On July 14, Bank of America listed Broadcom as a top AI pick as important as NVIDIA in a conference call (Top AI Pick along with NVIDIA).

(Source: uSMART)

According to analysis by J.P. Morgan, communications chip giant Broadcom (AVGO.US) will become the big winner in the field of artificial intelligence (AI), capturing most of the market share amid the substantial increase in demand for AI semiconductors in the next few years. .

According to "Barron's", analyst Harlan Sur reiterated his "Overweight" rating on Broadcom stock on Tuesday (16th) and reconfirmed its $200 price target.

How did Broadcom become a top AI company?

Training large AI models requires the use of a large number of GPUs, NPUs, LPUs and other processors produced by Nvidia, AMD and other companies - or XPUs. Ethernet switches are required to connect these high-performance chips and transmit data between them. , routing and other network chips - this is what Broadcom is good at, which has enabled the company to benefit a lot from the AI trend. As one of the largest companies in the semiconductor industry, Broadcom has climbed to the top of the industry through multiple acquisitions, making the company a barometer of overall chip market performance.

Global acquisition mania - the history of making a fortune is another history of acquisitions

Broadcom has rapidly expanded its reach and solidified its position in the technology industry through a series of massive acquisitions.

1. Avago merges with Broadcom

- May 2015: Avago Technologies announces acquisition of Broadcom for approximately $37 billion ($17 billion in cash and $20 billion in stock). At the time, it was the largest acquisition in the tech industry since the dot-com bubble burst.

- November 2016: After the merger was completed, Avago chose to continue operating under the Broadcom name to leverage Broadcom's brand influence in the market.

2. Continue to acquire and expand

- 2017: Broadcom announced the acquisition of Brocade Communications Systems for US$5.5 billion to further enhance its capabilities in the networking and storage markets.

- July 2018: Broadcom acquired CA Technologies for US$18.9 billion in cash to enter the enterprise software market.

- August 2019: Broadcom acquired Symantec's enterprise security business for US$10.7 billion in cash, expanding its presence in the cybersecurity field.

- 2022: Broadcom announces the acquisition of VMware for US$61 billion to further expand its software and cloud computing business.

Through these strategic acquisitions, Broadcom has not only consolidated its leadership position in the semiconductor industry, but also achieved diversification and global expansion of its business, covering multiple fields such as networking, security, enterprise software and cloud computing.

Get connected with Google

In 2013, the person in charge of Google AI discovered after careful calculations that for a huge cloud service company like Google, with the continuous development of the Internet, off-the-shelf general-purpose CPUs and GPUs alone will inevitably be unable to meet the huge computing needs of the future. The best solution The solution is to customize the chip for the application. To this end, Google has set a goal: to build a domain-specific computing architecture (Domain-specific Architecture) for the purpose of machine learning, and to reduce the total cost of ownership (TCO) of deep neural network inference to ten percent of its original value. one.

As an Internet software company, Google itself does not have the ability to develop a chip from scratch and must seek external help. After many discussions, Google selected Broadcom as its partner to develop its own chips.

At the 2016 Google I/O Developer Conference, Google’s CEO officially showed the world its self-developed chip TPU v1. According to a report by J.P. Morgan analysts, Google has reached in-depth cooperation with Broadcom since TPU v1. It has jointly designed all TPUs announced so far with Broadcom, and Broadcom’s revenue in this area has also increased due to Google. US$50 million in 2015 soared to US$750 million in 2020. In addition to chip design, Broadcom also provides Google with key intellectual property and is responsible for steps such as manufacturing, testing and packaging new chips to protect Google's new data centers.

Up to now, the two parties have cooperated to design the sixth generation TPU and are promoting the mass production of the sixth generation TPU (3nm process). Although there have been rumors in the market that Google will abandon its cooperation with Broadcom and turn to self-research to save costs. But recently, Broadcom still revealed at an analyst meeting that it had obtained a contract to provide multiple generations of TPUs to Google. Xiaomo believes that the contract includes the upcoming seventh generation (v7) TPU, which is expected to be launched in 2026/2027.

In the past, Google's annual TPU fee payment to Broadcom was expected to be US$2 billion, reaching US$3.5 billion in 2023. Due to the rapid expansion of AI demand, it is expected to reach US$7 billion in 2024.

How will Broadcom perform in 10 years?

According to Bloomberg analysts, generative artificial intelligence is expected to become a $1.3 trillion market in 2032 and is expected to grow at a compound annual growth rate of 42% over the next 10 years. Analysts note that training and inference hardware will drive near-term growth, with the industry shifting to software and consumer-oriented use cases such as digital advertising in the future.

Strong professional advantages: Broadcom focuses on opportunities in hardware and customizes designs for customers for specific workloads by applying specific integrated circuits (ASICs), that is, custom chips. Custom chips can be more cost-effective and efficient than expensive GPUs sold by competitors such as Nvidia. Through its focus on specialized areas, Broadcom is expected to maintain a competitive advantage in this highly competitive market.Diversification: Nvidia's data center hardware business grew 427% year over year in the first quarter to $22.6 billion and now accounts for about 87% of its total sales. This trend has squeezed its other divisions such as gaming and professional visualization, making it more sensitive to slowing demand for AI chips. Broadcom, by contrast, is involved in multiple areas, and although artificial intelligence is an important growth opportunity, it only accounted for 25% of sales in the second quarter. Broadcom's revenue increased 43% year over year, mainly due to the recent acquisition of VMware, which helps enterprise customers build customized on-premises private clouds.Stable business prospects: Although the cloud computing field is affected by the demand for artificial intelligence, it also benefits from the trend of enterprise digitalization. Broadcom also sells its chips and networking hardware to a broad base of customers, including smartphone makers and internet companies, mature industries unlikely to experience significant volatility over the next decade.

How to invest in Broadcom on uSMART?

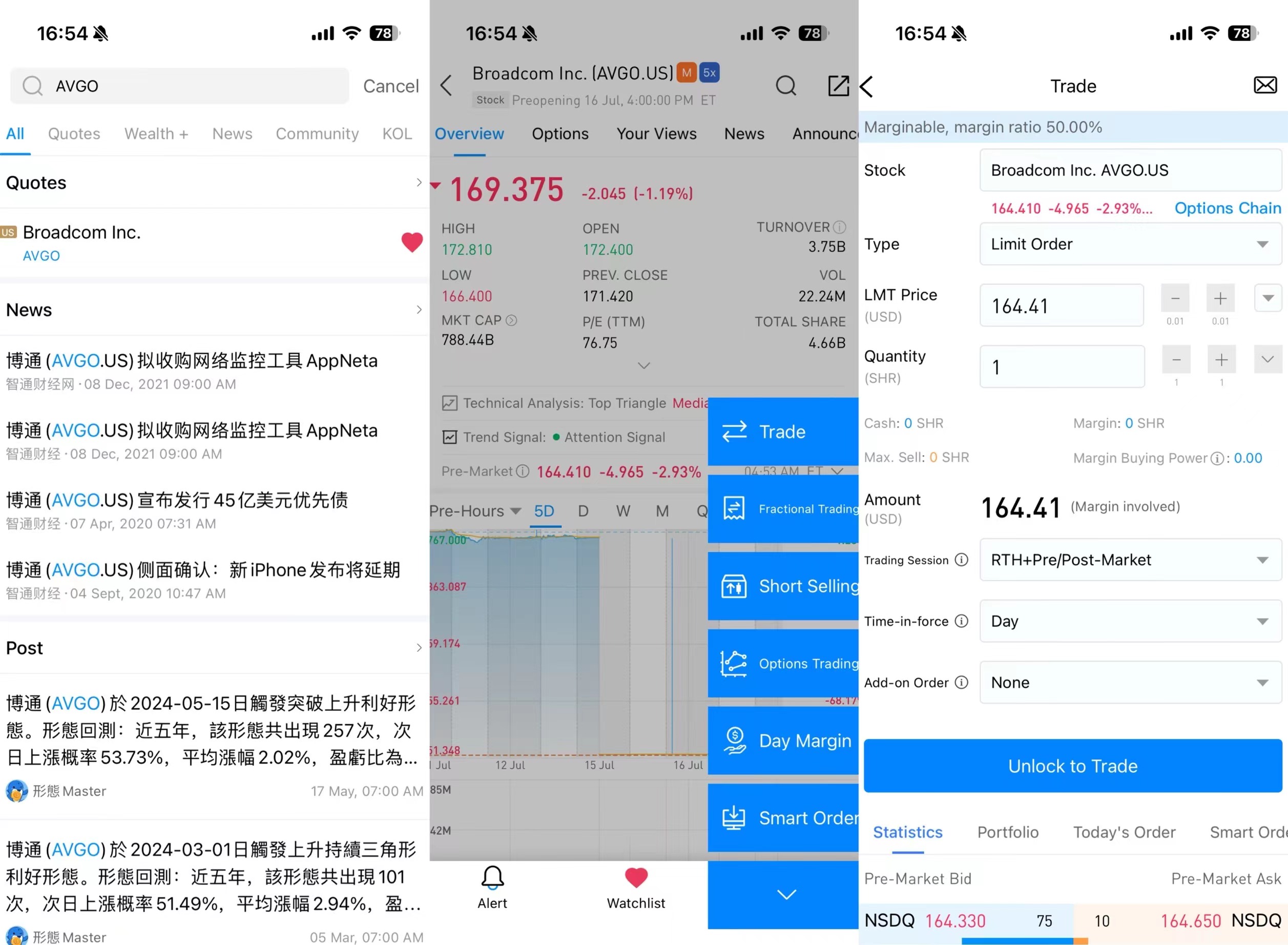

After logging into uSMART HK APP, click "Search" from the upper right corner of the page and enter "AVGO" to enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select the "Buy/Sell" function. Finally, fill in the transaction conditions and send the order; the image operation instructions are as follows: