Greentea Group (06831.HK) is offering its IPO from May 8 to May 13, 2025. The company plans to issue 168 million shares at an offering price of HKD 7.19 per share, with a minimum purchase of 400 shares per lot. The shares are expected to begin trading on the Hong Kong Stock Exchange on May 16, 2025 (Friday).

Greentea Group: A Well-Known Casual Chinese Restaurant Operator in Mainland China

Offering Ratio: A total of 168 million shares will be offered globally. Of this, 10% (about 16.836 million shares) will be offered for public subscription in Hong Kong, and the remaining 90% (about 152 million shares) will be part of the international offering.

Offering Price: HKD 7.19 per share, with a minimum lot size of 400 shares. The total cost for one lot is HKD 2,905.

Offering Dates: May 8 to May 13, 2025.

Listing Date: May 16, 2025.

IPO Sponsors: Citigroup and CMB International.

(Image Source: Greentea Group IPO Prospectus)

Company Profile

Greentea Dining is a well-known operator of casual Chinese restaurant brands in Mainland China. As of the most recent available data, Greentea has a total of 493 stores nationwide, covering most regions in China as well as Hong Kong, making it one of the leading brands in the industry. In 2024, Greentea ranked third in the Mainland China's casual Chinese restaurant market in terms of number of restaurants and fourth in revenue, with a market share of 0.7%. The company plans to continue its expansion over the next three years, with plans to open 150, 200, and 213 new stores respectively, further increasing its market share and strengthening its brand influence.

Financial Information

During the reporting period, Greentea Dining saw significant expansion in its restaurant network, increasing the total number of restaurants from 276 at the end of 2022 to 465 at the end of 2024, reflecting a 29.8% compound annual growth rate (CAGR). As of the latest data, the number of operating restaurants further increased to 489, with the majority of them located in shopping malls.

In 2023, thanks to an increase in customer traffic and turnover rate, the company's restaurant operations and delivery revenue grew by 50.7%, from 2.3736 billion yuan in 2022 to 3.5771 billion yuan. However, in 2024, restaurant performance saw a slight decline, with the average spend per customer dropping from 61.8 yuan in 2023 to 56.2 yuan. In 2024, the total revenue from Greentea-branded restaurants reached 3.8 billion yuan, with a market share of 0.7%, ranking fourth among domestic casual Chinese restaurant brands. By the number of restaurants, Greentea ranks third in Mainland China's casual Chinese restaurant market.

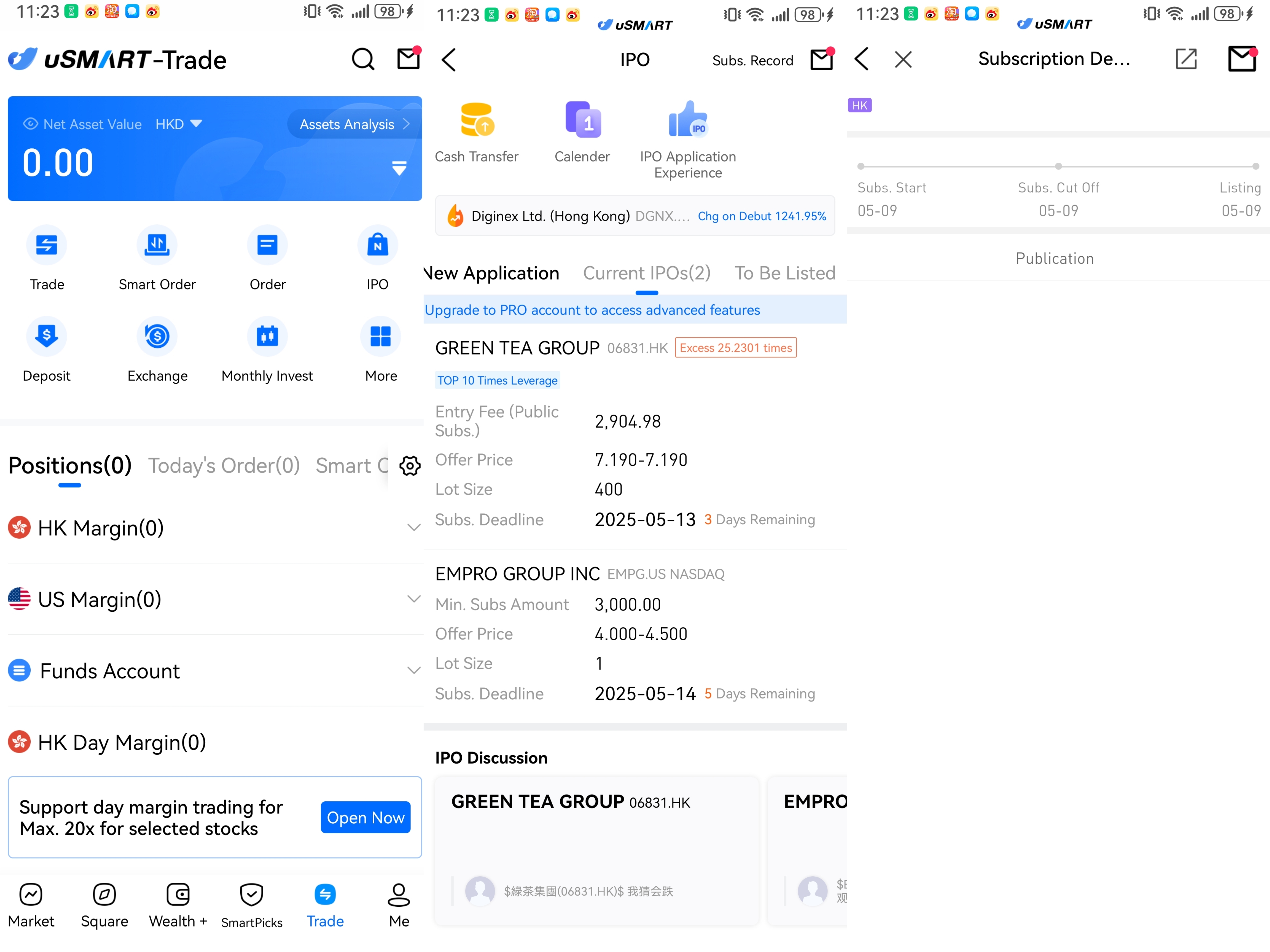

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

Seize the uSMART Exclusive Subscription Offer!

Cash Subscription: 0 handling fee

Financing Subscription: 0 interest*

Leverage up to 10x

*Available for both new and existing customers. Financing subscriptions of up to HKD 500,000 are interest-free.

(Image Source: uSMART HK)