On April 10, CATL (Contemporary Amperex Technology Co., Limited) passed the hearing for its Hong Kong listing and received approval to be listed on the Hong Kong Stock Exchange. The company plans to issue no more than 220,169,700 overseas listed ordinary shares, with the fundraising amount expected to range between USD 5 billion and USD 7 billion. According to the previous listing prospectus, the proceeds from the Hong Kong listing will be primarily used for overseas capacity expansion, international business development, and to supplement overseas operating capital, thereby supporting the company’s long-term internationalization strategy.

Company Profile

Founded in 2011, CATL focuses on the research, development, production, and sale of power batteries and energy storage batteries, and is a major supplier to electric vehicle giant Tesla. The company holds numerous innovative technologies, particularly in battery chemistry, management systems, and recycling technology. CATL is one of the world’s largest electric vehicle battery manufacturers, with a market capitalization ranking among the top, classifying it as a large-cap stock. Recently, CATL has made significant progress in strategic partnerships, global expansion, and product innovation, further solidifying its leading position in the global battery industry. Its power batteries have been installed in approximately 17 million vehicles, representing a significant share of the global EV battery market. One out of every three electric vehicles globally is powered by a CATL battery. Data shows that from 2017 to 2024, CATL ranked first globally in power battery usage for eight consecutive years, with a global market share of 37.9% in 2024.

Financial Information

According to its 2024 annual report, CATL recorded annual revenue of RMB 362.013 billion, representing a year-on-year decline of 9.70%. However, the net profit attributable to shareholders of the listed company reached RMB 50.745 billion, a year-on-year increase of 15.01%. CATL has maintained continuous profit growth for several years. In 2022 and 2023, the company’s net profits were RMB 33.5 billion and RMB 47.3 billion respectively, with a year-on-year growth of 41.5% in 2023. For the nine months ending September 30, 2023 and September 30, 2024, the company's net profits were RMB 32.5 billion and RMB 38.8 billion respectively, representing a 19.2% year-on-year increase for the first nine months of 2024. As a global leader in the EV battery market, the company has achieved significant breakthroughs in battery product R&D, production, and sales, and has continued to perform well in the A-share market.

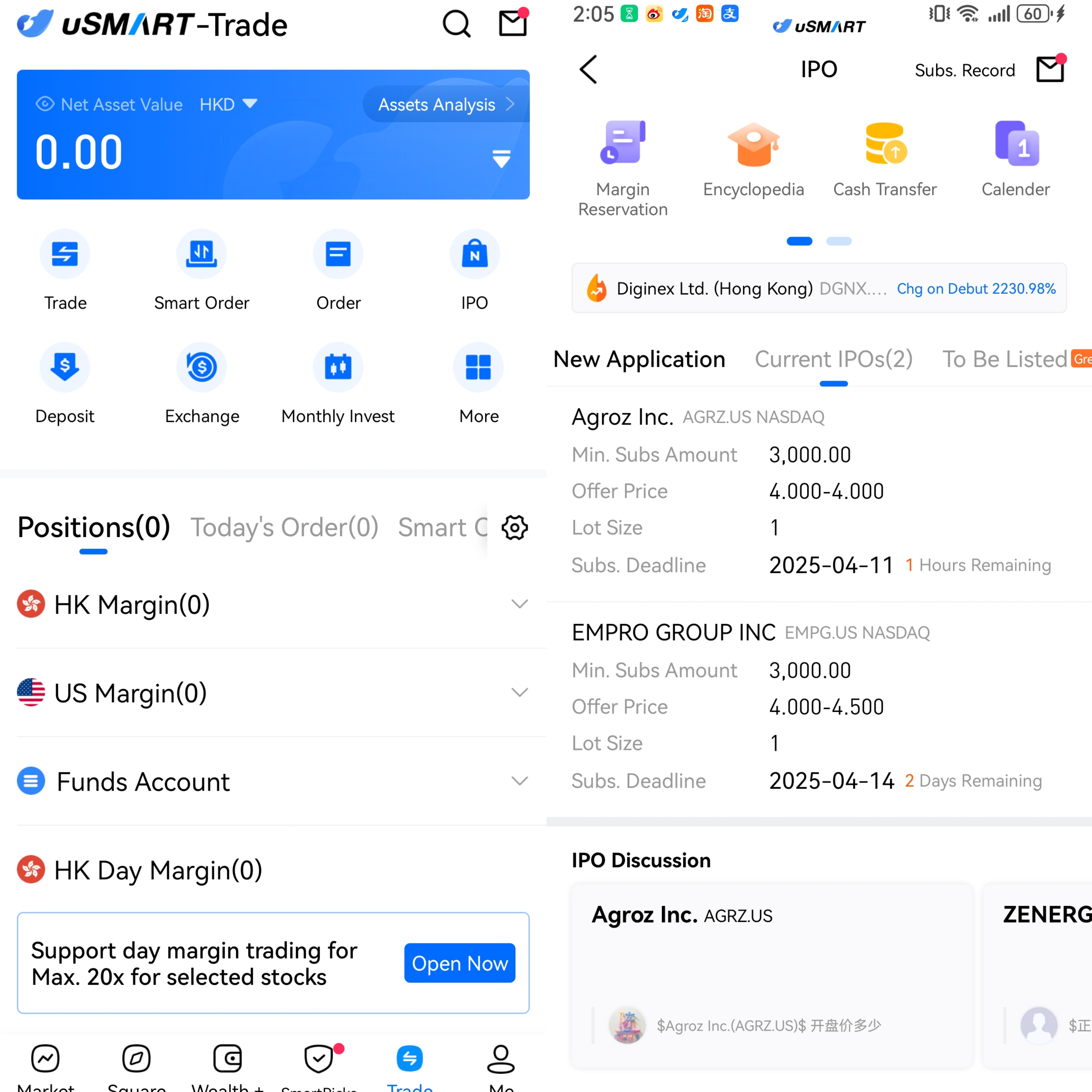

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)