37.0%,歸母淨利1.95億元,同比-81.9%,環比前三季度繼續放緩。這主要是因為公司從19年二季度開始去庫存挺價格,三季度確定全面調整思路,在解決渠道庫存,價格等問題上決心堅決,犧牲當年業績以謀求長遠健康發展。而且四季度是淡季,收入佔比低,增速波動大對全年影響有限。

2、調整源於升級下,產品結構調整,預計今年一季度繼續承壓:在白酒行業向上升級大浪潮中,100-200元左右價位逐步向次高端價位發展,而且江蘇地區經濟較發達,升級節奏相對較快。洋河藍色經典自03年上市,已有十多年發展歷史,特別是海之藍、天之藍等中檔價位產品,佔比高,不僅存在向上升級替代壓力,而且因暢銷逐步成為流量產品,,存在渠道利潤薄問題,渠道推廣積極性降低。公司此次調整力度大於以往任何一次,不僅放棄19年業績目標,而且在今年春節備貨中也是繼續控量挺價。但是受制於疫情影響,餐飲聚會受挫,春節動銷放緩,預計會延長公司調整時間週期,一季報仍將面臨較大壓力。

3、M6+上市增強高價位佈局,看好未來次高端夢繼續引領發展:我們判斷,公司調整到位後,海之藍、天之藍價格提升,渠道利潤增厚,生命力有所延續背景下,夢之藍持續放量帶動公司向上發展。同時,公司去年底還推出M6+,定價500元以上,通過新產品增強夢之藍高價位佈局,形成300-600元甚至更高價格的全覆蓋,繼續引領次高端發展趨勢。此外,公司自去年推出10-15億元回購計劃後,今年1月已開始回購股份,未來將完善公司激勵機制,提高內部積極性,推動長期健康發展。

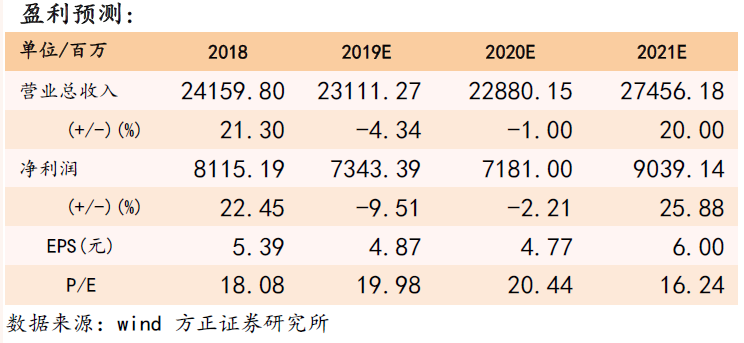

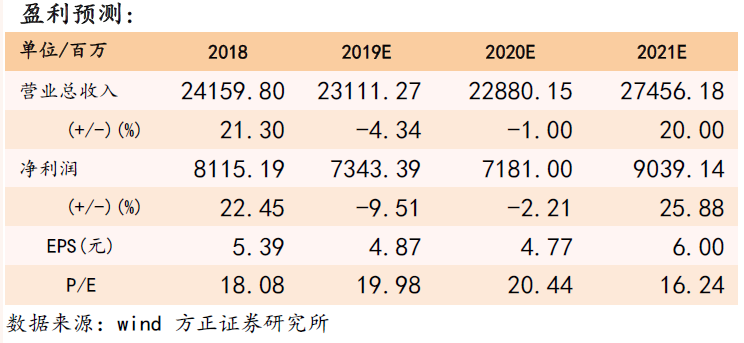

4、盈利預測與估值:預計公司19-21年EPS分別為4.87/4.77/6.00元,對應PE分別為20/20/16倍,考慮公司調整後可迎來向上發展,維持“強烈推薦”評級!

5、風險提示:1)疫情控制不及預期1)營銷調整進度低於預期;2)行業競爭格局加劇導致費用上升,影響淨利潤表現;3)夢之藍目前聚焦省內市場,省外市場擴張不達預期;4)食品安全問題等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.