The Fed Signals Further Rate Cuts

On August 27, Eastern Time, the Federal Reserve's website published the minutes from its latest discount rate meeting. These minutes disclose that, in July, members of the Chicago and New York Federal Reserve Banks voted to reduce the discount rate by 25 basis points. This document offers insights into the anticipated trajectory of Fed monetary policy. Current market expectations strongly indicate that the Fed is likely to implement a rate cut in September, with some projections even suggesting a substantial reduction of 50 basis points.

The Complex Relationship Between Monetary Policy and Currency Value

When the Fed lowers interest rates, a common question arises: Will the dollar depreciate as a result? To address this question, it is essential to examine the nuanced relationship between Fed rate cuts and dollar depreciation.

- Interest Rate Differentials: A reduction in U.S. interest rates can diminish the attractiveness of dollar-denominated assets to foreign investors, who might seek higher returns elsewhere. Consequently, this capital outflow can decrease demand for the dollar, potentially leading to its depreciation.

- Expectations of Investment Returns: Additionally, lower interest rates may reduce expectations for future returns on dollar assets, which can further decrease demand for the dollar.

- Inflation Expectations: Furthermore, market participants might anticipate that rate cuts could lead to higher future inflation. Since inflation erodes the purchasing power of currency, investors might therefore reduce their dollar holdings.

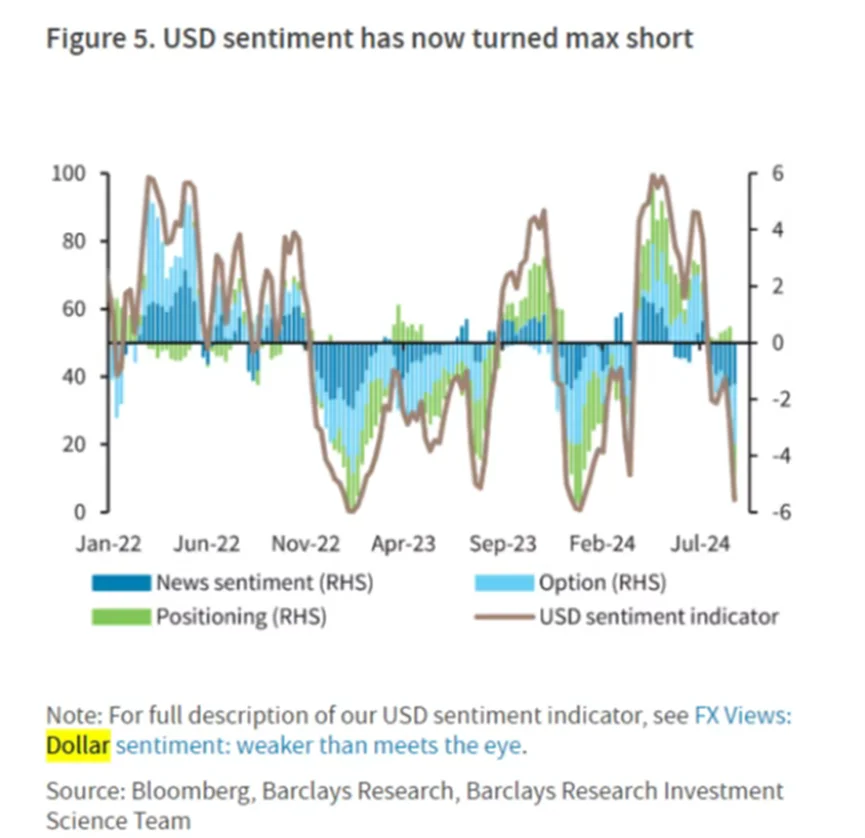

Nevertheless, the actual outcomes are more complex. Fed rate cuts may not necessarily result in a straightforward depreciation of the dollar; instead, the relationship could be non-linear. For example, Stephen Jen suggests that a growing number of dollar holders are liquidating their dollar assets, questioning the dollar's role as the world's primary reserve currency, and expressing concern over escalating U.S. trade and budget deficits. This perspective is supported by Barclays, which notes that the dollar has experienced its most severe monthly depreciation since November of the previous year, with market sentiment shifting from "extremely bullish" to "extremely bearish." In addition, recent data from the Commodity Futures Trading Commission (CFTC) indicate that speculators are currently maintaining long positions in international currencies.

In addition, recent data from the Commodity Futures Trading Commission (CFTC) indicate that speculators are currently maintaining long positions in international currencies.

Should We Be Overly Concerned About Dollar Depreciation?

The Fed's decisions regarding rate cuts involve complex economic considerations, and their impact on the dollar's value is not fixed. While theoretical frameworks suggest that rate cuts could lead to dollar depreciation, the actual effect depends on various economic and market factors. If, for instance, the Fed's rate cuts fall short of expectations, the downward pressure on the dollar may be mitigated or even reversed. Therefore, it is imperative for investors and policymakers to closely monitor economic indicators, market sentiment, and policy developments to more accurately forecast the dollar's future trajectory.

In an increasingly interconnected global economy, each adjustment of Fed interest rates serves as a test of global financial market stability. A comprehensive understanding of the economic rationale behind Fed rate cuts and their potential implications for currency values is essential for investors. By strategically employing a diversified investment portfolio, investors may uncover opportunities amid global financial fluctuations and remain well-positioned to anticipate future currency trends.