CATL (300750.SZ), a global leader in power batteries, recently announced that the company has passed the Hong Kong Stock Exchange (HKEX) listing hearing, with its H-share issuance plan entering the final sprint stage. According to market sources, CATL plans to raise over USD 5 billion. If successful, it will become the largest IPO in Hong Kong since Midea Group’s listing in September 2024.

What is a Secondary Listing? How is it Different from Dual Listing?

For mainland companies listing in Hong Kong after being listed in other markets, there are three main methods:

- Privatization and Delisting, then Listing in Hong Kong:

- A company first privatizes and delists from its original exchange, then applies to list in Hong Kong under a new entity.

- This route allows the company to shed the regulatory constraints of the original market but comes with high privatization and time costs.

- Dual Listing:

- In a dual listing, a company is listed on two capital markets, each serving as the primary listing market. The company must adhere to the regulations and rules of both exchanges as if it were conducting an IPO in Hong Kong for the first time.

- Disadvantages: Dual listing is time-consuming, costly, and subject to stricter regulations. Additionally, shares cannot be directly traded across markets, and stock prices are affected by factors such as different trading times and currency fluctuations.

- Advantages: Dual listing allows the company to tap into investor bases in both markets, significantly improving stock liquidity and financing capability.

- Secondary Listing:

- A secondary listing means that the company is still primarily traded on another exchange and regulated by its primary market's authorities.

- The process for secondary listing is much simpler compared to dual listing, as the company undergoes fewer listing reviews and regulatory procedures, and enjoys more exemptions.

- Stock Pricing: The stock price for a secondary listing typically mirrors the price on the original market, and shares can be exchanged between the two listings. However, stock performance will be closely tied to the performance of the original market, and the company must continue to follow regulatory requirements from the primary listing exchange.

Strategy for Evaluating Whether a Secondary Listing IPO is Worth Subscribing To

When considering whether to subscribe to a new secondary listing IPO, the strategy generally focuses on three key aspects: fundamentals, market sentiment, and the AH discount.

- Fundamentals:

- The fundamentals of a company are critical when evaluating any IPO, including a secondary listing. These include the company's financial health, industry position, profitability, and growth potential.

- A company with strong fundamentals is more likely to attract investor interest and experience a price increase after listing. Key financial metrics and growth prospects are essential factors to assess.

- Market Sentiment:

- Market sentiment is essentially the mood of the stock market during the IPO. It refers to the market’s emotional outlook—whether bullish or bearish—at the time of listing, as well as factors like industry trends, the overall market environment, subscription multiples, liquidity, and investor risk appetite.

- Market sentiment directly affects the first-day performance of a new stock. A strong positive market sentiment can lead to a substantial surge in price on listing day, while negative sentiment can lead to the opposite.

- AH Discount:

- A significant number of companies that list both in A-shares (mainland China) and H-shares (Hong Kong) tend to experience a discount in their H-share market capitalization relative to their A-share counterparts.

- Discounts: Generally, the larger the discount, the more attractive the stock is to investors in other markets, as they can purchase shares at a lower price in Hong Kong compared to the A-shares market.

- Impact of Discount: A lower discount is typically seen in companies with strong fundamentals, a large market capitalization, and higher foreign institutional recognition. Conversely, a higher discount may reflect lower investor confidence in the secondary market.

How to subscribe to Hong Kong IPOs via uSMART HK

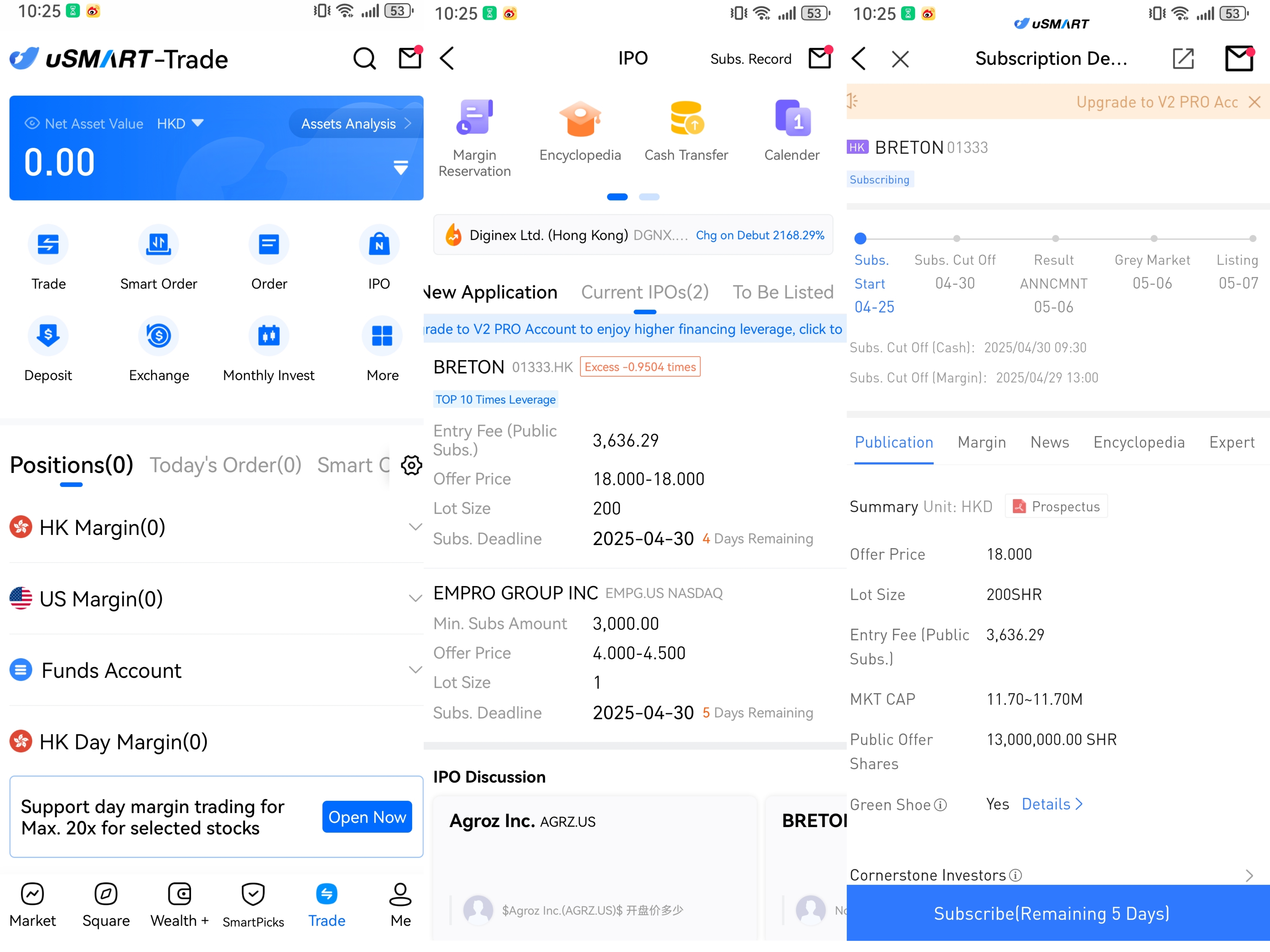

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)