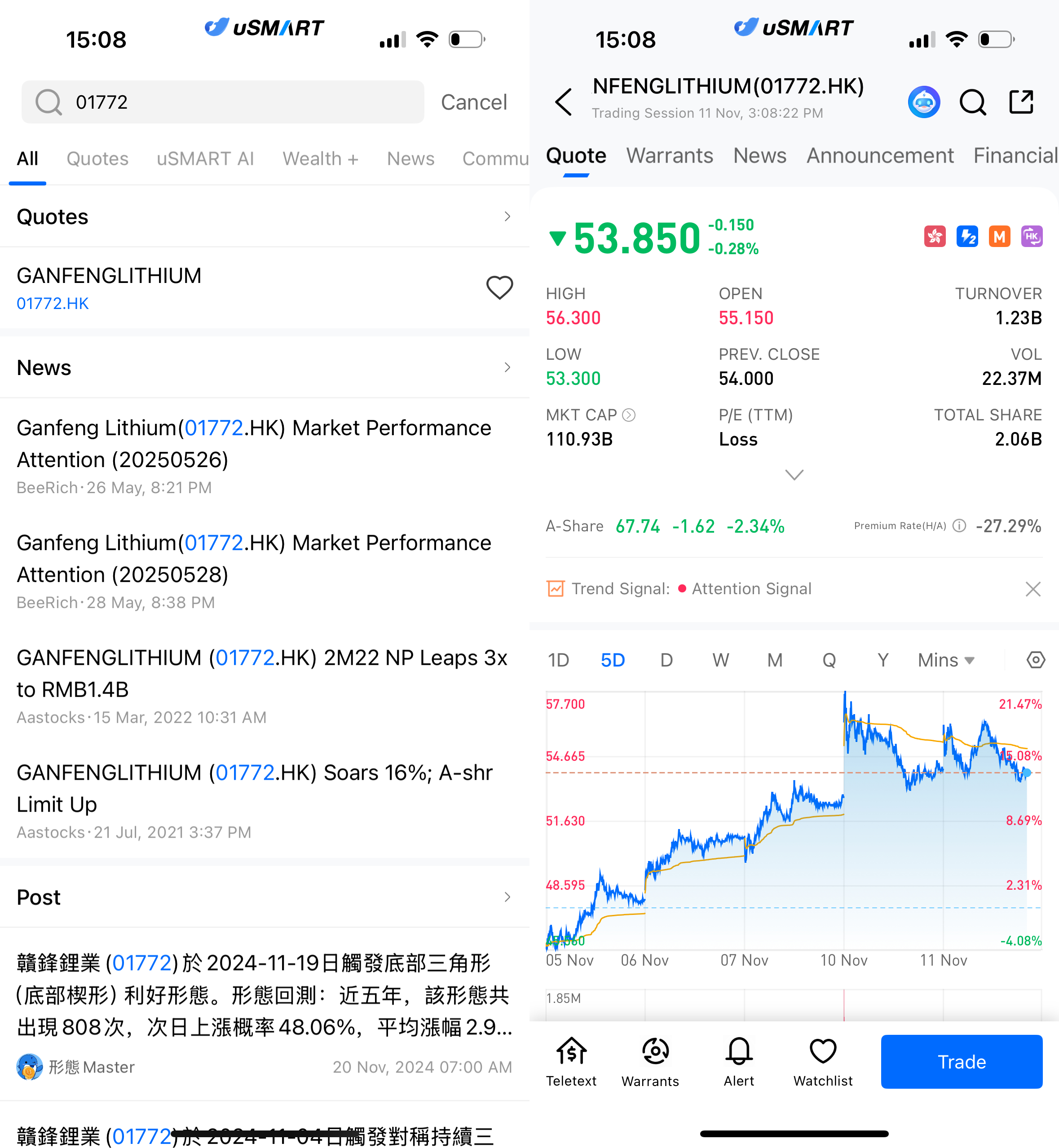

November 11, 2025 — Ganfeng Lithium (01772.HK) has recently demonstrated strong performance in its stock price, climbing from HK$48.6 on November 5 to HK$54 today, with a peak increase of 21%. The continuous rise in its stock price has garnered widespread attention in the market, with the current growth stabilizing around 15%. This reflects investors' high confidence in the company's future development prospects. Ganfeng Lithium's successful expansion is closely tied to its strategic position in the global lithium battery supply chain, particularly its positive progress in the Argentina lithium salt lake merger project, which further strengthens market confidence.

(Image Source: uSMART HK app)

Key Progress in the Lithium Salt Lake Merger Project

Ganfeng Lithium recently announced significant progress in its lithium salt lake merger project located in Argentina. The project's design aims for an annual production capacity of 150,000 tons of LCE (lithium battery-grade lithium carbonate), which will further enhance Ganfeng Lithium's position in the global lithium industry in the coming years. As a leading global supplier of lithium battery materials, this major project will accelerate the company’s lithium resource development, especially in the rapidly growing electric vehicle (EV) industry. Ganfeng Lithium’s move into the Argentine market, leveraging the region’s rich lithium resources, marks an important step in its global strategic layout. The implementation of the Argentina lithium salt lake project will not only increase Ganfeng Lithium’s resource reserves but also provide a stable source of income for the company in the coming years. As the project progresses, Ganfeng Lithium’s lithium salt production will significantly rise, helping the company further solidify its global leadership position.

Investor Confidence Grows, Continuous Capital Inflows

The rise in Ganfeng Lithium’s stock price is driven by the market's optimistic outlook for the company's future. Since early November, Ganfeng Lithium’s stock price has continued to increase, with a noticeable rise in trading volume, reflecting the high expectations investors have for its earnings growth. As the global electric vehicle industry develops rapidly, the growing demand for lithium batteries has enabled Ganfeng Lithium’s core business to expand swiftly. Particularly, amid the tightening supply of battery raw materials globally, Ganfeng Lithium has strengthened its control over the lithium supply chain through acquisitions and project development, making the company even more attractive to the market. In addition to the Argentina lithium salt lake project, Ganfeng Lithium has also made positive progress in its global lithium mining resource expansion. These strategic moves not only enhance the company's competitiveness in the global market but also provide strong support for maintaining robust earnings growth in the coming years

Broad Market Outlook, Earnings Growth Expected

Looking ahead, Ganfeng Lithium’s stock price is expected to continue to attract market capital. As global demand for lithium continues to grow, especially with the expansion of the electric vehicle market, the company’s ongoing investments in lithium resource development and supply chain integration are expected to yield stable revenue growth. The advancement of the Argentina lithium salt lake merger project, in particular, is poised to provide Ganfeng Lithium with a substantial supply of lithium resources in the coming years, further consolidating its leadership position in the global lithium market. As the lithium battery industry continues to innovate and grow, Ganfeng Lithium’s technological advantages and resource reserves will ensure its strong market competitiveness in the future. Market analysts widely believe that Ganfeng Lithium will achieve sustainable growth in the coming years, and its stock price is likely to break through higher levels. With the continued rise in demand for lithium in the supply chain, the company’s earnings growth will become even more significant. As a result, investors remain confident in Ganfeng Lithium’s future, expecting its stock price to maintain a strong upward trend in the coming months.

How to Buy Ganfeng Lithium on uSMART

After logging into the uSMART HK App, tap the search icon in the top-right corner, enter the stock code (01772.HK), and open the details page to view trading and historical information. Then tap “Trade” at the bottom-right, select the order type, enter your trading conditions, and submit your order.

(Image Source: uSMART HK app)