On May 19, Hong Kong’s “New Consumption Trio” — Mixue Group, Pop Mart, and Lao Feng Xiang Gold — continued their strong rally with all three stocks closing higher. Pop Mart surged 5.77% to a record high of HK$207, Mixue Group jumped 8.53% to HK$515.5, just shy of its previous peak of HK$533, while Lao Feng Xiang Gold edged up 0.81% to HK$681.5.

In terms of market capitalization, all three companies surpassed HK$100 billion by the close. Pop Mart led with HK$278 billion, followed by Mixue Group at HK$195.7 billion, and Lao Feng Xiang Gold at HK$117.7 billion.

Year-to-date, all three stocks have more than doubled, vastly outperforming the Hang Seng Index. Lao Feng Xiang Gold has risen 182.55%, Pop Mart 130.90%, and Mixue Group — which listed on March 3 — has gained 154.57%.

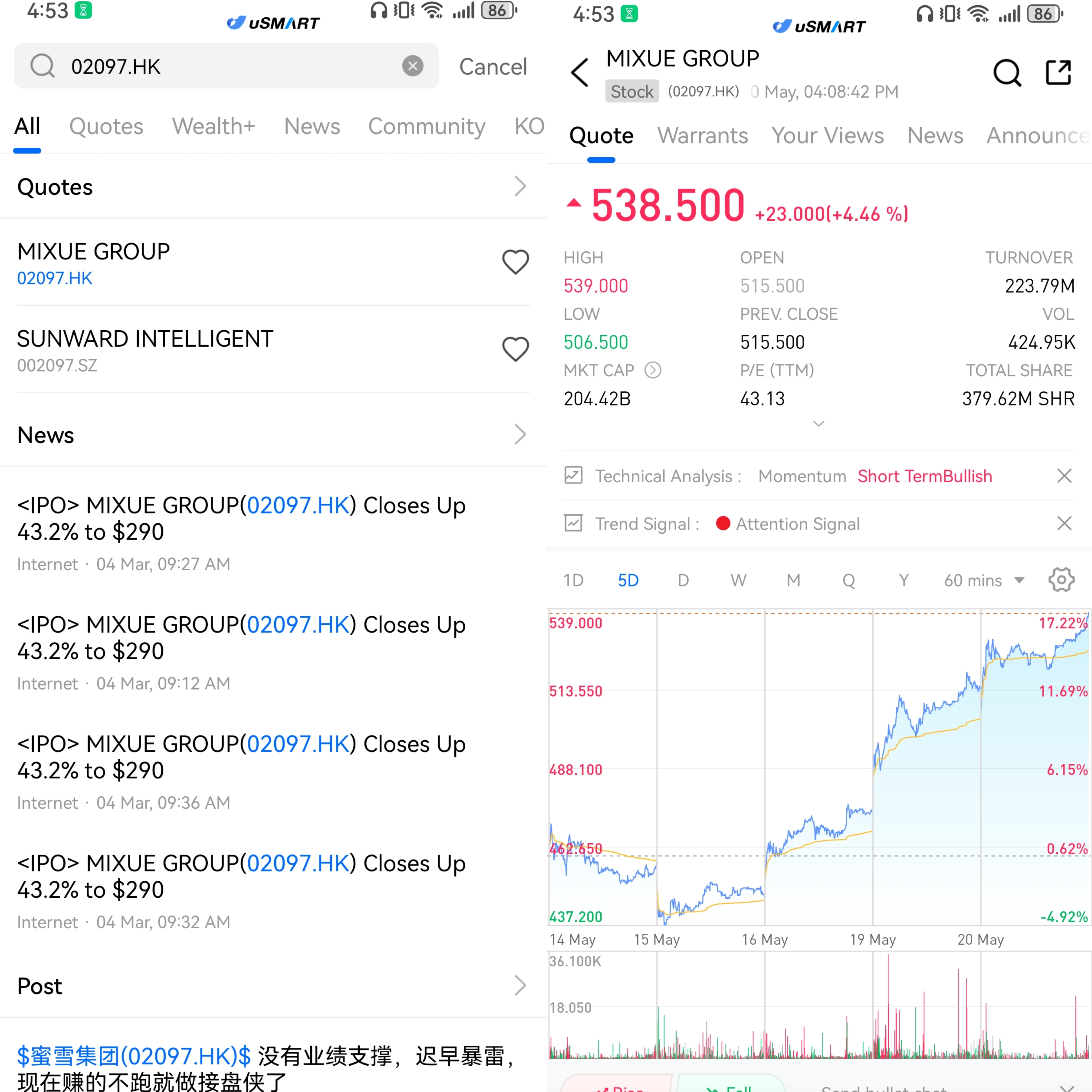

(Image source: uSMART HK)

Investment Banks Upbeat on the Outlook for the "New Consumption Trio"

Morgan Stanley has raised its target price for Pop Mart to HK$224, while also lifting its 2025–2027 sales and earnings forecasts by 5% to 9%. The bank is optimistic about the global popularity of Pop Mart’s flagship product Labubu 3.0, particularly in the U.S. market, which is expected to drive further store expansion. Additionally, the rapid establishment of its Vietnam supply chain, now actively shipping products, is seen as a key factor in mitigating U.S.-China tariff risks. The company has also implemented a 12%–27% price increase in the U.S., which has been well-received by consumers — a move that could further enhance profitability.

Daiwa has initiated coverage on Mixue Group with an “Outperform” rating and a target price of HK$539, citing the company’s leading position in the mass-market segment, strong economies of scale, and overseas expansion potential. The bank expects net profit to grow at an annual rate of over 20% from 2025 to 2027.

Meanwhile, Goldman Sachs has raised its target price for Lao Feng Xiang Gold to HK$976, highlighting management’s confidence that single-store GMV could exceed HK$1 billion — more than double the 2024 level and significantly higher than the average for global luxury brands. The company anticipates over 100% year-on-year sales growth in Q1 and plans to continue opening new stores in top-tier cities, supporting long-term growth while helping to offset margin pressure and rising incentive costs.

How to Buy Mixue Group on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)