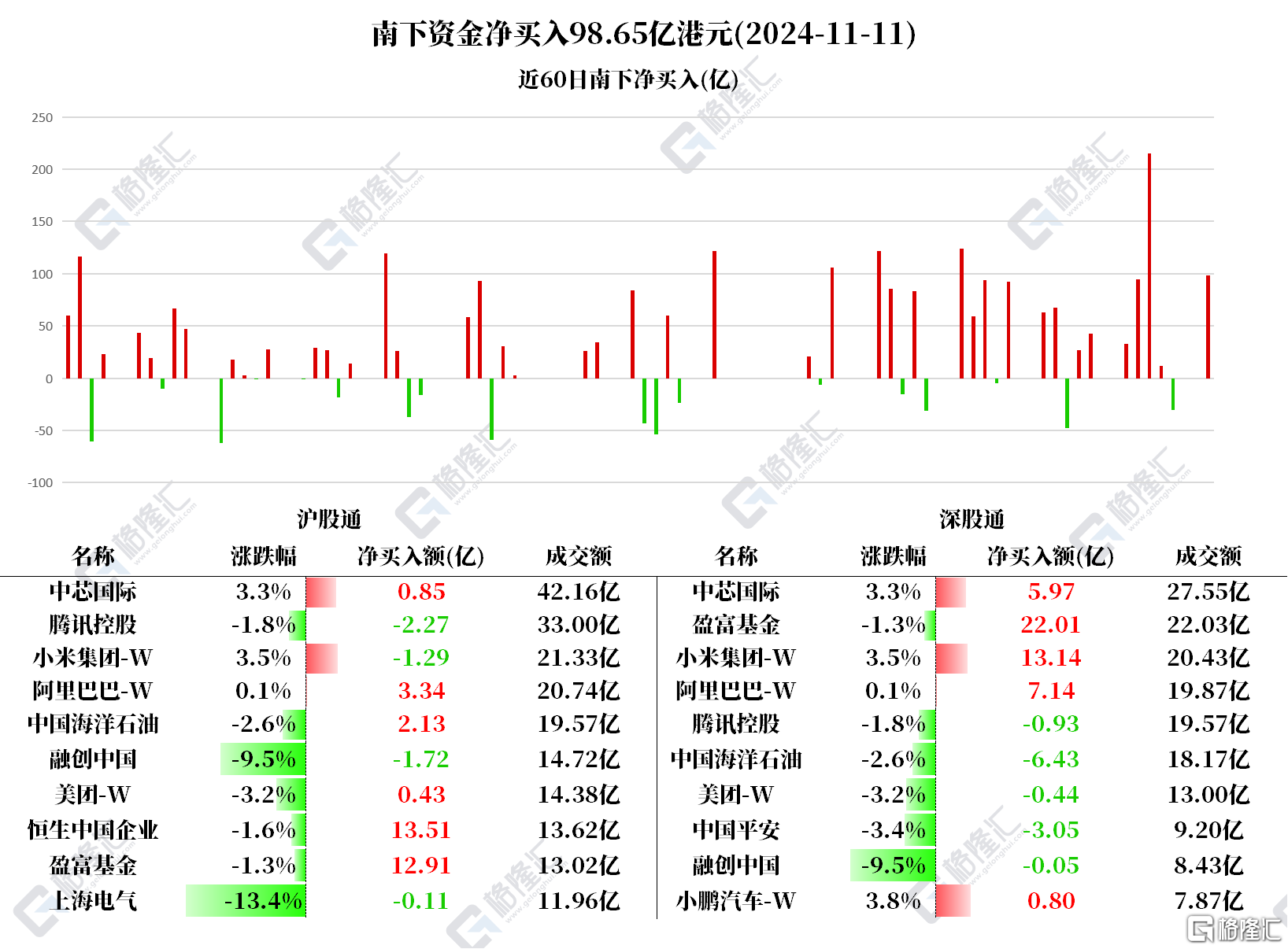

On November 11, Nancheng Funds purchased a net Hong Kong dollar of HK$9.865 billion.

Among them, Hong Kong Stock Connect (Shanghai) had net purchases of HK$6.071 billion, and Hong Kong Stock Connect (Shenzhen) had net purchases of HK$3.793 billion.

Net purchases of TraHK Fund were 3.492 billion yuan, Hang Seng China Enterprises were 1.351 billion yuan, Xiaomi was 1.185 billion yuan, Alibaba was 1.047 billion yuan, and SMIC was 682 billion yuan.

Net sales of CNOOC was 430 million yuan, Tencent was 320 million yuan, Ping An was 305 million yuan, and Sunac China was 177 million yuan.

According to statistics, funds from the south have purchased net SMIC for two consecutive days, totaling HK$2.2921 billion.

In addition, in the 36 trading days since it was included in the Hong Kong Stock Connect, funds from the south have purchased a total of HK$66.997774 billion in net purchases from Alibaba.

Beishui focuses on individual stocks

Xiaomi: On the news front, on November 11, according to the statistical report of the authoritative market survey agency provided by the supply chain, the Xiaomi 15 series ranked first in the sales market of China's smartphone market in the 44th week of 2024 (October 28 to November 3) with a score of 22.5%.

During this cycle, Xiaomi achieved sales of 1.453 million units, surpassing Huawei and Apple. The latter's market share and sales were 16.4%/1.056 million units and 16.3%/1.053 million units respectively, ranking second and third.

Alibaba: On the news front, Alibaba will release its results this Friday (November 15). Lyon previously pointed out that it expects the group's total revenue in the third quarter to increase by 4.8% year-on-year to RMB 235.5 billion, GMV to increase by approximately 6%, and CMR to increase by approximately 2% year-on-year. International retail is expected to maintain year-on-year growth of approximately 30%, while cloud computing will increase by 8% year-on-year. However, given continued investment, the group's adjusted EBIT may fall by 5% year-on-year.

SMIC: According to media reports, TSMC has not directly denied recent market rumors that TSMC will suspend the production of chips with processes of 7nm and below for relevant AI chip customers starting from November 11. The company responded to reporters: "TSMC does not comment on rumors.

Ping An Securities pointed out that against the background of dual limitations in equipment and OEM, the mainland of China semiconductor equipment manufacturers urgently need to increase the research and development of high-end equipment to support the expansion of local advanced process production capacity and realize the localization of the semiconductor industry chain. In addition, the United States has reviewed five equipment manufacturers, and domestic equipment replacement is imminent.

China Offshore Oil: On the news front, the impact of Hurricane Rafael on oil production in the U.S. Gulf of Mexico began to weaken. Coupled with market expectations that crude oil demand may weaken, international oil prices fell by more than 2% last Friday. Guangfa Futures believes that supply pressure is easing, demand is weak, the strengthening of the US dollar and geopolitical uncertainty coexist. Oil prices will face downward pressure in the short term, but space is relatively limited, and there is a high probability that oil prices will continue to fluctuate widely.

Tencent: Tencent will soon release its third quarter report for 2024 after Hong Kong stocks close on November 13, Beijing time. The market generally expects that Q3 Tencent is expected to achieve revenue of 167.746 billion yuan, a year-on-year increase of 8.49%; earnings per share is expected to be 4.76 yuan, a year-on-year increase of 26.78%.

Sunac China: On the news front, on November 8, the General Office of the Standing Committee of the National People's Congress held a press conference. The Standing Committee of the National People's Congress approved the addition of 6 trillion yuan of local government debt limit space and the arrangement of 4 trillion yuan of special debt relocation to support localized debt.

It is worth noting that Sunac China is promoting the restructuring of domestic bonds. Reports said that the company recently plans to provide creditors with four options for the domestic bond restructuring plan, seeking to reduce the size of domestic bonds of approximately 15.5 billion yuan by about half.