周大福( 1929.HK ):渠道下沉+多品牌战略,九十华诞龙头珠宝公司再迎辉煌,首次覆盖给予“推荐”评级

机构:方正证券

评级:推荐

周大福是全球市值最大的珠宝零售商,是大中华区总收入最高的珠宝公司。公司成立于1929年,至今已有90年历史。2019财年,公司收入达667亿港币:其中大陆地区占比63.7%,终端零售额近500亿人民币,市占率第一(约7%);港澳地区收入占比36.3%。公司实控人为香港四大家族之一的郑氏家族,目前管理层人员结构稳定,权力平稳过渡。

是少有的从“矿源到指尖”覆盖全产业链的珠宝公司。公司建立了从钻石源头采购,到自有钻石工厂切割打磨,再到品牌团队工厂设计镶嵌,最终在周大福门店销售的完整体系,公司有能力保证所售珠宝首饰销量60%以上为自建品牌工厂生产。

黄金产品优势明显,品牌矩阵布局钻石品类。周大福以黄金产品起家,在黄金产品上不断推陈出新,公司是最先推出当前流行的古法黄金概念和产品的,FY2019黄金产品收入占比在60%以上。公司采取多品牌战略,旗下主打高端钻石的品牌有HOF(于2014年收购的美国钻石品牌)和TMARK,此外有面向千禧一代的MONOLOGUE和SOINLOVE轻奢珠宝品牌。目前各品牌逐渐进入成熟阶段。

内地门店数突破3000家,将以加盟店形式拓展加速拓展低线市场。公司最大的优势在于能够开设和管理庞大的自营门店体系,公司在内地的自营店超过1700家(2019/6),远超同行,但超过60%的门店分布在一二线城市,为了提升在低线城市的市占率,公司去年开始以加盟的形式加速开店:FY2019内地新增的539家门店中有近70%是加盟店。虽然公司目前在低线城市的渗透率相对低,但长期形成的良好产品口碑和品牌形象将有助于下沉渠道拓展。

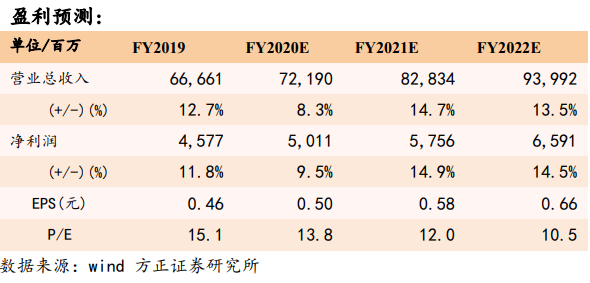

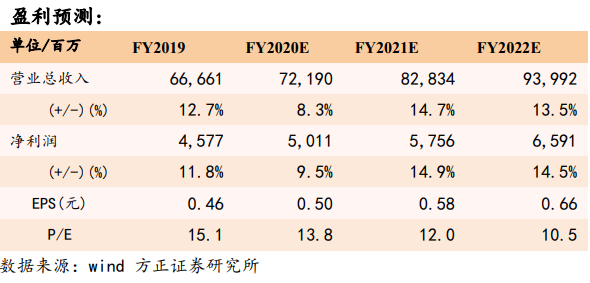

投资评级与估值

我们预计公司2020~2022财年实现收入722、828、940亿港元,净利润为50/58/66亿港元,对应PE估值14/12/11倍,首次覆盖,给予“推荐”评级。

风险提示

大陆地区可选消费增速放缓;公司港澳地区收入占比约36%,香港地区局势动荡对零售业有较大冲击,预计对公司业绩产生负面影响

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.