Kingsoft Cloud (03896.HK) has seen its stock price stabilize and rise in recent Hong Kong trading sessions. Over the past five days, the company’s stock price has gradually strengthened after negative factors cleared, reaching over HKD 6 during today’s intraday trading, showing a moderate increase compared to the previous trading day. From a trading volume perspective, there has been a significant increase in activity following the earnings report, with market expectations of the company’s inflection point rising.

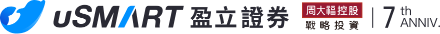

(Image source: uSMART HK app)

Entering an Improvement Cycle, Net Profit Turns Positive for the First Time

Kingsoft Cloud’s Q3 2025 earnings report revealed a significant turning point in its overall operational performance, with "first-time profitability" being the highlight of the quarter. Driven by the continuous growth of AI-powered cloud services, optimization of public cloud structure, and effective cost control, the company achieved a critical breakthrough in its overall profitability for the first time in years.

|

Metric |

Data |

|

Total Revenue |

RMB 2.478 billion |

|

Adjusted Operating Profit |

RMB 15.36 million (first positive) |

|

Adjusted Net Profit |

RMB 28.73 million (first time achieving quarterly profit) |

|

Public Cloud Revenue YoY Growth |

~49% |

|

Smart Computing Cloud Billings YoY Growth |

~120% |

(Data source: Kingsoft Cloud Q3 2025 financial report)

This quarter, the smart computing-related business continued to expand rapidly, becoming an important engine for the company’s revenue and profit growth. Meanwhile, the public cloud business structure has been continuously optimized, boosting overall gross margin levels. Industry insiders generally believe that after years of cost structure adjustments and business focus, Kingsoft Cloud is entering a new cycle of healthy growth.

Strengthened Ecosystem Synergy, Xiaomi-Kingsoft Collaboration Expands

Of particular note is that Xiaomi's ecosystem continues to be one of Kingsoft Cloud’s most stable sources of growth. The revenue from the Xiaomi-Kingsoft ecosystem increased significantly this quarter, further expanding its share. This not only strengthens the company’s base but also lays the foundation for its future AI ecosystem strategy.

Kingsoft Cloud mentioned in the earnings report that the collaboration between Xiaomi and Kingsoft Cloud is transitioning from traditional cloud resource procurement to a deeper level of collaboration in smart cloud and AI computing power platforms, which suggests that the business potential ceiling is being raised. In multiple areas including smart devices, IoT, and AI model training, Xiaomi’s powerful terminal and ecosystem are forming tighter links with Kingsoft Cloud’s computing power capabilities, providing sustained momentum for revenue growth in the coming quarters.

Moving Towards Key AI Computing Milestones, Profit Sustainability Becomes a Key Focus

Following the earnings release, the market widely believes that Kingsoft Cloud has completed a key transition from “scale growth” to “quality improvement,” with AI computing cloud services expected to be the core focus for the next two to three quarters. However, profitability has just turned positive, and the scale remains relatively limited, so future stability will depend on the efficiency of computing power resource investment, the competitive landscape of public cloud services, and the deepening of ecosystem strategic collaborations.

Overall, the profitability breakthrough this quarter not only has stage significance but also provides the underlying momentum for the company to reshape market expectations. In the context of accelerating industry AI adoption and cloud service restructuring, Kingsoft Cloud has entered a higher-certainty phase of growth.

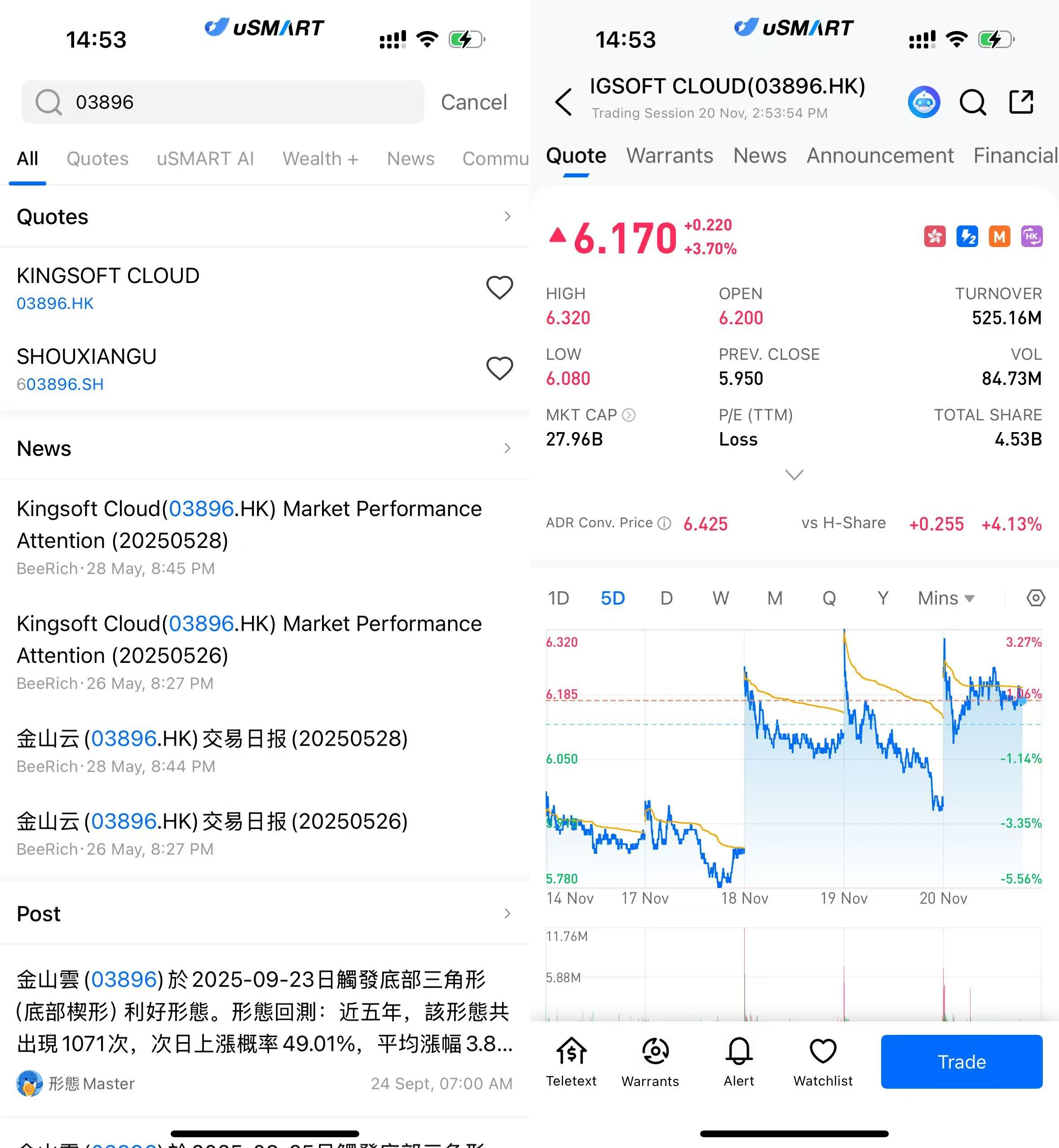

How to Buy Kingsoft Cloud via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (03896.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)