On May 23, 2025, China’s leading condiment producer, Haitian Flavouring & Food Co., Ltd., passed its Main Board listing hearing with the Hong Kong Stock Exchange. CICC, Goldman Sachs, and Morgan Stanley are acting as joint sponsors.

According to sources familiar with the matter, Haitian has begun assessing investor demand for its Hong Kong IPO, aiming to raise approximately US$1 billion. The listing is expected to take place as early as next week, potentially making it one of the largest consumer-sector IPOs in 2025.

(Image source: Haitian Flavouring & Food IPO prospectus)

Company Overview

Haitian Flavouring & Food Co., Ltd. is a leading enterprise in China's condiment industry. Listed on the A-share market for over a decade, the company currently boasts a market capitalization of nearly RMB 250 billion. As a key player in the consumer staples sector, Haitian is committed to providing high-quality, safe, and delicious condiments to global consumers, enhancing everyday cooking and dining experiences.

The company’s core product offerings include soy sauce, oyster sauce, seasoning sauces, specialty condiments, and other cooking ingredients. With a well-established portfolio of over 10 major product lines, 300+ varieties, and 1,000+ SKUs, Haitian achieves an annual production and sales volume exceeding 4 million tons. The company operates five modern production bases across China, and its products are exported to more than 100 countries and regions worldwide, earning wide consumer trust.

The company’s proposed listing in Hong Kong marks a significant milestone in its brand internationalization strategy, reflecting an important step toward expanding its global footprint and capital market presence.

Financial Highlights

According to the latest financial report, Haitian recorded revenue of RMB 26.901 billion in 2024, representing a year-on-year growth of 9.53%. Net profit attributable to shareholders reached RMB 6.344 billion, up 12.75% year-on-year, while net profit excluding non-recurring items stood at RMB 6.069 billion, up 12.51%. These results reflect the company’s continued efforts in channel optimization, product mix enhancement, and cost control, which have contributed to stable improvements in profitability.

In the first quarter of 2025, Haitian sustained its recovery momentum, with revenue reaching RMB 8.315 billion, a year-on-year increase of 8.08%. Net profit attributable to shareholders was RMB 2.202 billion, up 14.77%, and net profit excluding non-recurring items reached RMB 2.147 billion, a 15.42% increase compared to the same period last year. These figures indicate that Haitian has largely emerged from its previous adjustment phase, with growth momentum gradually strengthening and operational quality significantly improving, laying a solid foundation for continued performance growth throughout the year.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

0% interest* on margin subscriptions, with up to 10x leverage

0 handling fee for cash subscriptions

Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

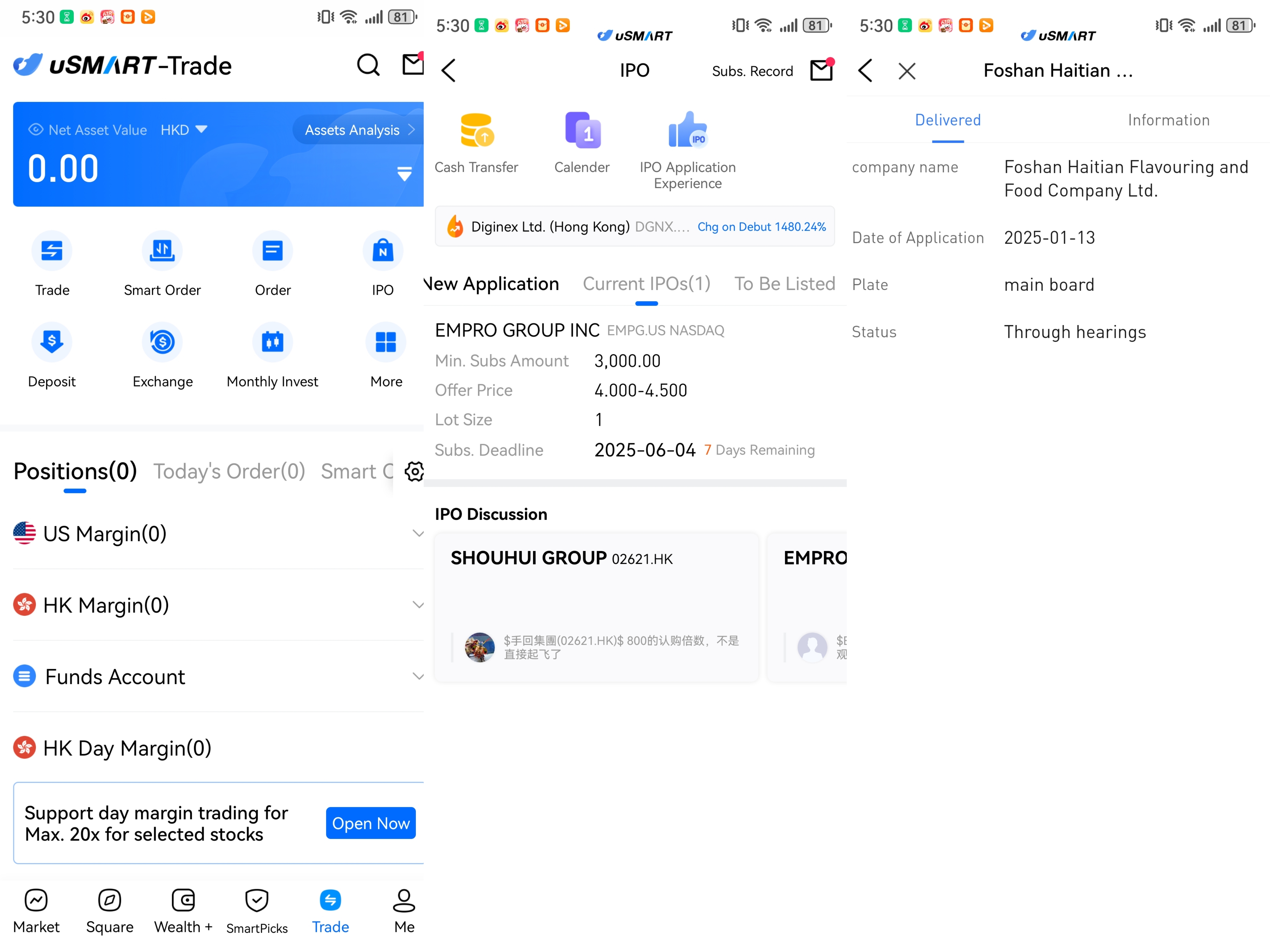

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)