According to a disclosure from the Hong Kong Stock Exchange on May 5, Jiangsu Hengrui Medicine Co., Ltd. has passed the hearing for its listing on the main board of the HKEX. Morgan Stanley, Citigroup, and Huatai International are serving as joint sponsors. The company is expected to officially list on the Hong Kong Stock Exchange as early as May.

(Image Source: Hengrui Medicine Prospectus)

Company Profile

Hengrui Medicine is a global leading innovative pharmaceutical company, focusing on the research, development, and production of innovative drugs in areas such as oncology, metabolic and cardiovascular diseases, immune and respiratory diseases, and neuroscience. The company is advancing its international strategy, with multiple products having received regulatory approvals both domestically and internationally, achieving significant market share in various regions. With strong research and development capabilities and a robust technological platform, Hengrui Medicine holds an important position in the global pharmaceutical industry. According to data from Frost & Sullivan, the global market for oncology, metabolic and cardiovascular diseases, and other areas accounted for 57.4% of the global pharmaceutical market in 2023, and it is expected to maintain high growth from 2023 to 2028. Hengrui Medicine will continue to consolidate its innovation advantage in these fields, driving global business growth.

Financial Information

Hengrui Medicine has achieved solid financial performance through continuous innovation. In 2024, the company’s total revenue reached RMB 28 billion, with a compound annual growth rate of approximately 14% since 2014, significantly outpacing the global pharmaceutical market’s growth rate of around 4%. Innovative drugs have become the main source of the company’s revenue, with their sales share increasing from 38.1% in 2022 to 46.3% in 2024. At the same time, the sales share of generic drugs has declined year by year, from 60.3% in 2022 to 42.0% in 2024. The company’s net profit margin increased from 17.9% in 2022 to 22.6% in 2024, and its operating cash inflows were RMB 1.265 billion, RMB 7.644 billion, and RMB 7.423 billion, respectively.

Furthermore, Hengrui Medicine’s revenue for the three months ending March 31, 2024, increased by 20.1%, from RMB 5.998 billion to RMB 7.206 billion in the same period of 2025, primarily driven by the growth in innovative drug sales, which increased drug sales revenue by RMB 639 million, as well as a RMB 550 million increase in licensing income. These factors have collectively driven the company's continued growth and further strengthened its competitive position in the global pharmaceutical market.

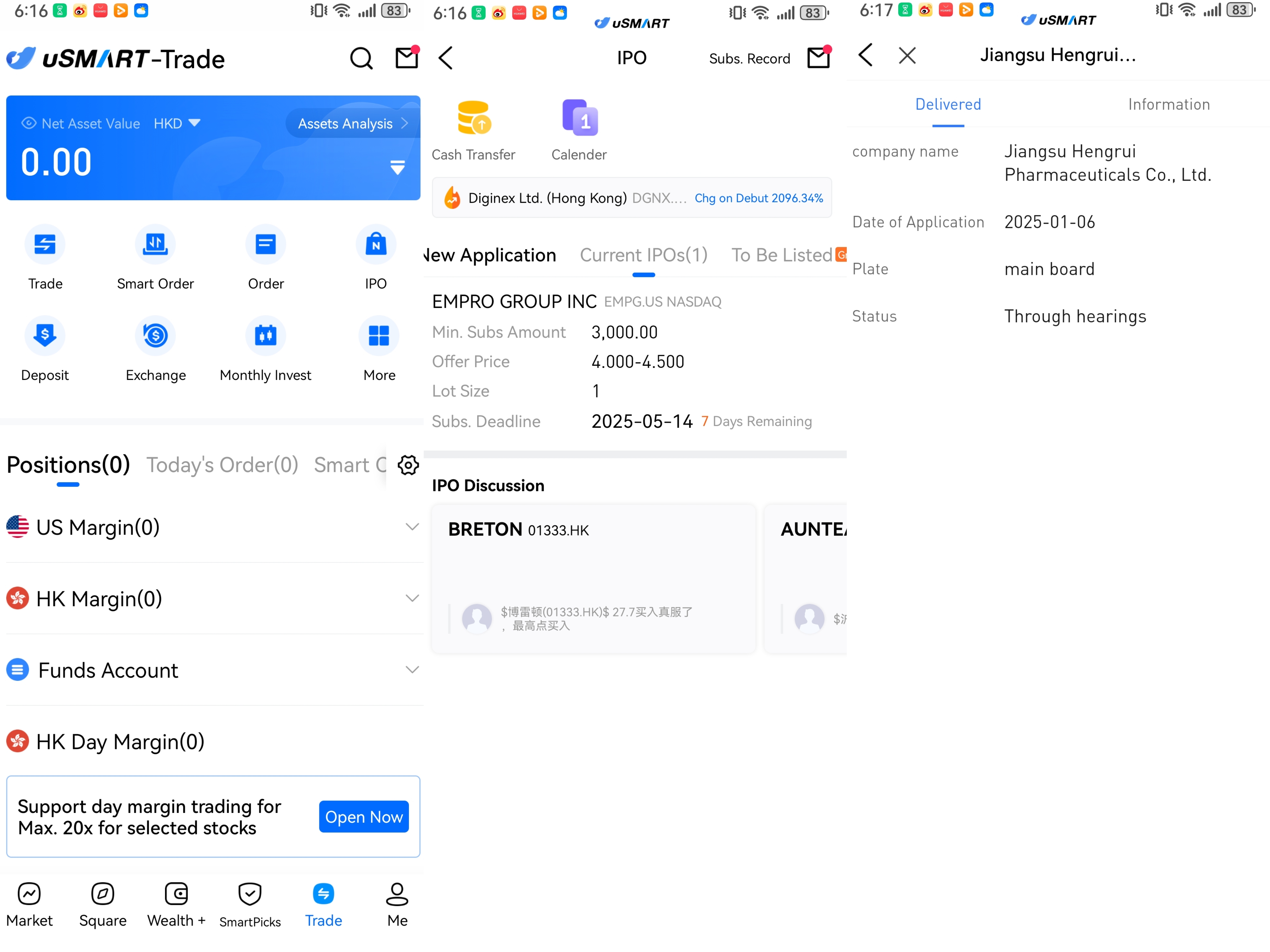

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)