Duality Biotherapeutics (09606.HK) opened its IPO subscription from April 7 to April 10, 2025. The company plans to issue 15,071,600 shares at a price range of HK94.60toHK94.60toHK103.20 per share, with an expected listing on the Main Board of the Hong Kong Stock Exchange on April 15, 2025, under the stock code "9606."

Duality Biotherapeutics: A Biotech Company Focused on Innovative ADC Drug Development

Offering Structure: Plans to issue 15.0716 million shares, with 10% allocated to Hong Kong public offering and 90% to international offering, plus a 15% over-allotment option.

Price Range: HK94.60toHK94.60toHK103.20 per share, with a board lot of 100 shares and an entry cost of approximately HK$10,424.1 per lot.

Subscription Period: April 7 to April 10, 2025.

Listing Date: April 15, 2025.

IPO Sponsors: Morgan Stanley, Jefferies, and CITIC Securities.

(Source: Duality Biotherapeutics Prospectus)

Company Overview

Founded in 2019, DualityBio is dedicated to developing innovative Antibody-Drug Conjugate (ADC) therapies for patients with cancer and autoimmune diseases. The company has established a robust pipeline comprising 12 proprietary ADC drug candidates. Among these, DB-1303/BNT323 and DB-1311/BNT324 serve as DualityBio's two core products. Additionally, the company has independently developed five other clinical-stage ADC candidates, each recognized by Frost & Sullivan as being among the most advanced globally in terms of overall development progress or primary indications.

Financial Information

DualityBio has demonstrated consistent revenue growth in recent years, achieving RMB 1.787 billion in revenue in 2023 and further increasing to RMB 1.941 billion in 2024, representing year-on-year growth of approximately 8.6%. Through strategic collaborations with international pharmaceutical leaders such as BioNTech and BeiGene, the company has secured approximately USD 400 million in upfront and milestone payments, with total deal values exceeding USD 6 billion. These partnerships have provided substantial financial support for the company's ongoing research and development efforts.

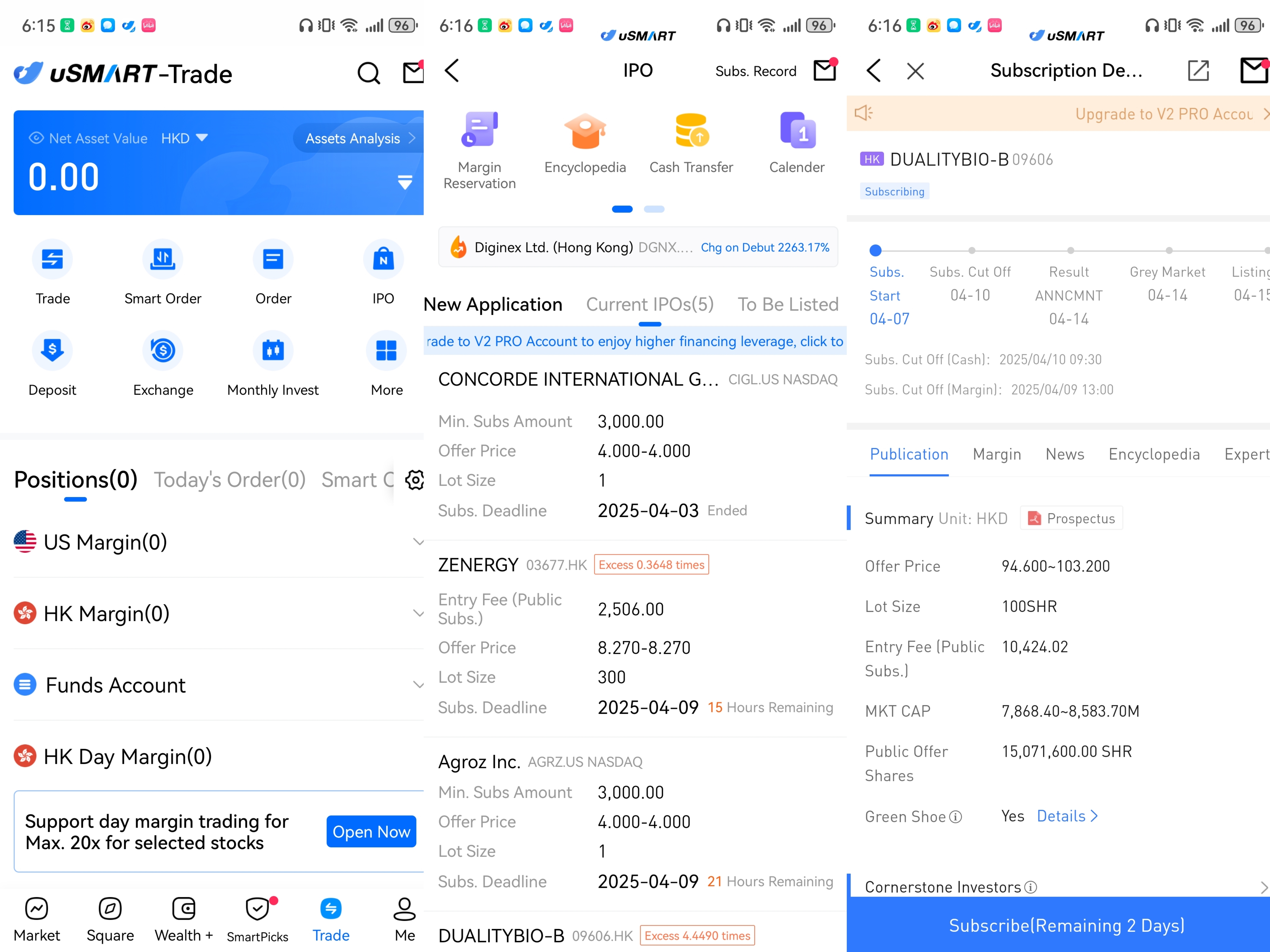

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)