New Kian Group Co., Ltd. (02573.HK) is conducting its initial public offering (IPO) from May 30 to June 5, 2025. The company plans to offer approximately 10.5854 million shares at an indicative price range of HK$18.9 to HK$20.9 per share, with a board lot size of 200 shares. The shares are expected to begin trading on the Hong Kong Stock Exchange on June 10, 2025.

New Kian Group Co., Ltd.: Producer of Food-Grade Glycine and Sucralose

Offering Size: 10.5854 million H shares, with 10% allocated for the Hong Kong public offering and the remainder for international placement

Offering Price: HK$18.9 to HK$20.9 per share; board lot size of 200 shares; estimated minimum subscription amount HK$4,222.16

Offering Period: May 30 to June 5, 2025

Listing Date: June 10, 2025

IPO Sponsor: Minyin Capital

Company Profile

New Kian Group Co., Ltd. is a global leading manufacturer of food-grade glycine and sucralose, primarily engaged in the production and sales of food-grade glycine, industrial-grade glycine, and sucralose. According to 2023 data, the company held approximately 5.1% of the global market share by volume and 3.1% by revenue in the food-grade glycine segment. Its food-grade glycine also accounted for around 0.31% of the global food additive market. New Kian has established a comprehensive international supply chain system, operating five manufacturing facilities across China, Indonesia, and Thailand. The company has built a global sales network, with products sold to around 40 countries across six continents, demonstrating strong international market coverage and competitive strength.

Financial Information

New Kian Group Co., Ltd. recorded revenue of approximately RMB 761 million in 2022, with a net profit of around RMB 122 million. In 2023, revenue declined to approximately RMB 447 million, and net profit dropped to about RMB 44.66 million. Revenue rebounded to approximately RMB 569 million in 2024; however, net profit slightly decreased to around RMB 43.41 million. Overall, the company experienced revenue fluctuations and a downward trend in profitability over the three-year period, reflecting certain market challenges and cost pressures in its operations.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

0% interest* on margin subscriptions, with up to 10x leverage

0 handling fee for cash subscriptions

Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

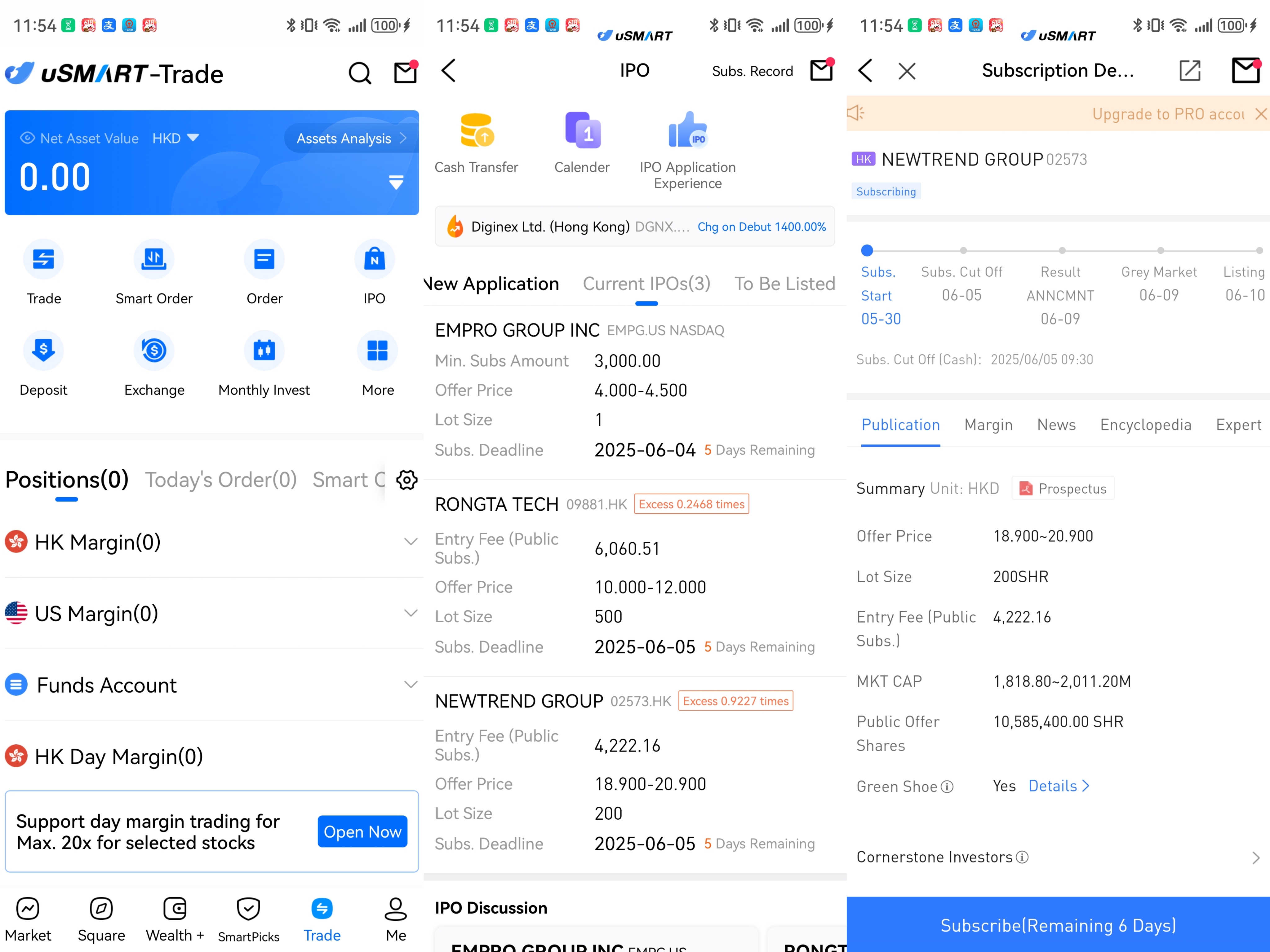

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)