After the market closes on August 28th, Eastern Time (August 29th, Beijing time), "the first hard-core stock in the universe", AI chip giant NVIDIA (NVDA.US) will announce its second quarter results for fiscal year 2025.

Regardless of whether its performance is good or bad, Nvidia will bring the strongest signal to the AI concept and even the entire US stock market. This financial report will tell investors whether U.S. companies are still investing heavily in AI technology. It is also the most important financial report of technology companies this financial reporting season, which may determine whether AI transactions can continue.

NVIDIA has been considered by Wall Street to be the most important stock in the world. Since the beginning of this year, as the concept of AI continues to heat up, NVIDIA's stock price has risen and hit new highs repeatedly. Although it experienced a major correction in July, Nvidia's cumulative increase during the year was still as high as 155%, and its market value increased by US$1.82 trillion.

(Source: uSMART)

Q2 performance forecast

Wall Street expects Nvidia to not only beat second-quarter estimates but also raise its third-quarter guidance, which could be supported by Taiwan Semiconductor Manufacturing Co.'s (TSM.US) recent earnings beat.

The current market consensus is that Nvidia's second-quarter revenue is expected to increase by about 112% year-on-year to US$28.68 billion; earnings per share are expected to be US$0.60, a year-on-year increase of 141.49%. However, its adjusted gross profit margin is expected to drop 3 percentage points from the first quarter. above, to 75.8%.

In the second quarter, data center, Nvidia's most critical business, is expected to achieve revenue of US$25.023 billion, a year-on-year increase of 142.40%. This means that the business's share of the company's revenue is expected to continue to expand to 87%, compared with 86% last quarter. But it's worth noting that data center growth may be lower than the 426% revenue growth in the previous quarter and the 408% in last year's fourth quarter.While the data center business has received a lot of attention, the gaming business remains an important source of revenue for Nvidia. According to consensus expectations from Bloomberg, the game business is expected to achieve US$2.793 billion in Q2, a year-on-year increase of 12.34%.

Goldman Sachs expects Nvidia's gaming unit to achieve double-digit growth in fiscal 2025 and 2026 as the company continues to transition and upgrade to the Ada Lovelace architecture, coupled with progress in generative AI-related services. Specifically, revenue from the gaming business is expected to grow from US$9.25 billion in fiscal 2023 to US$14.57 billion in fiscal 2026, representing a compound annual growth rate of 16.4%.

At the same time, the market also expects growth to slow further in the third quarter.

LSEG data shows that Nvidia may expect third-quarter revenue to rise 75% to $31.69 billion, ending its five consecutive quarters of triple-digit growth.The company's data center revenue is expected to slow further in the third quarter, rising 91% year-over-year to $27.7 billion.

Market sentiment is likely to depend both on Nvidia's results and its guidance

Northwestern Mutual Wealth Management said evidence of strong demand for Nvidia would be a bullish sign that companies are continuing to invest and not divest in anticipation of an economic slowdown. But what investors want to know most is whether this is sustainable and what demand will be like in 25 and 26 years.

Barclays analysts also warned that Nvidia's financial report may be a "reality test" for the overall market, especially the technology field. If Nvidia's latest financial report fails to exceed expectations again and raises its profit forecast, it may disappoint investors and have a wider impact on the entire market.

Wall Street's views on Nvidia sharply divided

On the one hand, the market is generally optimistic about artificial intelligence (AI), but on Wall Street, there are voices of support and skepticism. As the global leader in AI chip design, NVIDIA controls 80% to 95% of the market share. The market expects that Nvidia will continue to maintain its leading position with the launch of the next generation Blackwell chip series. NVIDIA Blackwell is the ultimate full-stack matrix solution for general-purpose computing. Nvidia said that Blackwell has 6 revolutionary technologies that can support models with up to 10 trillion parameters for AI training and real-time large language model (LLM) inference.

However, Nvidia may face delays in production of its next-generation Blackwell AI chips.

Previously, Huang said in May that the chips would ship in the second quarter, but analysts pointed out that there may be design obstacles that could delay it. Research firm Semianalysis believes this may affect revenue growth in the first half of next year. In addition, Nvidia's profit margins may also be squeezed if TSMC, Nvidia's chipmaker, raises expenses.

Bank of America said that Nvidia's second-quarter results may not be as expected and recommended that investors hedge against potential losses by purchasing put options on the S&P 500 Index ETF (SPY.US). Bank of America analyst Gonzalo Asis warned that investors may be underestimating the risk of disappointing results, and that a more effective way to hedge this risk is to buy put options on the S&P 500 Index rather than Nvidia put options.Daniel Morgan, senior portfolio manager at Synovus Trust, pointed out that NVIDIA is not only the benchmark for the chip industry, but also the benchmark for the entire AI industry. If Nvidia fails to meet expectations, investors may sell off stocks of all AI-related companies. However, many Wall Street analysts still believe that Nvidia's performance in the short term is not worthy of excessive concern. On the occasion of the earnings release, Wall Street institutions such as Citigroup, Goldman Sachs and KeyBanc reiterated their bullish views on Nvidia. Morgan Stanley believes that Nvidia's performance guidance will be supported by increased demand for H200 chips. Even if shipments of Blackwell series GPUs are delayed, customer enthusiasm for this product line remains high.

Goldman Sachs strategist Scott Rubner said that as Nvidia's financial report day approaches, the options market implies that its stock price has room to rise by more than 9%, and the market value is expected to increase by approximately US$298 billion. He also pointed out that due to the recent widespread sell-off in U.S. technology stocks, Nvidia’s performance threshold for this quarter has been lower than in previous quarters.

NVIDIA may face greater stock price fluctuations on earnings day

According to Market Chameleon, backtesting the past 12 quarterly performance days, NVIDIA has a higher probability of rising on the day of performance release, about 75%. The average stock price change is ±8.1%, with a maximum increase of +24.4% and a maximum decrease of -7.6%.

(Source: Market Chameleon)

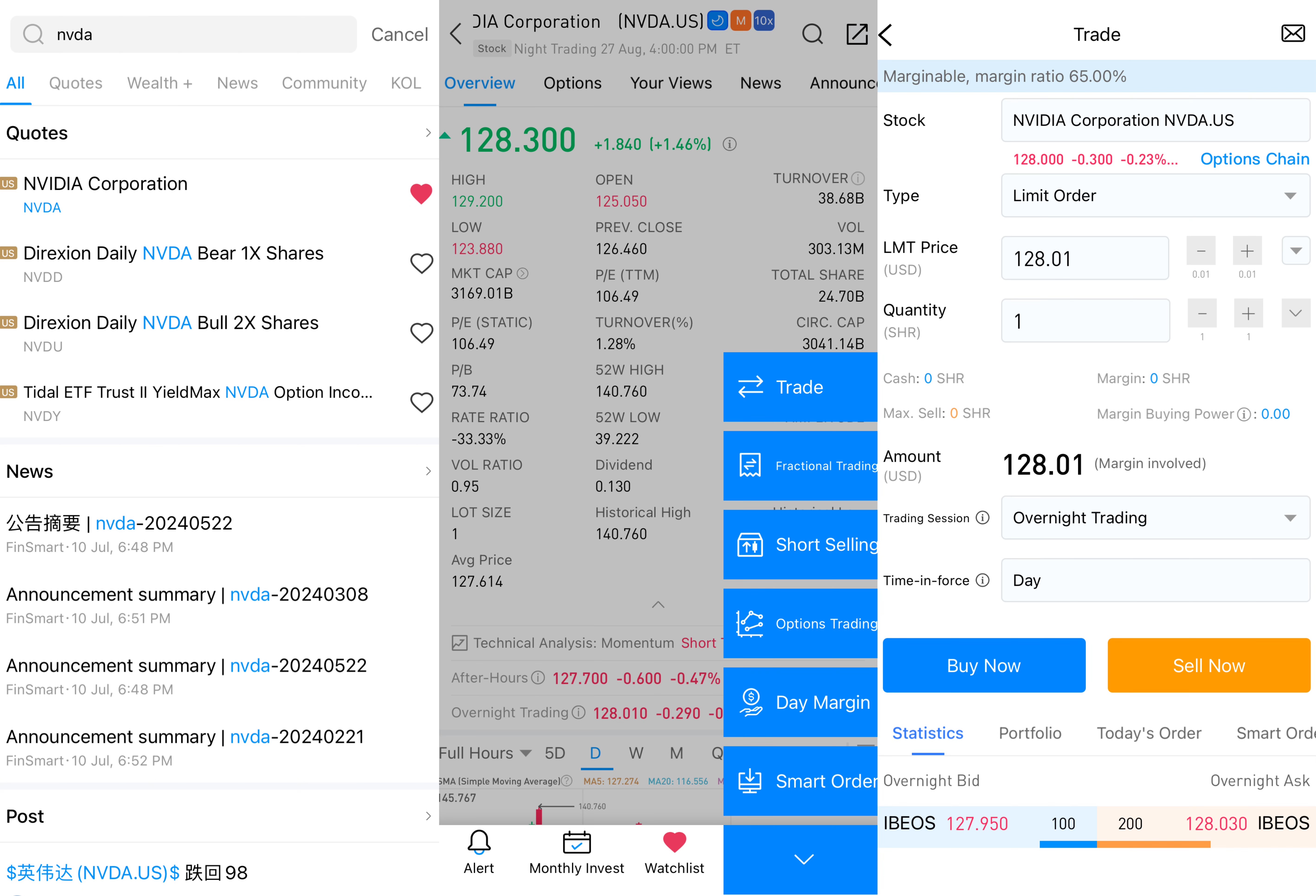

How to invest in NVIDIA on uSMART?

After logging in to uSMART HK APP, click "Search" from the upper right corner of the page, enter "NVDA" or "NVIDIA", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

This image is for illustrative purposes only

This image is for illustrative purposes only