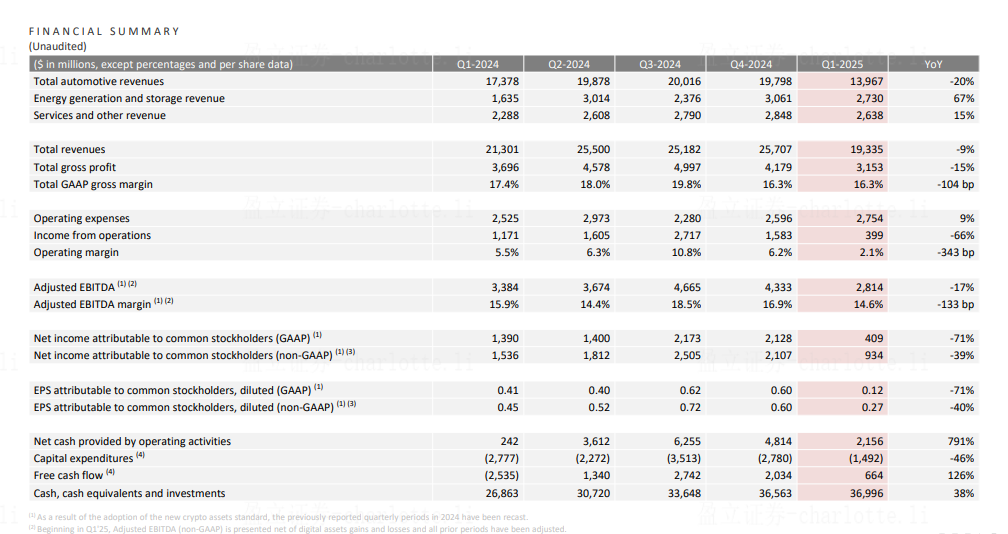

On Tuesday, April 22, 2025, after the U.S. stock market closed, Tesla released its financial results for the first quarter of 2025. In Q1, Tesla's revenue was $19.34 billion, a 9% year-over-year decline, falling short of analysts' expectations of $21.37 billion, but up 2% compared to Q4 of the previous year. Operating profit for the quarter was $399 million, a sharp 66% year-over-year decrease, far below analysts' expectations of $1.13 billion. In terms of business performance, automotive revenue was $14 billion, down 20% year-over-year, while the energy sector performed relatively well, with energy production and storage revenue reaching $2.638 billion, a 67% increase compared to the previous year.

(Image source: Tesla official website)

In the first quarter, amid the tariff war initiated by the Trump administration, Tesla's earnings and revenue failed to meet Wall Street expectations for several reasons. First, the performance of Tesla's core business—automotive sales—was underwhelming. The company upgraded the production lines for its Model Y at its four car manufacturing plants, resulting in fewer vehicle deliveries. Second, Tesla resorted to price cuts and sales incentives to boost sales, which put pressure on profitability. Additionally, the depreciation of the dollar negatively impacted the company's performance, with currency fluctuations leading to a loss of about $200 million. Beyond these factors, Elon Musk's political stance and related comments also affected Tesla's brand image, even leading to boycotts in some markets.

After the earnings report was released, Tesla's stock initially rose by over 1% in after-hours trading but quickly reversed, dipping more than 1% before rebounding. The rise in U.S. stock futures, following President Trump's after-hours comments that he would not seek to remove Federal Reserve Chairman Jerome Powell, helped boost Tesla's stock, which ultimately closed up more than 3%. Furthermore, Musk's announcement that he would reduce his involvement in the DOGE project starting next month further drove Tesla’s stock upward, with gains surpassing 5%.

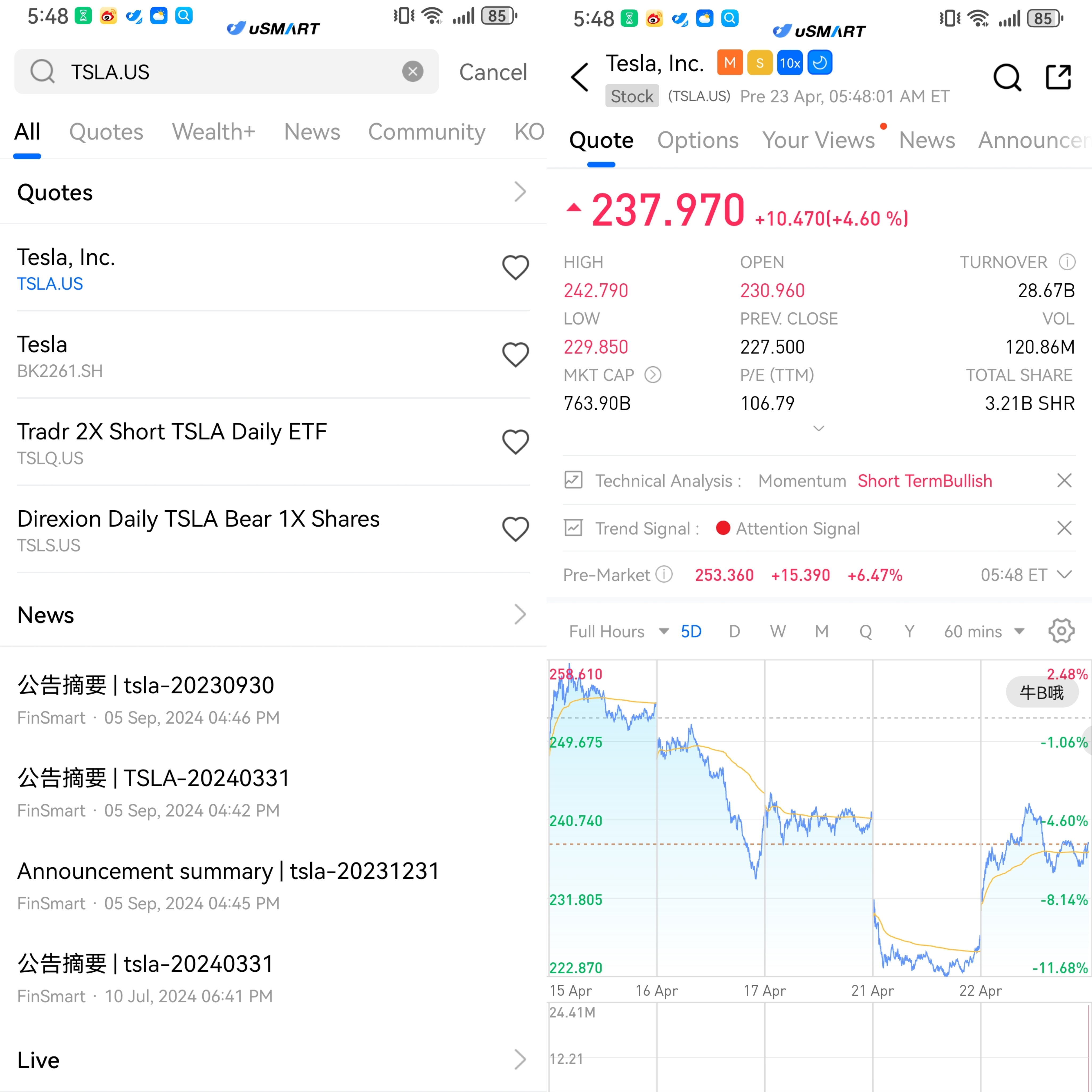

How to Buy Tesla on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)