Jihong Co., Ltd. (02603.HK) is conducting its IPO from May 19 to May 22, 2025. The company plans to offer 67.91 million shares, with the maximum offering price set at HKD 10.68 per share. The board lot size is 500 shares. The shares are expected to begin trading on the Hong Kong Stock Exchange on May 27, 2025.

Jihong Co., Ltd.: A Biotechnology Company Focused on Innovative Therapies for Chronic Diseases through Independent Research and Development

Offering Ratio: 90% of the shares are for international offering, while 10% are for public offering, with no over-allotment option.

Offer Price: The maximum offer price is HKD 10.68 per share, with a board lot size of 500 shares. The entry fee is approximately HKD 5,393.85.

Offering Period: May 19 to May 22, 2025

Listing Date: May 27, 2025

IPO Sponsors: China International Capital Corporation Hong Kong Securities Limited and CMB International Financing Limited.

(Image source: Jihong Co., Ltd. IPO prospectus)

Company Profile

Jihong Co., Ltd. was founded in 2003 and is headquartered in Xiamen, Fujian. It is a comprehensive enterprise with a "dual-engine" business model, focusing on both paper-based fast-moving consumer goods (FMCG) packaging and cross-border social e-commerce. In 2024, the company ranked first in China's paper-based FMCG packaging industry by revenue, with a market share of 1.2%. Since entering the cross-border social e-commerce sector in 2017, Jihong has leveraged its big data advantages to precisely select products. Through a closed-loop model of "Facebook ads + independent sites + cash on delivery," the company successfully replicated China's e-commerce operational experience in the Southeast Asian market. According to relevant data, Jihong ranked second among Chinese B2C export e-commerce companies in terms of revenue from Asian social e-commerce in 2024, with a market share of 1.3%.

Financial Information

Driven by the growth of its cross-border social e-commerce business, Jihong Co., Ltd. has seen continuous growth in recent years. From 2021 to 2024, the company’s cross-border e-commerce revenue was RMB 2.834 billion, RMB 3.107 billion, RMB 4.257 billion, and RMB 3.366 billion, respectively. The gross profit margin has remained high, reaching 60.5% in 2024, helping to drive the overall company gross margin to 43.8%, surpassing the industry leader Anker Innovations' 43.67%. In the first quarter of 2025, the company achieved operating revenue of RMB 1.477 billion, a year-on-year growth of 11.55%, and net profit of RMB 59.16 million, up 38.21% year-on-year. While ensuring high growth, the company has demonstrated excellent profitability and operational resilience through precise supply chain management and effective payment collection mechanisms, achieving efficient fund turnover.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

- 0% interest* on margin subscriptions, with up to 10x leverage

- 0 handling fee for cash subscriptions

- Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

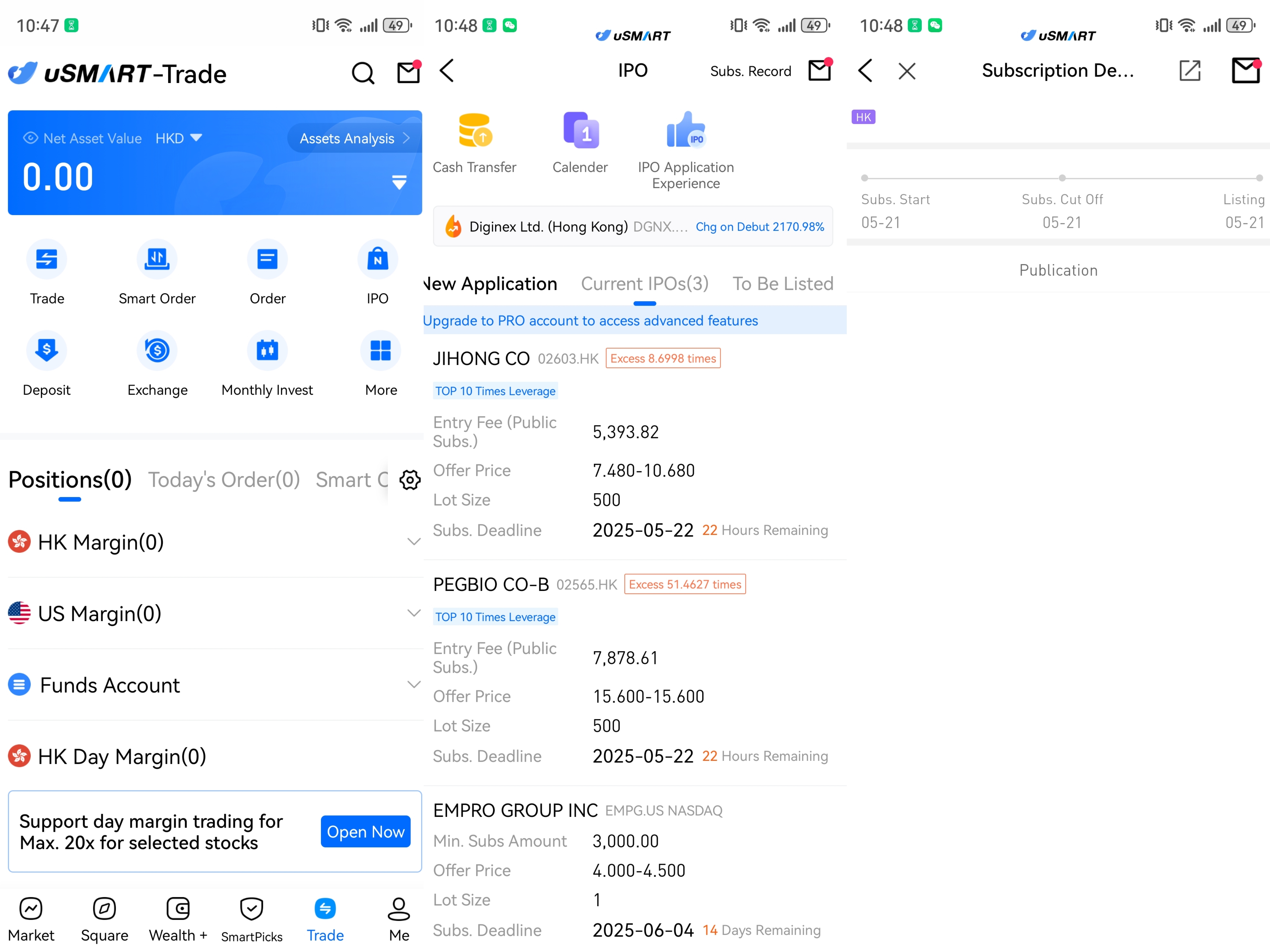

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)