On Tuesday (May 27), shares of Tesla (TSLA.US) surged 7% intraday, reaching their highest level since February and rebounding more than 70% from the lows seen in April. The rally followed comments from Elon Musk, who announced that he has returned to a “24/7, seven days a week” work mode, with intense focus on X, xAI, Tesla, and SpaceX’s Starship project.

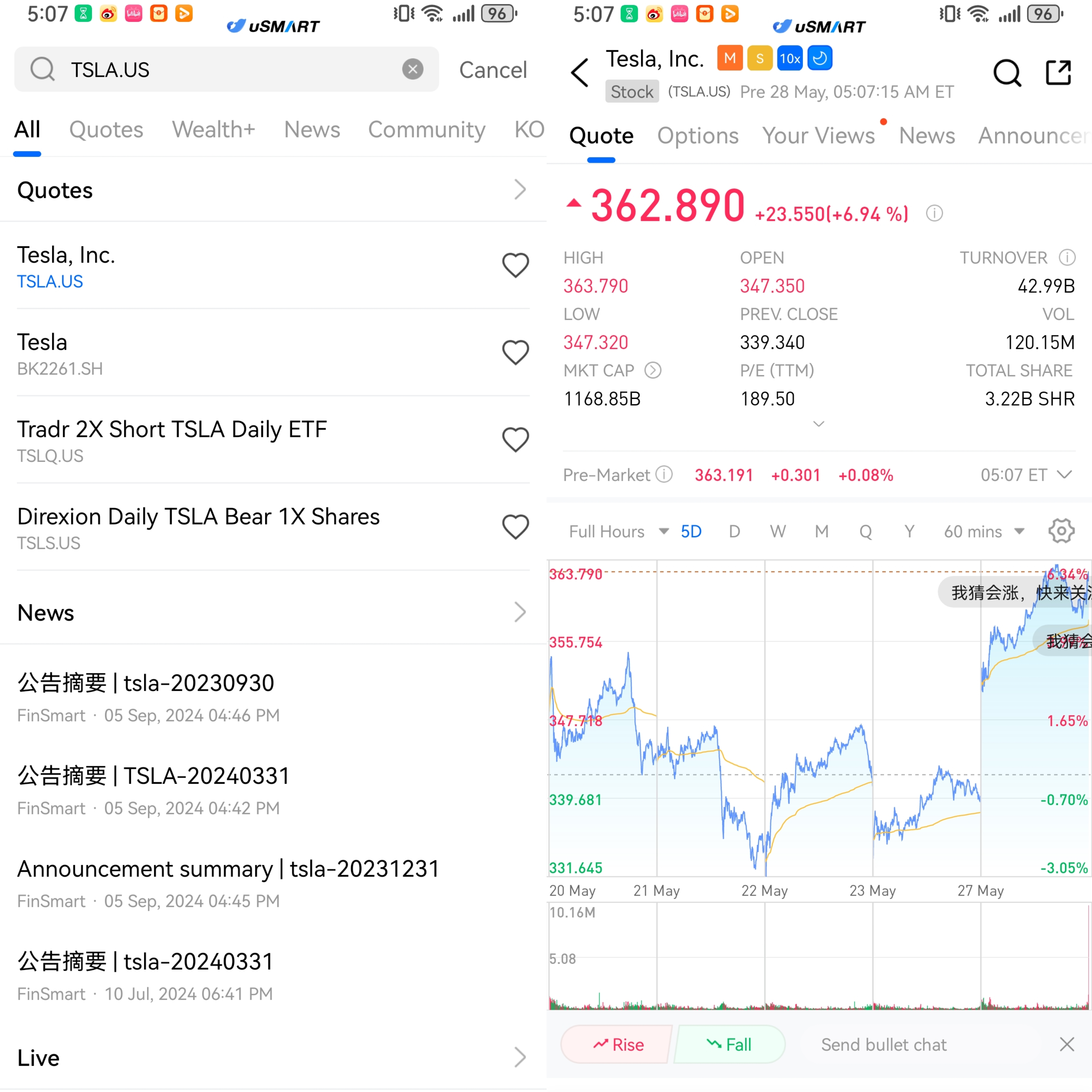

(Image source: uSMART HK)

Signal of Musk’s "Return to Business"

Elon Musk has previously stated his intention to withdraw from political affairs and refocus on business management. During Tesla’s earnings call in April, he mentioned that he would “significantly reduce” his involvement in the Trump administration’s “Office of American Innovation.” Just last week, at the Qatar Economic Forum, he further stated that his future political donations would be “substantially reduced.” According to sources familiar with the matter, Musk has grown weary of politics and now aims to return to full-time business operations. Investors widely interpret this shift back to hands-on corporate leadership as a positive signal, believing it will help Tesla sharpen its strategic focus and accelerate innovation. This renewed confidence in Tesla’s long-term growth potential has significantly boosted its stock price.

Easing of U.S.-Europe Trade Tensions and Rebound in Consumer Confidence

Amid earlier threats from the Trump administration to impose steep tariffs on the EU and other trading partners, global markets were gripped by fear, prompting investors to dump risk assets and triggering sharp declines in equities. However, tensions have eased significantly following Trump’s decision to delay tariff hikes on the EU, the announcement of a preliminary trade deal with the UK, and a formal agreement reached between the U.S. and China on May 12. These developments have led to a swift improvement in investor sentiment and a rebound in global equity markets.

The de-escalation of trade conflicts has not only resulted in immediate tariff relief but also helped stabilize corporate outlooks and consumer confidence. According to data from The Conference Board, the U.S. Consumer Confidence Index surged from 86 to 98 in May—the largest monthly gain since March 2021. With tariffs being rolled back and stock markets on the rise, consumer expectations for equity performance over the next 12 months have also improved significantly. This renewed confidence has supported the share prices of both consumer-focused and technology companies, further fueling the market rally.

How to Buy Tesla Group on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)