新东方在线(1797.HK):大学产品升级,优播模式可期,维持“买入”评级

机构:国盛证券

评级:买入

大学业务战略重点明确,产品全线升级。2019财年公司大学业务营收6.31亿元,占比68.7%。大学板块盈利能力稳定且增速可观,毛利率在60-65%,净利率稳定在20%左右。展望2020财年,大学板块内各业务线战略重点进一步明确,产品定位全线升级。其中:

1)国内考试:考研课程占比最大、贡献主要增量,考研系列分为全程班和直通车,每科客单价分别为1000-2000元、4000-5000元,公司积极推广直通车精品课程,通过提高课程质量和附加服务持续提升客单价。

2)出国留学:起步较晚、以录播产品为主,后伴随精品化战略直播课程占比提升,2019财年出国留学板块增速快于国内考试,营收占比30%并有望持续提升。出国留学板块的课程优势在于采用雅思官方考试考官担任线上老师,与TPO官方独家合作引用原版教材,课程品牌及议价能力强。

3)英语学习:新概念、商务英语BEC等系列英语读物为主,原有产品种类较多、定位范围较广,目前已积极调整产品结构,定位高客单价精品课程。

东方优播商业模式可持续,城市拓展迅速。2019财年K12业务营收1.59亿元,占比17.3%,其中K12大班营收1.02亿元、东方优播营收0.57亿元。截至2019财年,东方优播培训人次达23万,同增369%,已进驻63个城市,新增37个城市,未来三年计划每年新增50个进驻城市,到2022年完成200家以上的地级市覆盖。从经营模式来看,东方优播小班化的教学效果有效保证用户留存,低价到正价转化率接近20%,正价科对科续班率达70%,线下地推的获客方式使得获客成本远低于同行业水平,2019财年仅为16元/人次。根据已有成熟网点数据,我们测算东方优播的单城市网点可于第三年实现盈利,预计第一/二/三年的入口班培训人次分别为1500/3000/6000人次,正价班培训人次分别达200/400/800人次,第三年实收收入达到300万元以上。前期由于网点固定成本投入以及教师利用率有待提升,前两年毛利率在0%-10%,后伴随教师利用率提升毛利率可达50%,稳态下净利率可达15%-20%。长期来看,单城市网点正价培训人次可达5000人,实收收入可达1000万元。

组织架构及人才团队调整完成,K12班课及优播并行发展。公司于2019财年进行了组织架构及人才团队的全新调整,进一步明确K12班课及东方优播为并行重点、大学业务稳步发展的战略目标。公司上市后建立了强大的大中台中心,将分属于各事业部、独立运营的市场营销、IT运营、客户中心集中于总部统一管理。大学及K12业务持续打磨产品,大学业务沿用线下兼职教师,K12班课调用线下优质教师,建立了50人以上的线上全职团队,截至2019财年,东方优播教师已达500人,均为全职,并于武汉建立第二个培训基地,加速培养新生代优秀教师。

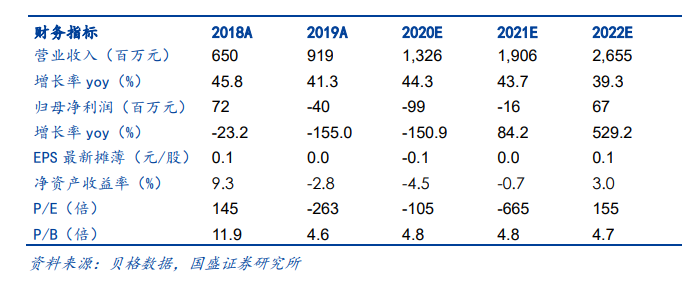

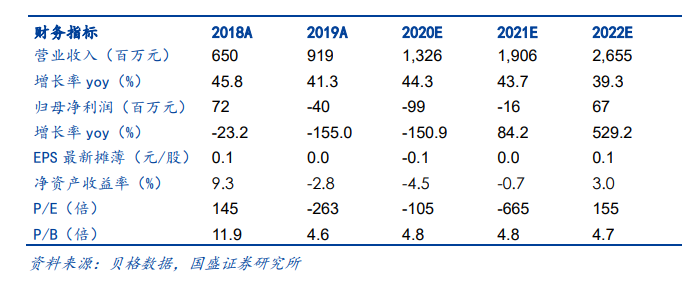

投资建议。作为新东方集团旗下唯一在线平台,公司品牌+用户+教研三大核心优势显著。我们维持2020/2021/2022财年归母净利-0.99/-0.16/0.67亿元,亏损逐步收窄并于2022财年实现盈利。我们长期看好K12在线市场的成长空间及背靠集团的竞争优势,维持“买入”评级。

风险提示:在线教育渗透率不达预期;行业竞争加剧;盈利能力改善不达预期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.