MetaLight Inc. (02605.HK) is conducting its initial public offering (IPO) from June 2 to June 5, 2025. The company plans to offer 24.856 million shares at an offering price of HK$9.75 per share. The minimum trading lot size is 400 shares. The stock is expected to commence trading on the Hong Kong Stock Exchange on June 10, 2025.

MetaLight Inc. :Parent Company of the Real-Time Bus Arrival Information App Chelaile – Launches IPO

Offering Structure: The company plans to issue 24.856 million shares globally, of which 10% (approximately 2.4856 million shares) will be offered in the Hong Kong public offering, and 90% (approximately 22.3704 million shares) will be placed internationally.

Offer Price: HK$9.75 per share, raising approximately HK$242 million. One board lot consists of 400 shares, requiring a minimum investment of approximately HK$3,939.34.

Offering Period: From June 2 to June 5, 2025

Listing Date: Shares are expected to commence trading on the Hong Kong Stock Exchange on June 10, 2025

Sole Sponsor: China International Capital Corporation (CICC)

(Source: MetaLight Inc. Prospectus)

Company Profile

MetaLight Inc., founded in 2010 and headquartered in Wuhan, is a high-tech enterprise specializing in time-series data analysis. The company is dedicated to deep mining and modeling of sequential data points arranged by time to identify and predict trends, patterns, and fluctuations of analytical subjects over time. In 2013, MetaLight launched its core product, the Chelaile app, which leverages advanced time-series data technology to provide users with accurate and real-time public transit information. According to relevant data, MetaLight ranks among the top 20 time-series data service providers in China and is the third-largest provider by revenue in China’s public transportation sector. As of December 31, 2023, Chelaile covers 264 cities nationwide, making it the largest real-time bus information platform in China by city coverage, with a cumulative user base exceeding 260 million.

Financial Information

According to the prospectus, MetaLight’s revenue mainly comes from mobile advertising services and data technology services. From 2021 to 2023, the company reported total revenues of RMB 163.4 million, RMB 135.4 million, and RMB 174.5 million, respectively. During the same period, gross profits were RMB 122.7 million, RMB 98.8 million, and RMB 133.2 million; gross profit margins were 75.1%, 73.0%, and 76.3%. Adjusted net profits were RMB 44.2 million, RMB 9.8 million, and RMB 46.5 million. The notable fluctuation in 2022 was mainly due to the impact of the COVID-19 pandemic, which significantly reduced public transportation usage and caused a short-term decline in platform traffic and related service demand. With the easing of the pandemic, the company achieved a performance recovery in 2023, with significant rebounds in both gross profit and net profit.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

0% interest* on margin subscriptions, with up to 10x leverage

0 handling fee for cash subscriptions

Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

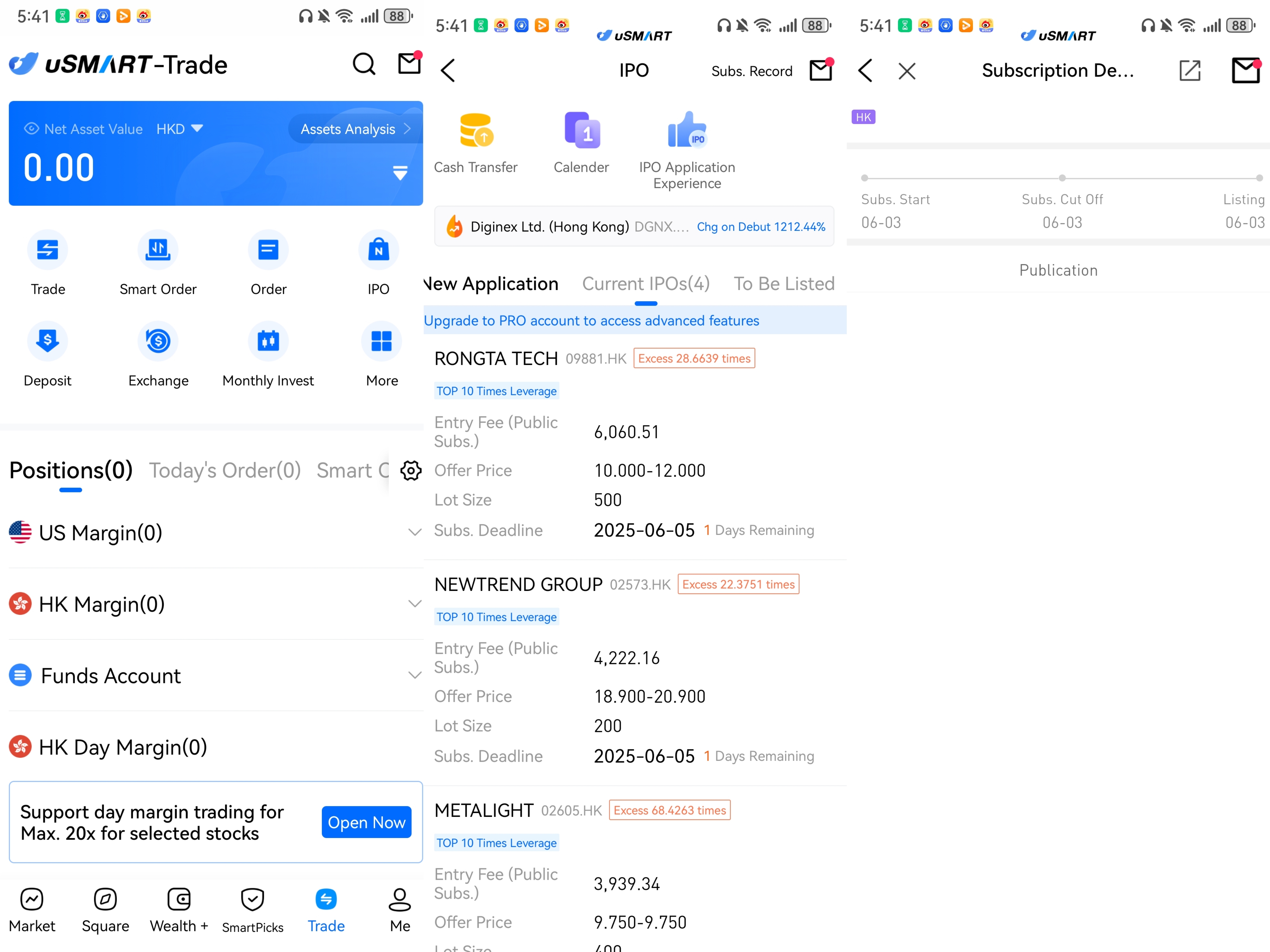

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)