Xizang Zhihui Mining Co., Ltd. (2546.HK) has launched its Hong Kong initial public offering (IPO), with the subscription period running from December 11 to December 16. The company plans to issue a total of 121,952,000 H shares, comprising 12,196,000 shares for the Hong Kong public offering (subject to reallocation) and 109,756,000 shares for the international offering (subject to reallocation). The offer price ranges between HK$4.10 and HK$4.51 per share, with a board lot size of 1,000 shares. Trading is expected to commence on the Main Board of the Hong Kong Stock Exchange on December 19. The joint sponsors are Orient Securities (Hong Kong) Limited and Maxa Capital Limited.

Zhihui Mining: A Leading Zinc, Lead, and Copper Concentrates Producer in Tibet

Offering Structure: Hong Kong public offering accounts for approximately 10% (12,196,000 shares), and international placing accounts for approximately 90% (109,756,000 shares).

Offer Price: HK$4.10–4.51 per share; 1,000 shares per lot.

Offering Period: December 11–16 (pricing expected on December 17).

Listing Date: December 19.

Joint Sponsors: Orient Securities (Hong Kong) Limited, Maxa Capital Limited.

Company Overview

Zhihui Mining is a mining company engaged in exploration, mining, and the production and sales of zinc, lead, and copper concentrates in Tibet, China. According to data from Shanghai Metals Market, based on average annual production in 2024, the company ranked fifth in Tibet in zinc concentrates output, fourth in lead concentrates, and fifth in copper concentrates.

Its Montyah mine comprises both an open-pit mine and an underground mine, the latter having commenced commercial operations in the second quarter of 2025. The company operates across the full value chain—from mining and beneficiation to the sale of concentrates.

Financial Information

According to the prospectus, Zhihui Mining recorded revenues of approximately RMB 482 million, RMB 546 million and RMB 301 million for 2022–2024, respectively, with net profits of around RMB 118 million, RMB 155 million and RMB 56 million during the same periods. For the seven months ended July 31, 2025, the company posted revenue of about RMB 257 million and net profit of roughly RMB 52 million. Based on the mid-point offer price of HK$4.30 per share, Zhihui Mining expects to raise net proceeds of approximately HK$471 million, which are earmarked for enhancing mining capacity (around 29.2%), increasing exploration investment (around 23.4%), upgrading beneficiation and concentrate production capacity (around 18.7%), investments and acquisitions (around 14.0%), supplementing working capital (around 7.7%) and repaying bank loans (around 7.0%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

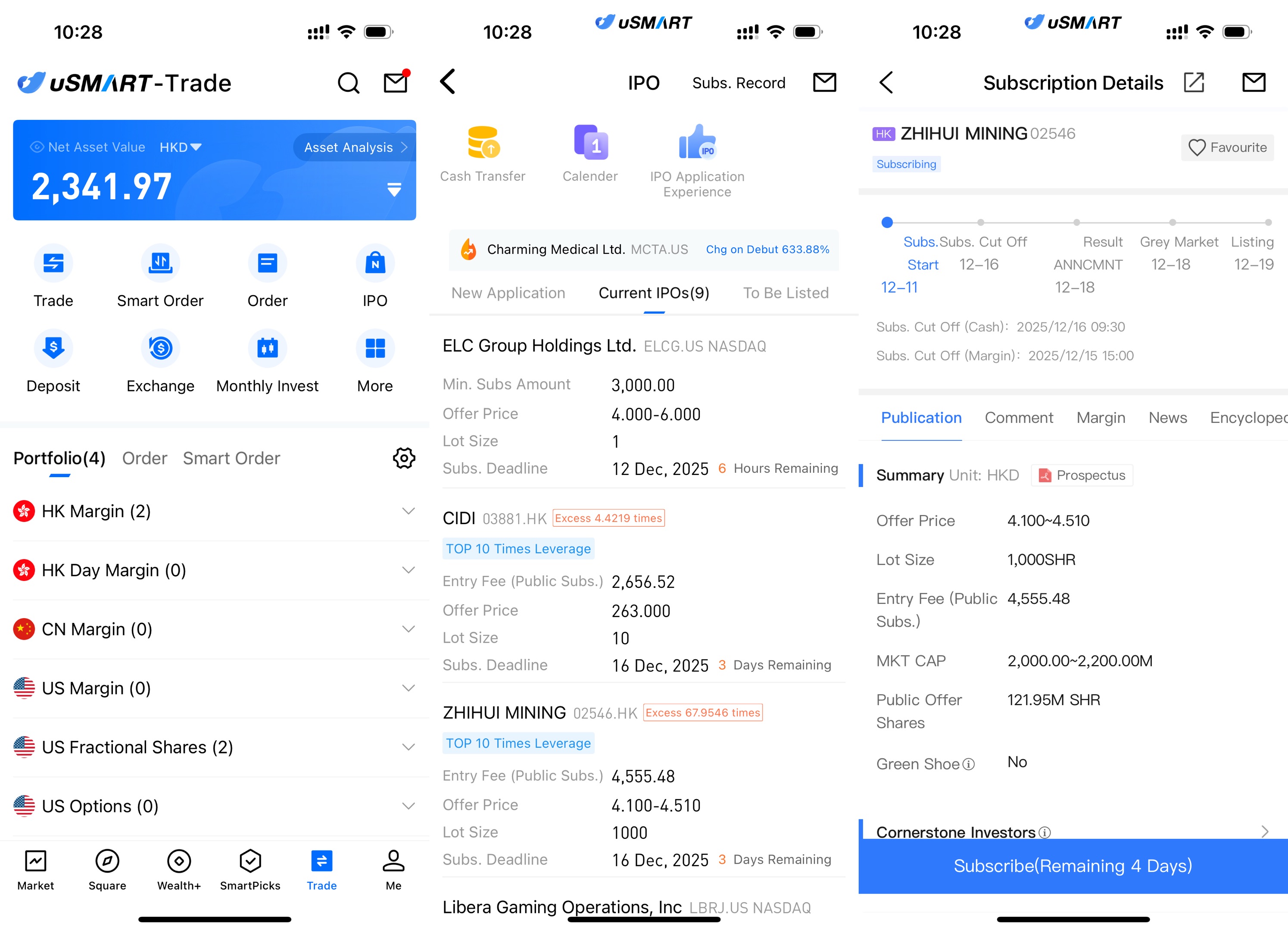

How to Subscribe for Zhihui Mining via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Zhihui Mining, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)