JINYAN KAOLIN NEW MATERIALS (Anhui Jinyan Kaolin New Material Co., Ltd., GOLDEN ROCK, 2693.HK) has launched its initial public offering (IPO) in Hong Kong. The subscription period runs from November 25 to November 28, 2025, with a global offering of 24,300,000 H-shares, including a 15% over-allotment option. The offering price is set at HK$7.30 per share, with a board lot size of 500 shares, resulting in a minimum investment of approximately HK$3,686.82. The company expects to be listed on the Main Board of the Hong Kong Stock Exchange on December 3, 2025. Joint sponsors for the IPO are Guoyuan Financing (Hong Kong) Limited and Minsheng Capital Limited.

Jinyan Kaolin New Materials: A Leading Chinese Coal-Series Kaolin Producer

Offering Structure:

Hong Kong public offering: ~10% (2,430,000 shares)

International placement: ~90% (21,870,000 shares)

Offer Price: HK$7.30 per share

Board Lot Size: 500 shares

Minimum Investment (per lot): ~HK$3,686.82

Subscription Period: November 25–28, 2025

Expected Listing Date: December 3, 2025

Joint Sponsors: Guoyuan Financing (Hong Kong) Limited, Minsheng Capital Limited

Company Overview

Jinyan Kaolin New Materials specializes in the mining, research and development, processing, and sales of coal-series kaolin. The company possesses fully integrated capabilities across the entire value chain. Its main products include precision casting-grade mullite materials and refractory-grade mullite materials, which are widely used in industries such as automotive, aerospace, medical devices, metallurgy, and construction materials.

According to a report by Frost & Sullivan, based on revenue in 2024, Jinyan Kaolin is the largest producer of precision casting-grade mullite materials in China, with a market share of 19.1%, and ranks fifth in the overall Chinese coal-series calcined kaolin industry.

Financial Highlights

As disclosed in the prospectus, Jinyan Kaolin reported revenues of

approximately RMB 190 million, RMB 205 million, and RMB 267 million for the years 2022, 2023, and 2024, respectively. The net profit for the same period was approximately RMB 24 million, RMB 44 million, and RMB 53 million. For the five months ending May 31, 2025, the company generated revenue of approximately RMB 105 million and a net profit of approximately RMB 18 million. Based on the offer price of HKD 7.30 per share, the company expects to raise a net amount of approximately HKD 124.3 million, assuming the over-allotment option is not exercised. The funds will be used for the deep processing of corundum-based aluminum-silicon materials (approximately 70.8%), establishing a silicon-aluminum new materials engineering research center (approximately 20.6%), repaying bank loans (approximately 0.6%), and for working capital and general corporate purposes (approximately 8.0%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

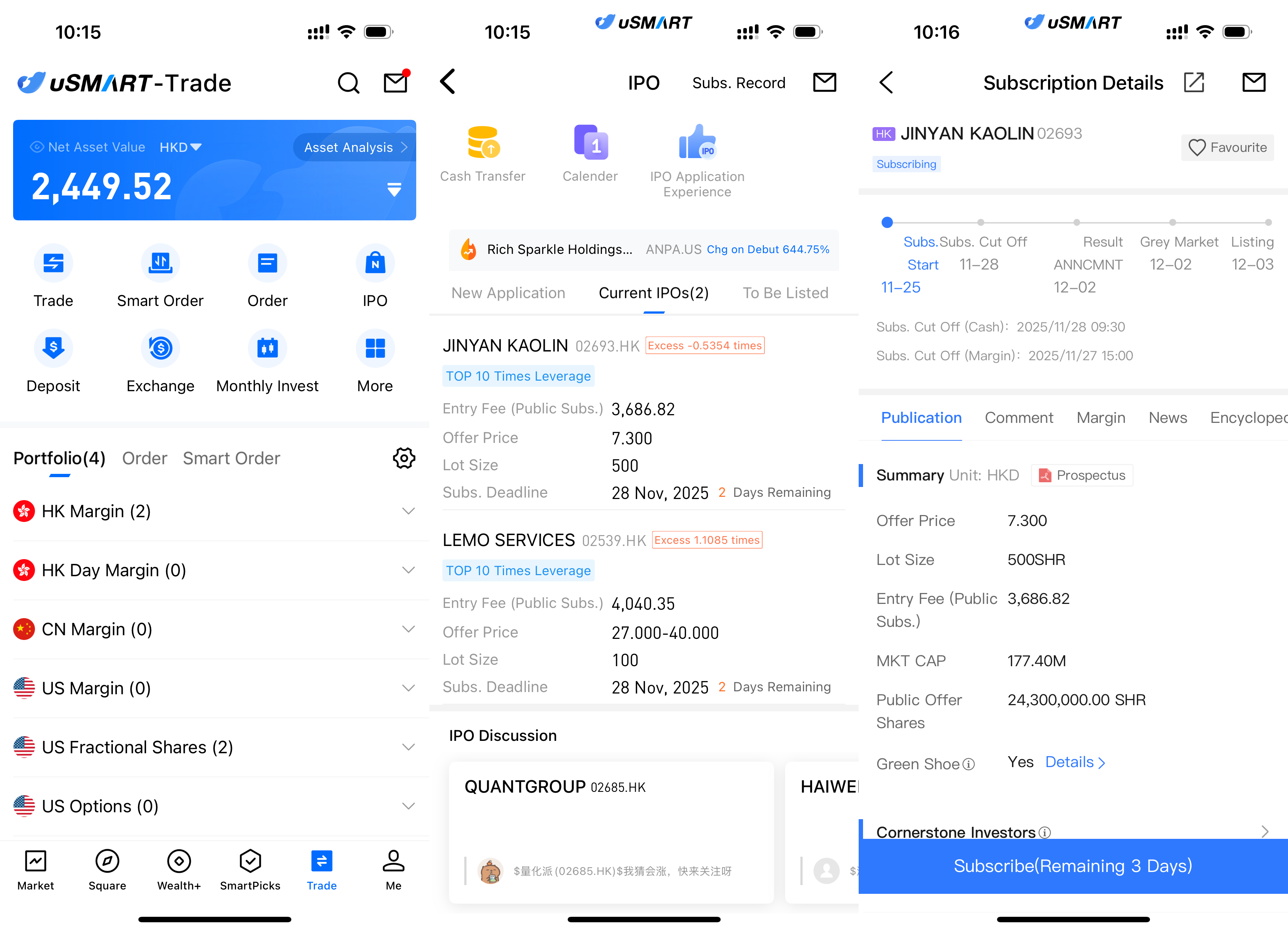

How to Subscribe for JINYAN KAOLIN via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select JINYAN KAOLIN, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)