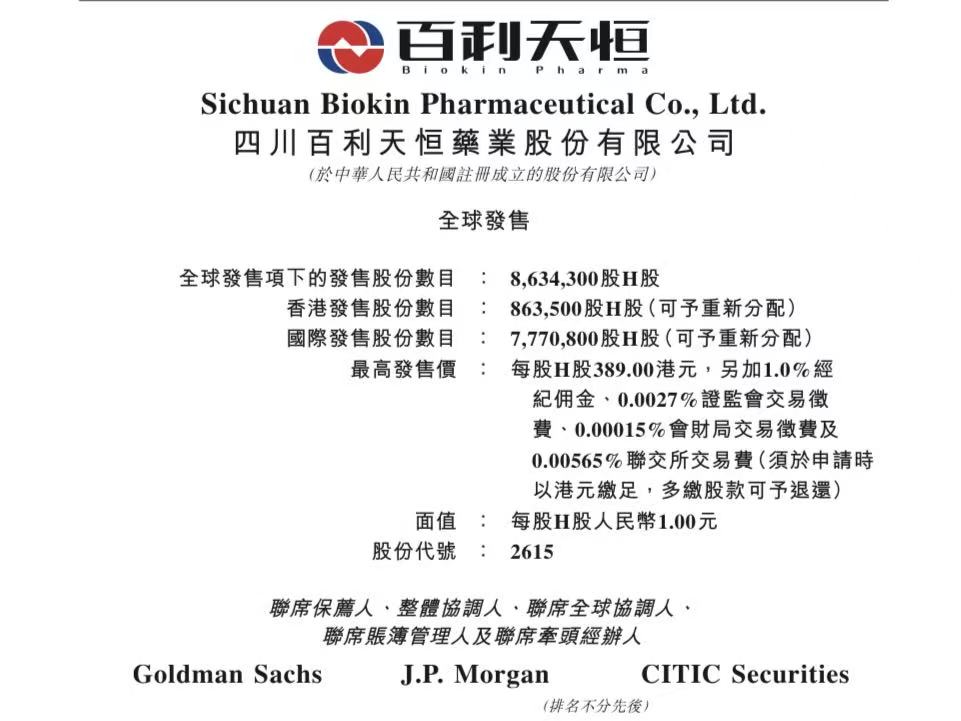

BaLi Tianheng Pharmaceutical Co., Ltd. (Sichuan Biokin Pharmaceutical Co., Ltd., 2615.HK) has launched its Hong Kong IPO, with the offering period running from November 7 to November 12. The company plans to issue a total of 8,634,300 H-shares globally, with a reallocation mechanism in place. The offering price range is HKD 347.50–389.00 per share, with a lot size of 100 shares and an entry fee of approximately HKD 39,292.31. The stock is expected to be listed on the Hong Kong Stock Exchange's Main Board on November 17. The joint sponsors are Goldman Sachs, J.P. Morgan, and CITIC Securities.

BaLi Tianheng: A Comprehensive Pharmaceutical Enterprise with R&D and Commercialization Capabilities

Offer Breakdown: Approximately 10% of the shares (863,500 H-shares) are for public offering in Hong Kong (with a reallocation option), while around 90% (7,770,800 H-shares) will be for international placement (with a reallocation option).

Offer Price: HKD 347.50–389.00 per share; lot size of 100 shares; entry fee approximately HKD 39,292.31.

Offer Period: November 7 to November 12 (pricing date expected on November 13).

Listing Date: November 17.

IPO Sponsors: Goldman Sachs, J.P. Morgan, CITIC Securities.

Company Profile

BaLi Tianheng is a comprehensive pharmaceutical group with capabilities in early-stage research and development, clinical development, manufacturing, and commercialization. Its business covers the research and sales of innovative biologics, generic drugs, and traditional Chinese medicine. The company owns the world’s first and only EGFR×HER3 bispecific antibody ADC drug, iza-bren, which is currently in Phase III clinical trials. In December 2023, BaLi Tianheng entered into a strategic cooperation agreement with BMS, with a total deal value of up to USD 8.4 billion. The company’s products are distributed through more than 1,000 dealers, covering hospitals and pharmacies across more than 30 provinces in China.

Financial Information

According to the prospectus, BaLi Tianheng reported the following revenues and profits (in RMB) for 2022–2024: 2022: Revenue of approximately 702 million, net loss of 282 million; 2023: Revenue of approximately 560 million, net loss of 781 million; 2024: Revenue of approximately 5.82 billion, net profit of 3.71 billion. For Q1 2025, the company reported revenue of approximately 170 million and a net loss of 1.12 billion. At the mid-price of HKD 368.25, the company expects to raise a net amount of approximately HKD 3.02 billion. The funds will be used for the research and development of candidate biologic drugs outside mainland China (approximately 60%), the establishment of a global supply chain (approximately 30%), and working capital and general corporate purposes (approximately 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

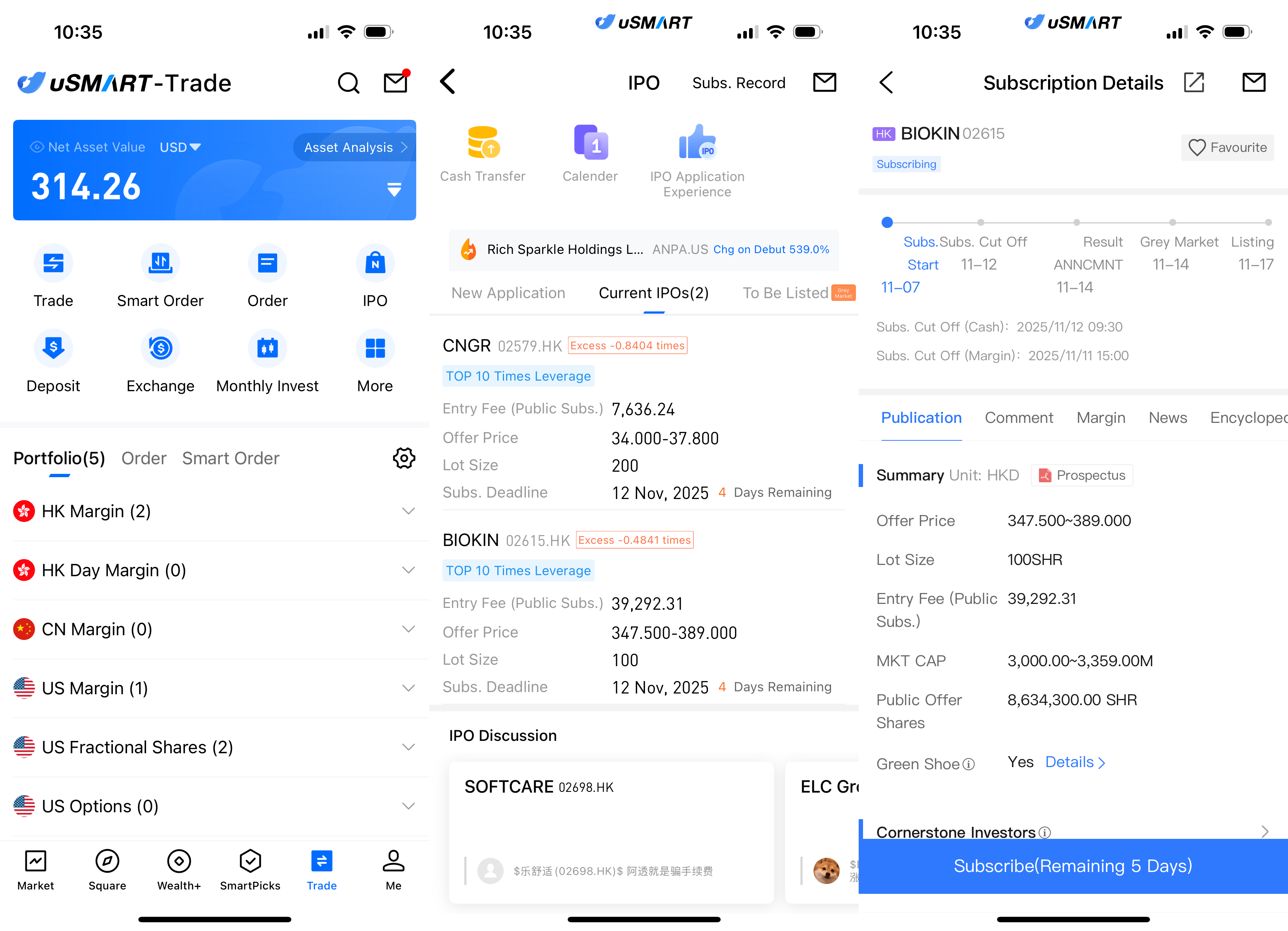

How to Subscribe for BaLi Tianheng via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select BaLi Tianheng, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)