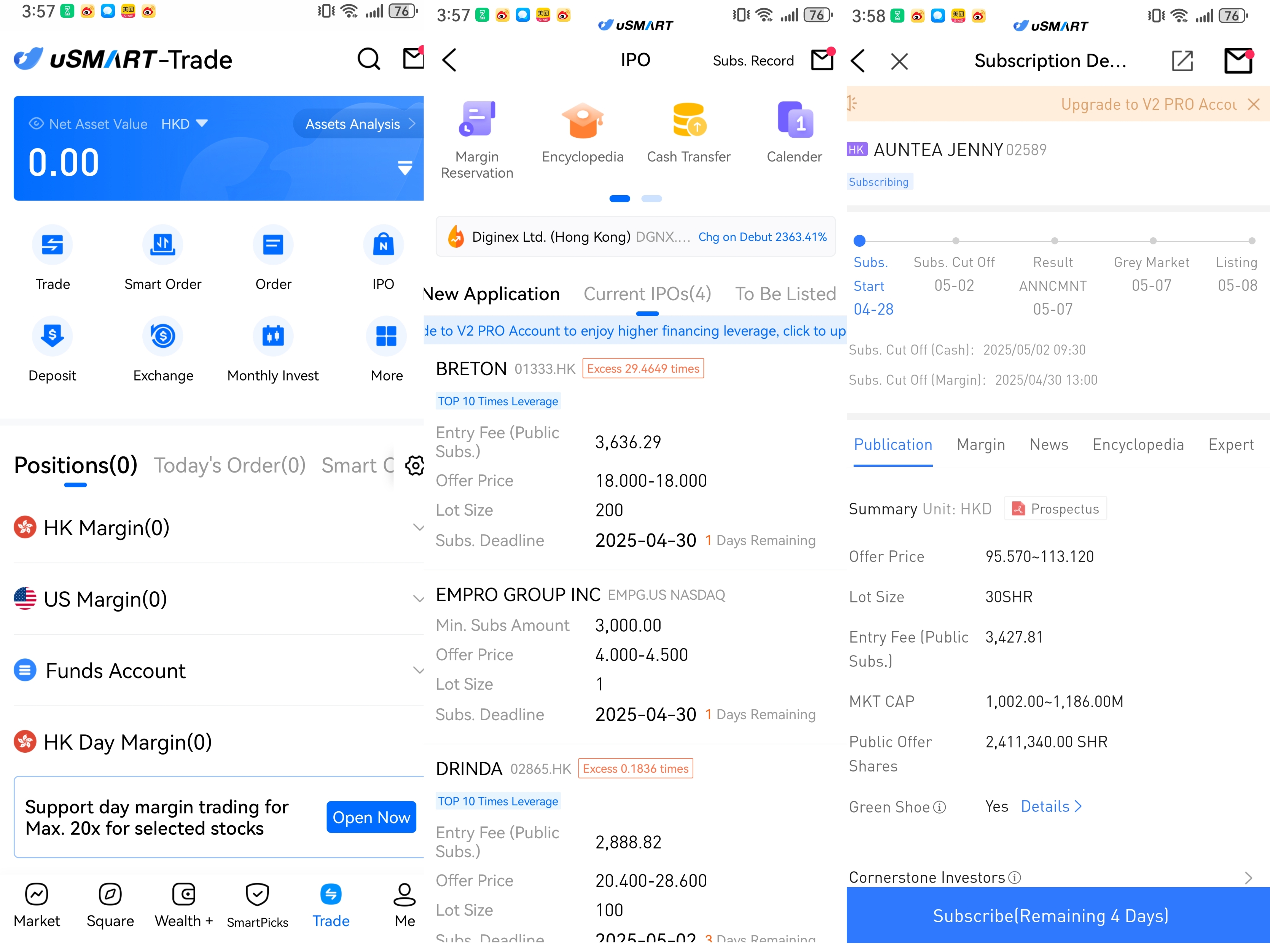

Auntea Jenny (02589.HK) will launch its IPO from April 28 to May 2, 2025, with a global offering of 2.4113 million H-shares. The offering price will range from HKD 95.57 to HKD 113.12 per share, with each board lot consisting of 30 shares. The H-shares are expected to begin trading on the Hong Kong Stock Exchange at 9:00 AM on May 8, 2025 (Thursday).

Auntea Jenny: One of Shanghai’s Largest Tea Beverage Chains

Offer Proportion: The global offering consists of 2.4113 million shares, with 241,100 shares offered in Hong Kong and 2.1702 million shares offered internationally, plus an additional 361,700 shares under the over-allotment option.

Offer Price: The offer price will range from HKD 95.57 to HKD 113.12 per share, with a minimum trading board lot size of 30 shares. The entry fee is approximately HKD 3,427.83.

Offer Period: April 28 to May 2, 2025

Listing Date: May 8, 2025

IPO Sponsors: CITIC Securities (HK) Limited, Haitong International Capital Limited, and Oriental Financing (HK) Limited.

(Image source: Auntea Jenny Prospectus)

Company Overview

Founded in 2013, Auntea Jenny is dedicated to designing, developing, and commercializing a series of high-cost-performance milk tea and tea beverage products. The company has captured a significant market share in China’s ready-to-drink tea market and is currently one of the largest tea beverage chains in Shanghai. Auntea Jenny has developed several proprietary beverage brands and product lines, including its main brand "Auntea Jenny," the innovative "Hoo Cafe," and "Light Enjoy" versions, catering to the diverse needs of consumers. According to reports, Auntea Jenny ranked fifth in GMV in China’s ready-to-drink tea market in 2023, with a market share of 4.6%. The company primarily operates under a franchise model, and by the end of 2024, Auntea Jenny had 9,176 stores, with 9,152 operated by franchisees.

Financial Information

In the past three years, Auntea Jenny’s revenue was approximately RMB 2.2 billion, RMB 3.348 billion, and RMB 3.285 billion, respectively. Net profit during the same period was RMB 149 million, RMB 388 million, and RMB 329 million, with some fluctuations observed. From 2022 to 2023, Auntea Jenny experienced rapid expansion, with GMV growth rates of 40.5% and 46.8%, becoming the fastest-growing brand among the top five ready-to-drink tea brands in terms of store count and GMV growth. However, entering 2024, as competition in the tea beverage market intensified, Auntea Jenny's performance slightly declined. Despite this, the company’s gross profit margin has continued to improve over the past three years, reaching 26.7%, 30.4%, and 31.3%, respectively. The prospectus indicates that the increase in gross profit margin was mainly due to the "optimization of production processes and supply chain management," as well as "increased purchasing volume and bargaining power."

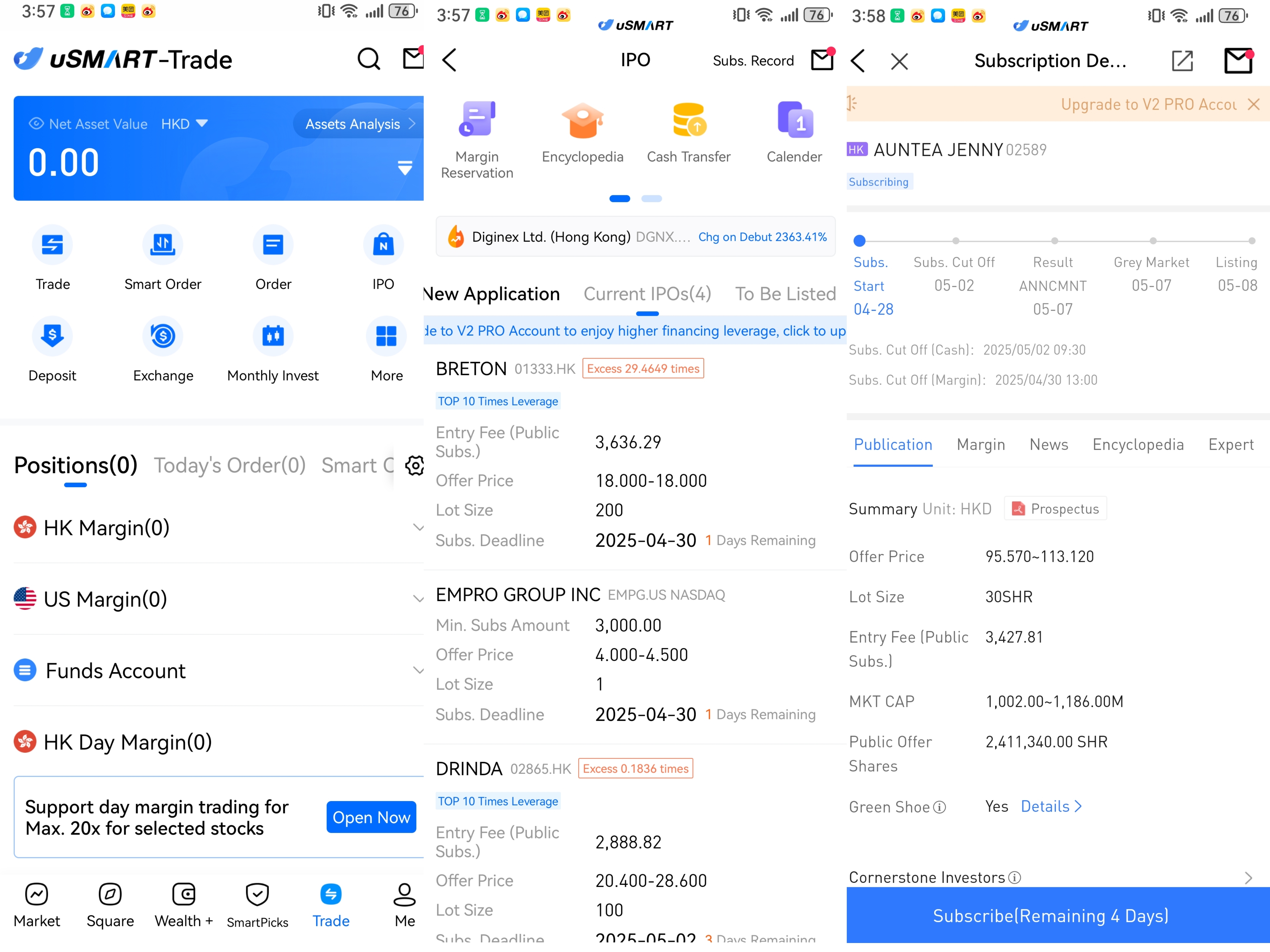

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)