On August 21, Xiaomi Group-W (01810.HK) released its second quarter results announcement. Revenue hit a record high, recording 88.89 billion yuan year-on-year. Revenue from innovative business segments such as smart electric vehicles was 6.4 billion yuan. Total revenue in the second quarter It rose 32% year-on-year and has achieved positive growth year-on-year for four consecutive quarters.

Taking into account the adjusted net loss of 1.8 billion yuan from innovative businesses such as smart electric vehicles, Xiaomi's second-quarter net profit rose 38.3% to 5.07 billion yuan, and its adjusted net profit rose 20.1% to 6.18 billion yuan, which was better than market expectations. Xiaomi founder Lei Jun posted on Weibo that "this is the best quarterly report in Xiaomi's history."

Xiaomi's cumulative profit in the first half of the year was 9.28 billion yuan, up approximately 18% year-on-year. Adjusted profit rose 51% to 12.67 billion yuan, and no interim dividend was paid. The group's revenue in the first half of the year was approximately 164.39 billion yuan, a year-on-year increase of approximately 30%.

After the financial report was released, Xiaomi's stock price rose sharply today, rising by more than 7% to HK$18.90.

(Source: uSMART)

Product lines bloom

Xiaomi divides its business into three main parts: smartphones, IoT and consumer goods, and Internet services.●Smartphones: Mainly including Xiaomi and Redmi.

●IoT and consumer products: mainly include tablets, laptops, wearable devices, TVs, major appliances, etc.

●Internet services: mainly include advertising business and game business.

With the gradual completion of Xiaomi's "Full Ecosystem for People, Cars and Homes" strategy, the scale of Xiaomi's smart hardware continues to expand. In the second quarter, Xiaomi's product line accelerated across the board, with revenue from smartphones, IoT, consumer goods, and Internet business reaching 46.5 billion yuan, 26.8 billion yuan, and 8.3 billion yuan respectively, all exceeding market expectations. While the group's total revenue hit a record high, revenue from the IoT and consumer products business and the Internet business also increased by 20.3% and 11.0% year-on-year respectively, setting a new historical record.

In the second quarter, Xiaomi's global smartphone shipments reached 42.2 million units, a year-on-year increase of 28.1%. As of June 30, 2024, the number of IoT devices (excluding smartphones, tablets and laptops) connected to the Xiaomi AIoT platform increased by 25.6% year-on-year to 822 million units; there are 5 or more devices connected to the Xiaomi AIoT platform ( The number of users (excluding smartphones, tablets and laptops) increased by 24.2% year-on-year to 16.1 million. As of June 2024, the number of monthly active users of Mijia App has increased by 16.8% year-on-year, reaching 96.9 million, and the number of monthly active users of Xiao Ai has increased by 12.4% year-on-year, reaching 132 million. During this period, the gross profit margin of Xiaomi's IoT and consumer goods business reached 19.7%, a year-on-year increase of 2.2 percentage points.

The financial report shows that IoT and consumer goods revenue has reached a record high, mainly due to the growth in revenue from smart home appliances in China, tablets in overseas markets, and wearable devices in the global market. Among them, the performance of the major appliance business was particularly outstanding, with revenue increasing by 38.7% year-on-year, becoming the focus of the earnings call. Data shows that in the second quarter, Xiaomi's air-conditioning product shipments exceeded 3.3 million units, a year-on-year increase of more than 40%; Xiaomi's refrigerator and washing machine products also achieved significant growth, while the service capabilities of Xiaomi's home appliance products continued to improve. As of August 14, Xiaomi has launched "old-for-new" services in five categories: air conditioners, TVs, refrigerators, washing machines, and water heaters, and has launched a one-stop "disassembly and assembly" service nationwide.

Lin Shiwei, vice president and chief financial officer of Xiaomi Group, said at the earnings call that the significant increase in IoT gross profit margin reflects the stability of Xiaomi's overall gross profit margin and the complementarity of its business. He also revealed that Xiaomi is exploring the possibility of introducing major appliance business into overseas markets. In the future, both major appliance and IoT business will have huge growth potential in overseas markets.

AI empowers the entire ecosystem

The financial report shows that Xiaomi’s R&D expenditure in the second quarter was 5.5 billion yuan, a year-on-year increase of 20.7%.

"AI comprehensive empowerment" is an important strategy of Xiaomi. On the one hand, this has led to the high-endization of mobile phones, and on the other hand, it is also widely used in the automotive field.

Among them, in terms of intelligent assisted driving, Xiaomi's intelligent driving system Xiaomi Pilot has self-developed all technologies, all of which support leading intelligent assisted driving functions. It uses an end-to-end large model, that is, the integration of perception, decision-making, and planning, which has now been implemented Extremely narrow parking spaces with 5cm accuracy and valet parking at a maximum cruising speed of 23km/h with extremely high availability.

In addition, Xiaomi AI technology is also empowering Xiaomi smart factory production and construction. In July 2024, Xiaomi officially released a new generation of Xiaomi mobile phone smart factory-Xiaomi Changping Smart Factory. Its annual production capacity reaches 10 million units of flagship mobile phones. Through in-depth self-research of manufacturing equipment, it has achieved 100% automation of key processes, and its software self-research rate has reached 100%. From the product side, the process innovation verification and production of popular flagship models such as Xiaomi 14 Bay Blue, Xiaomi 14 Ultra, Xiaomi MIX Fold 4, Xiaomi MIX Flip, etc. all come from this factory.

Electric vehicle revenue is 6.2 billion, adjusted net loss is 1.8 billion

In the second quarter, Xiaomi's revenue from innovative businesses such as smart electric vehicles reached 6.4 billion yuan, and a total of 27,307 new cars were delivered in a single quarter. However, the net loss of this innovative business was as high as 1.8 billion yuan. Based on this calculation, Xiaomi Motors' loss per vehicle exceeded 60,000 yuan. This shows that it has not yet become Xiaomi’s revenue pillar. Xiaomi Auto’s gross profit margin was 15.4%. In comparison, the gross profit margin of Xiaomi's mobile phone business during the same period was 21.1%.

In this regard, Lei Jun said: "Building a car is hard, but success must be cool! Xiaomi Auto is still in the investment period, I hope everyone understands."

Regarding the losses in the smart electric vehicle business, Xiaomi CEO and President Lu Weibing said that the relevant business does not have economies of scale, coupled with the large initial investment and the high cost of the models, he expects that the losses will further narrow as the scale, production capacity, and delivery capabilities increase. . Xiaomi's first car is a pure electric sedan. Its investment cost is relatively high, and it will still take some time to digest this part of the cost.

Lu Weibing also pointed out that the company began to increase production capacity in June, switching from single-shift to double-shift production, and can stably deliver 10,000 vehicles per month. Since July 1, the delivery of Xiaomi SU7 series has been further accelerated, and the delivery cycle is expected to be shortened by up to 5 weeks after the order is locked. Lu Weibing said that as the order delivery cycle is further shortened, it is expected that the monthly delivery volume of SU7 series new vehicles will continue to increase in the future. He is confident in achieving the new target of cumulative delivery of 120,000 vehicles throughout the year.

At present, Xiaomi is still in the early stages of car manufacturing, which means a large strategic investment. However, Xiaomi's cash reserves have not decreased but increased this quarter.

As of June 30, 2024, Xiaomi's cash reserves were 141 billion yuan. The company responded that this provides a solid financial guarantee for the continuous and in-depth development of the automobile business and core basic business, and helps Xiaomi achieve sustained explosive growth. According to Lei Jun's plan, Xiaomi Motors will become one of the top five automakers in the world through 15 to 20 years of hard work, striving for the overall rise of China's auto industry.

Is it time to invest in Xiaomi now?

Citigroup said that Xiaomi Group-W (01810.HK) announced second-quarter results that exceeded expectations, and the stock price is expected to respond positively to strong electric vehicle profit margins. Slightly raised the company's target price to HK$22.7 and raised its profit forecast for the company.

Yin International issued a research report, raising Xiaomi Group's 2024-26 fiscal year earnings per share forecast by 6-8% to reflect the strong second quarter performance, and raising the target price by 0.5% from 24.29 Hong Kong dollars to 24.4 Hong Kong dollars, corresponding to 23.9 times the 2024 fiscal year. P/E ratio, maintain "Buy" rating.

Combined with Xiaomi's future development, judging from the current stock price, Xiaomi Group's stock still has potential and room for growth in the future.

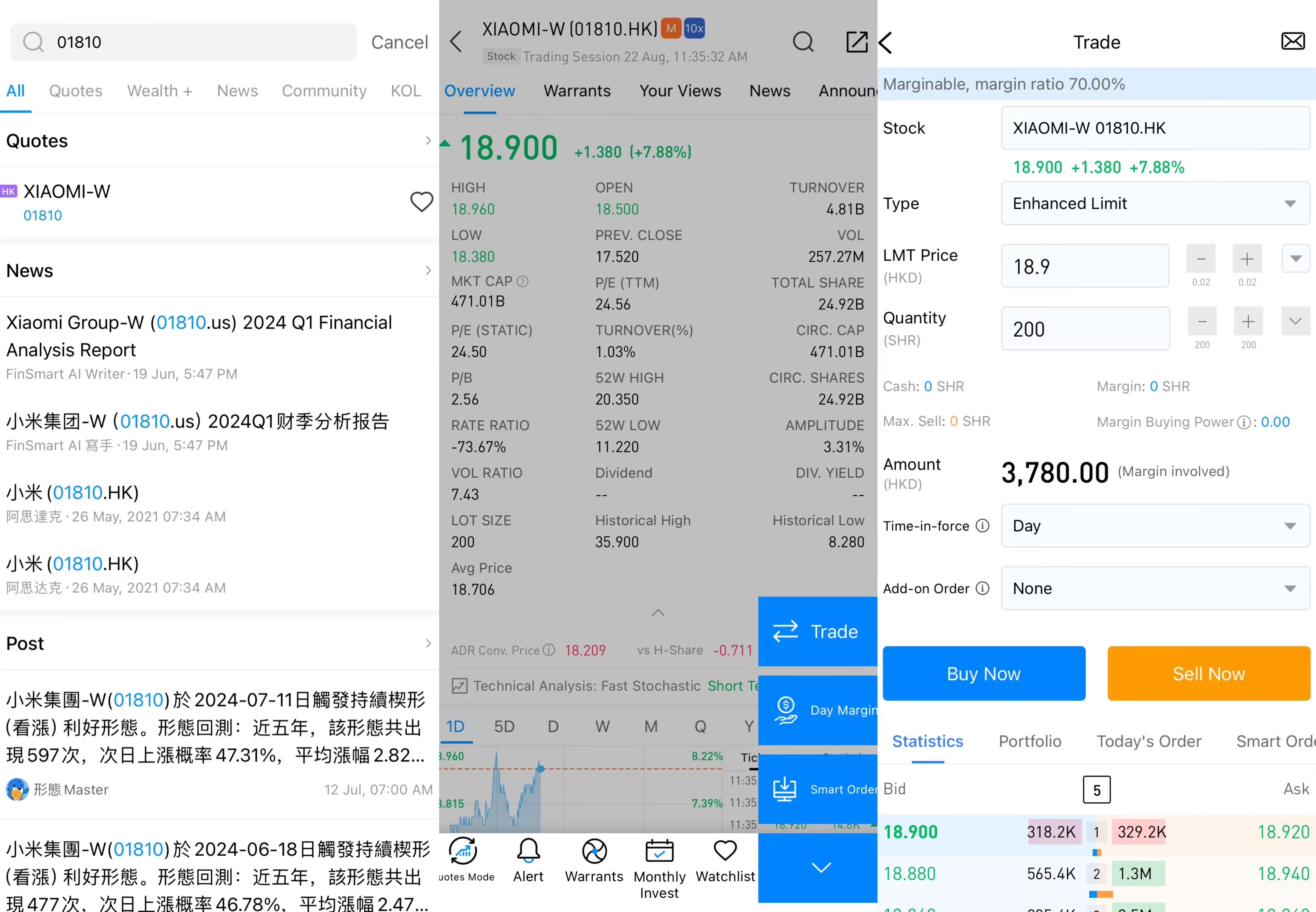

How to buy Xiaomi Group-W with uSMART HK?

After logging into uSMART HK APP, click "Search" from the upper right corner of the page, enter "Xiaomi" or "01810", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

This image is for illustrative purposes only