Rongta Technology (09881.HK) is conducting its initial public offering (IPO) from May 30 to June 5, 2025. The company plans to offer 18.4 million shares at an indicative price range of HK$10 to HK$12 per share, with a board lot size of 500 shares. The shares are expected to commence trading on the Hong Kong Stock Exchange on June 10, 2025.

Rongta Technology: AIDC Device and Solutions Provider

Offering Size: 18.4 million H shares, with 10% allocated to the Hong Kong public offering and the remaining 90% to international placement

Offering Price: HK$10 to HK$12 per share; board lot size of 500 shares; minimum investment (entry fee) approximately HK$6,060.51

Offering Period: May 30 to June 5, 2025

Listing Date: June 10, 2025

IPO Sponsor: Yuexiu Capital

Company Profile

Rongta Technology is a global provider of Auto-Identification and Data Capture (AIDC) devices and solutions, specializing in the design, R&D, manufacturing, and marketing of printing equipment, weighing scales, POS terminals, and PDAs. By integrating technologies such as the Internet of Things (IoT), cloud printing, and artificial intelligence, the company aims to enhance the efficiency and accuracy of both business operations and daily life. In addition to offering customized solutions, Rongta also provides over 100 standard products that are widely used across various sectors, including retail, education, food and beverage, logistics, manufacturing, and healthcare.

Financial Information

According to publicly available financial data, Rongta Technology recorded revenues of RMB 393 million, RMB 349 million, and RMB 350 million in the fiscal years 2022, 2023, and 2024, respectively, reflecting relatively stable performance. Net profits for the same years were approximately RMB 37.45 million, RMB 27.60 million, and RMB 41.35 million, with a noticeable recovery in profitability in 2024. However, as of the end of 2024, the company’s cash and cash equivalents stood at only RMB 7.61 million, indicating tight liquidity, which may pose challenges for future operations and cash flow management.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

0% interest* on margin subscriptions, with up to 10x leverage

0 handling fee for cash subscriptions

Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

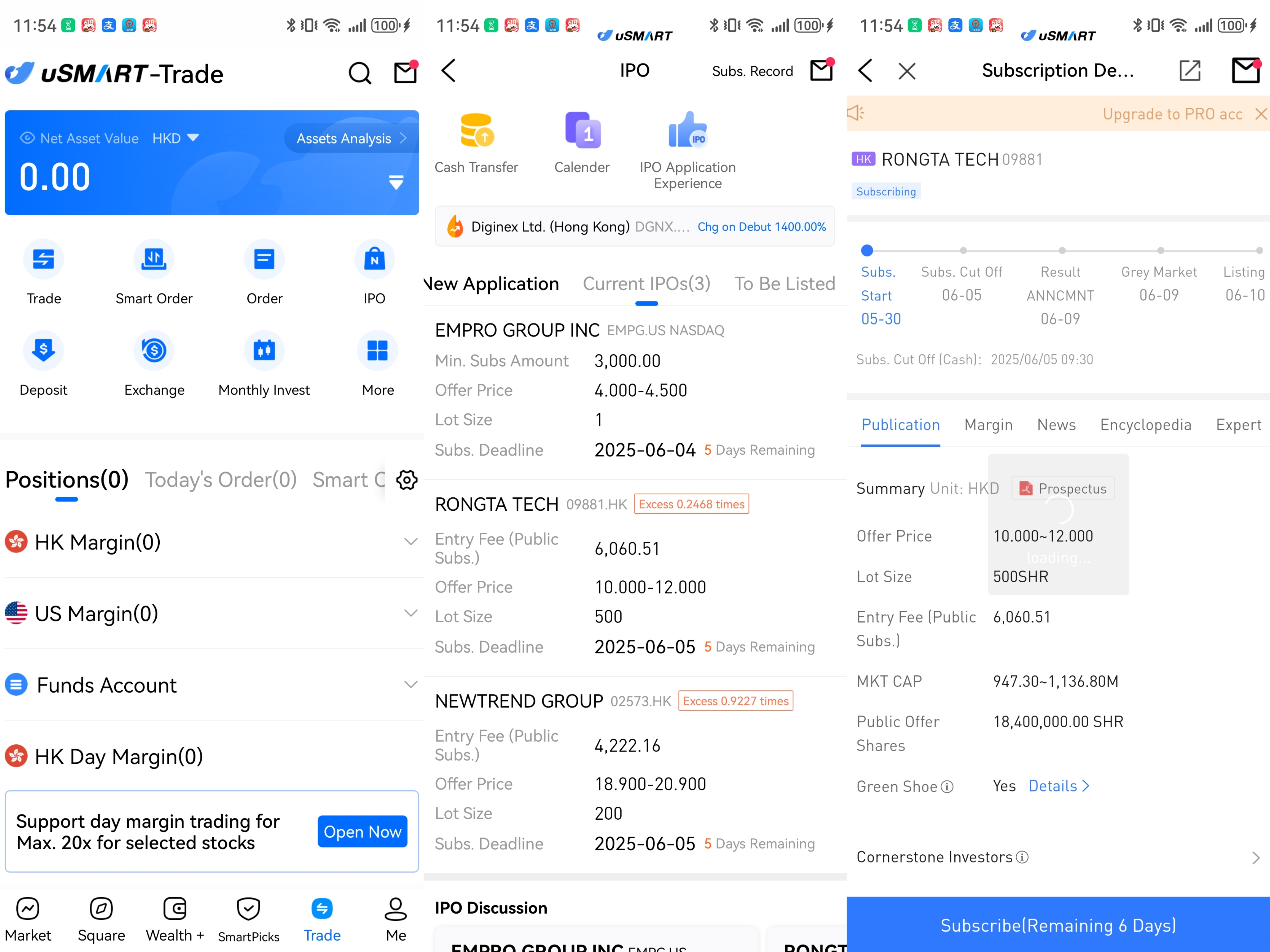

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)