Former U.S. President and current presidential candidate Trump was shot during a public speech in Pennsylvania. He was slightly injured and bleeding but his life was not in danger. This is the first time that a "presidential-level" figure in the United States has been in danger since Ronald Reagan was assassinated in 1981. Shot to death.

After the assassination, a photo of Trump with his right hand raised and bleeding from his ear quickly became popular around the world.

The assassination not only won Trump sympathy points, but Trump's resolute image also gained people's confidence in his election as the next president of the United States. After the assassination, professionals predicted that Trump's probability of winning the election directly increased to nearly 70%.

How has the market reacted?

Amid the turmoil surrounding the assassination, the reaction of the stock market is temporarily unclear as global stock markets are closed on Sunday.

After the incident, most analysts expected that investors' first reaction would be to rush into safe-haven assets.

Generally speaking, safe-haven assets can be divided into traditional safe-haven assets and non-traditional safe-haven assets. Traditional safe-haven assets are represented by the U.S. dollar, U.S. bonds, and gold. Recently, more and more investors are considering cryptocurrency as a non-traditional safe-haven asset. A safe-haven investment.

After the assassination, U.S. bond interest rates rose slightly, and cryptocurrencies such as Bitcoin and ETH rose sharply in response.

Traditional safe havens: U.S. dollar, U.S. bonds

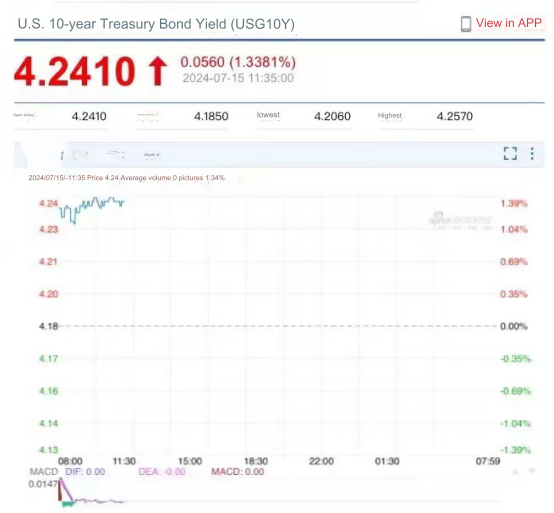

Market analysts pointed out that after the shooting, the proportion of bets on Trump winning the U.S. presidential election increased, and the U.S. dollar index and U.S. Treasury yields are expected to continue to rise next week.

The U.S. dollar index edged higher against most currencies in early trading on Monday.

U.S. Treasury futures yields edged higher.

If Trump wins the election, the loose fiscal policy advocated by Republicans will keep bond yields high, and the dollar will appreciate.

But there are also early signs that bond investors are becoming increasingly sensitive to domestic political turmoil in the United States. Mark Rosenberg, co-founder of GeoQuant, pointed out: The trend of a positive correlation between long-term U.S. bond yields and U.S. political risks is emerging, which may weaken the traditional safe-haven function of U.S. Treasury bonds.

Non-Traditional Hedging: Cryptocurrencies

Within hours after the gunshot, the cryptocurrency market rose collectively, with Bitcoin rising more than 3% and once again rising above the $60,000 mark. Second-tier currencies rose even more strongly, such as Dogecoin, Hedera, Aptos, Sui, Mog Coin, etc., each soaring 5% to 20%. Of course, MAGA and Trump SOL, two niche currencies issued by Trump supporters, have increased by 30% and 100% respectively.

During Trump’s first term in office from 2017 to 2021, Trump repeatedly expressed doubts about cryptocurrency and once described this new gadget as a “fraud”; however, his stance has almost reversed 180 degrees in recent years. During this campaign, it has been stated many times that once elected, he will strongly support the development of cryptocurrencies and related industries such as Bitcoin. Industry organization Stand With Crypto tracks the words and deeds of hundreds of major U.S. politicians to assess their support for cryptocurrency. Trump was rated the highest A grade, while his opponent Biden was rated D.

One of the core beliefs of cryptocurrency investors is that the excessive issuance of currencies in "centralized" countries, led by the U.S. dollar, is difficult to reverse, so these legal currencies are bound to continue to depreciate and become "increasingly worthless." On the contrary, "decentralized" cryptocurrencies such as Bitcoin and ETH have an issuance limit, and it is impossible for anyone to issue additional coins, so they will "increasingly maintain their value." Under this circumstance, Trump’s victory helped to consolidate this core belief to a certain extent.

U.S. stocks may become more volatile in the near future

While traders generally believe that the assassination attempt on Trump will not derail the stock market's trajectory in the long term, price volatility is likely to increase in the near term. The market has been battling speculation of overvaluation given the boom in artificial intelligence stocks, the uncertainty surrounding recent public company earnings releases, and the risks posed by rising interest rates and political uncertainty.

During Trump’s term in office, significant progress was made in the deregulation and reform of U.S. financial regulations. The Trump administration advocates relying on traditional energy, achieving net energy exports, and significantly reducing investment in new energy. The specific implementation focuses on promoting the development of traditional energy and reducing environmental supervision.

During Trump's term in office, he implemented the economic policy of "global contraction, America first". Internally, he promoted the reshoring of manufacturing through tax cuts and interest rate increases, and externally protected domestic industries through punitive tariffs and the establishment of technical barriers.

Investors expect stocks in the banking, health care and oil industries to benefit from a Trump victory.

Disclaimers:Investing involves various risks, and the value and returns of securities may fluctuate significantly. Moreover, past performance is not indicative of future results. In particular, trading in virtual assets and virtual asset-related products carries substantial risk and is suitable only for investors with a high risk tolerance and the financial capacity to absorb losses if trades become unprofitable. Indeed, transactions involving virtual assets or related products may lead to significant financial losses. Therefore, it is crucial to assess whether such transactions align with your investment goals, financial situation, risk tolerance, and investment experience. Furthermore, you should be prepared to absorb the full extent of potential losses, including any additional amounts beyond the initial investment, resulting from trading virtual assets or related products. Consequently, when considering participation in such trading or investment activities, it is essential to understand and acknowledge both the general risks involved and any specific risk factors associated with trading virtual assets or related products.