华晨中国(1114.HK)宝马利润率环比回升超预期本部业务持续亏损维持“买入”评级目标价9.0港元

机构:招商证券

评级:买入

目标价:9港元

上半年净利润同比下降9.4%,华晨宝马投资收益同比下降3.4%,但宝马净利润率环比回升幅度超预期,目前终端销售定价趋稳

■本部业务持续亏损,暂时未见转机

■维持买入评级及目标价9.0港元(6.2xFY19EP/E)

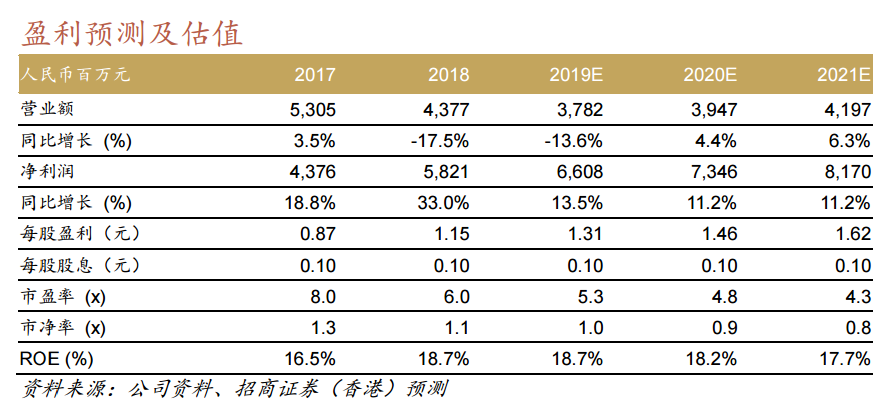

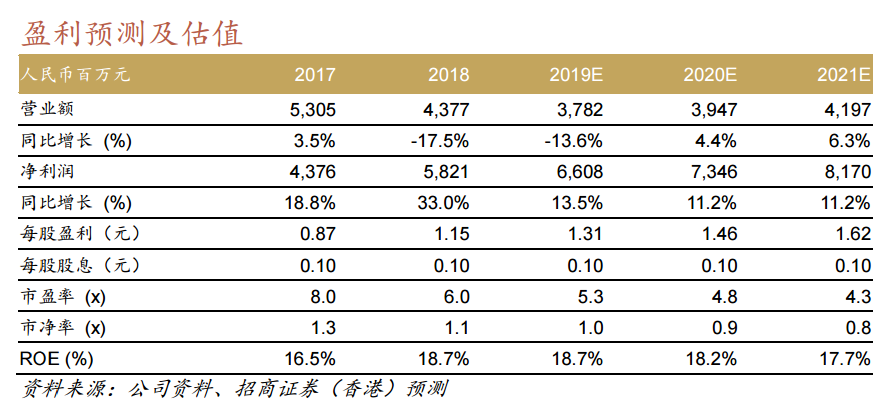

宝马利润率环比回升,本部业务难扭亏上半年净利润同比下降9.4%至32.3亿元人民币,若剔除特别派息一次性预扣税2亿元人民币影响,同比降3.8%。宝马合资公司(持股50%)投资收益同比下降3.4%至35.5亿元人民币,其净利率9%同比下降2.7ppt,但环比回升2.2ppt好于预期。宝马销量同比增长25.9%至26.4万辆,ASP同比持平,盈利未能同步增长原因:

1)对宝马经销商较大补贴保障销量,以及3系换代降价清库存;

2)人民币兑欧元走弱,华晨宝马远期外汇对冲损失。

本部面包车业务亏损扩大:1)收入/毛利(均不含华晨宝马)同比下滑16.7%/35.4%;2)销售/管理/财务费率合计同比提升4.3ppt至26.9%。

管理层对宝马及豪华车市场展望乐观,终端定价趋稳

管理层维持宝马销量增长15%的指引,前7月已完成目标销量约60%,预计实现目标难度不大。管理层认为中国豪华车市场上半年增长约9%,全年估计10%以上,远高于整体汽车行业(我们预计同比下降5%以上),未来2-3年豪华车市场仍有很大的增长空间。我们渠道调研显示,宝马的折扣率从上半年的低双位数逐步收窄到目前的高单位数,主要得益于库存控制更加合理,以及宝马3系老款清库存完成,新3系提高整体终端价格的稳定性。我们估计宝马下半年不会再出现对经销商高额补贴的情况,去年下半年终端价格因关税预期下调受冲击,宝马额外向经销商增加补贴。

维持买入评级及目标价9.0港元

上调2019-21E宝马合营公司净利润预测2%/1%/2%反映上半年宝马利润率恢复好于预期。对本部面包车业务盈利做更保守预期,因其金杯品牌产品线老化,未来导入雷诺产品底盘也仍需较长调整周期,目前仍未见转机。综合两方面因素,对公司2019-21E净利润预测维持大致不变。维持买入评级及目标价9.0港元,相当于6.2xFY19EP/E(估值倍数维持)。考虑到未来公司持有宝马股权减少后,盈利稳定性降低,给予估值相对当前汽车制造商行业平均(7.6x)折让近20%,相对公司历史平均(11.3x)折让45%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.