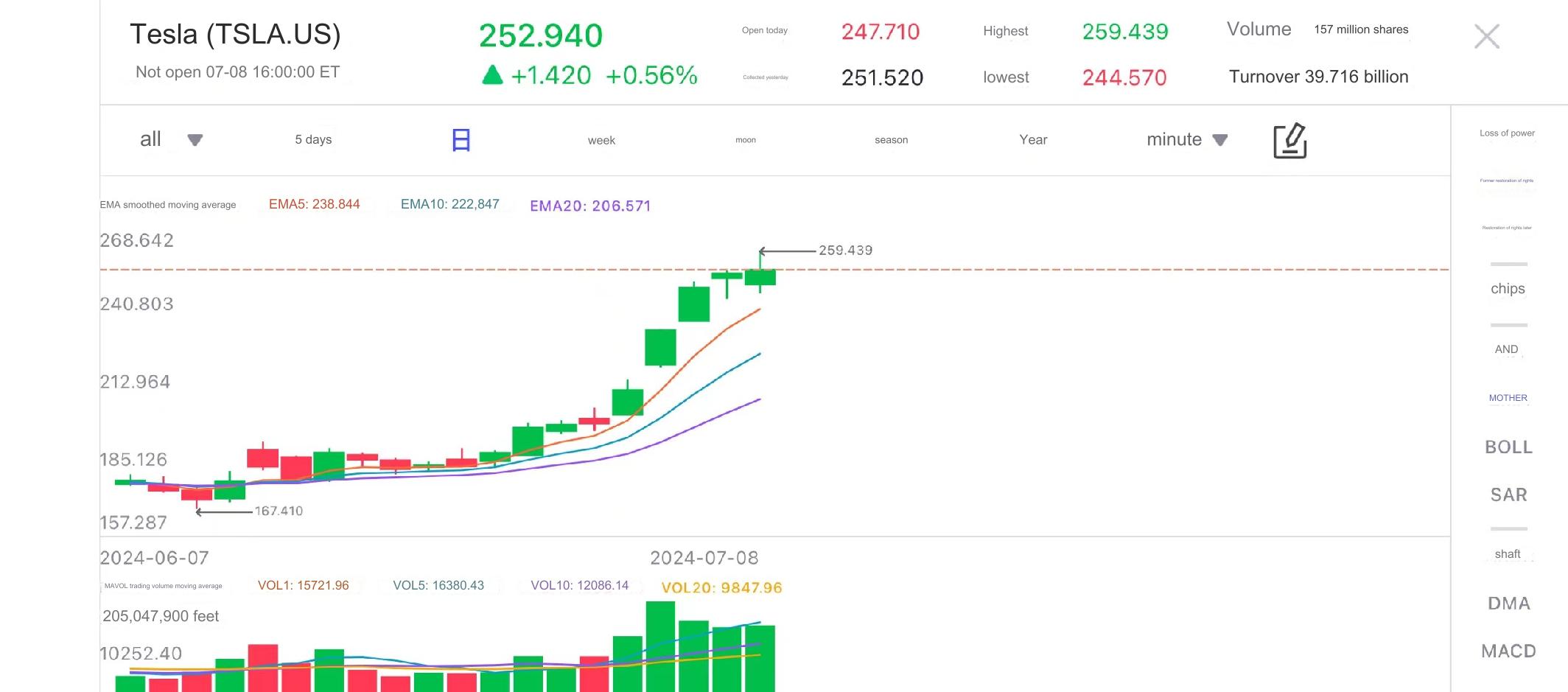

Tesla (TSLA.US) closed up 0.56% on Monday, with the stock price rising to $252.9. It has risen for nine consecutive days. It has risen 30% since Tesla announced that its second-quarter delivery numbers were better than expected, making Tesla It has finally achieved a cumulative increase this year, with an increase of 3%, regaining pace with the "Big Seven" in the US stock market, and reversing the previous sharp decline. Despite this, Tesla's stock price trend has still lagged behind the trend of the U.S. stock market since entering 2024. The Nasdaq Composite Index has risen by 22% in 2024, and the S&P 500 Index has also risen by 17%.

(Source: uSMART)

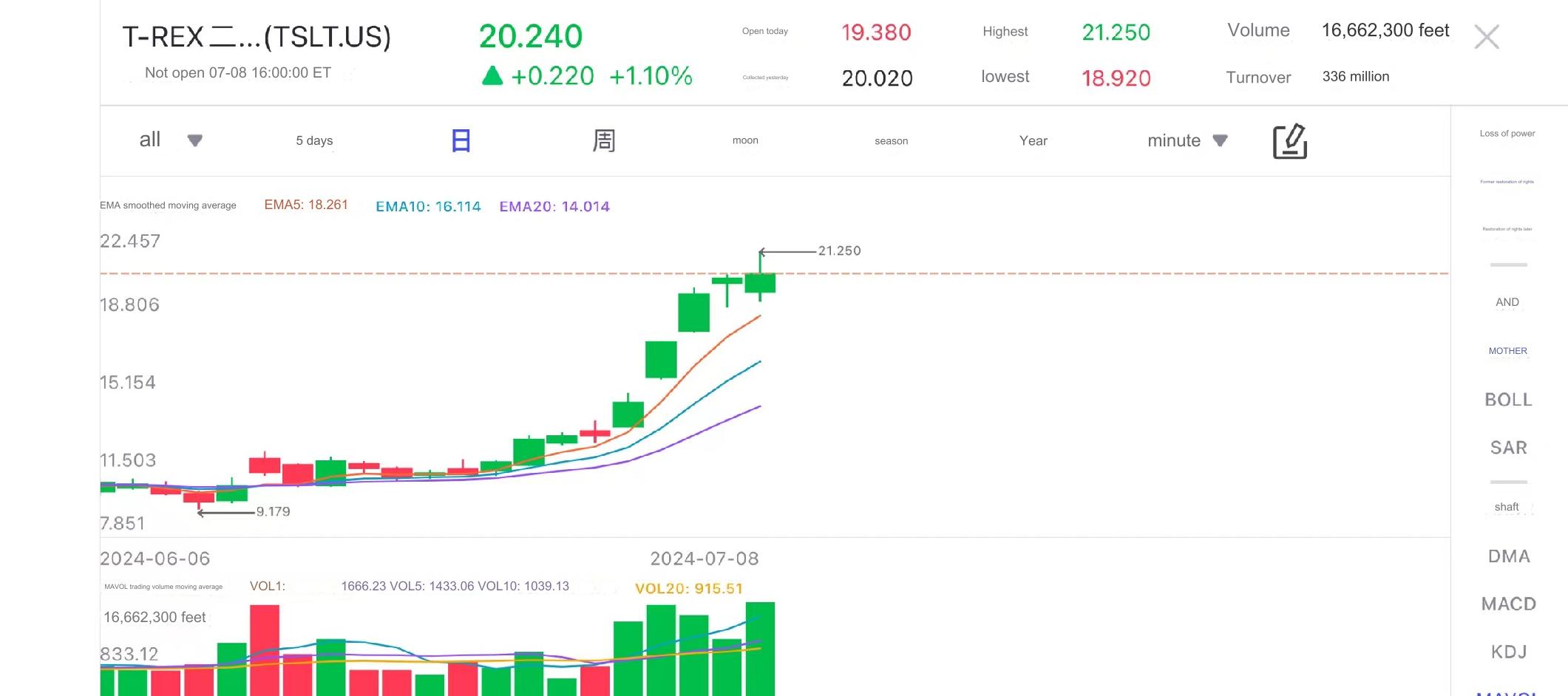

Tesla's stock price has skyrocketed in recent days, and the T-REX Double Long Tesla Daily Target Active ETF, which tracks changes in Tesla's stock price, has also skyrocketed. From July 1st to July 5th, T-REX achieved a weekly increase of 58.39%. T-REX also allocates financial derivatives and Tesla's stock to form an asset portfolio, amplifying the daily performance of Tesla's stock, thus bringing excess returns to investors, but it also means excess risks.

(Source: uSMART)

On the news, Tesla announced on July 2 that its actual delivery volume in the second quarter was 443,000 vehicles, higher than the expected 436,000 vehicles. Although it still shows the same year-on-year downward trend as in the first quarter, the decline is not significant, especially compared with the 15% sales decline previously forecast by Wall Street.

Analysts pointed out that while Tesla faced the dual challenges of reduced demand and price cuts, delivery data that exceeded expectations eased concerns about weak demand for electric vehicles. However, the market is divided on Tesla's future growth prospects, with Wells Fargo recommending selling Tesla shares and CFRA Research taking a more optimistic view.

At the beginning of the year, Wall Street expected Tesla to earn about $3.80 per share, while current expectations have dropped to about $2.40. Brian Rauscher, founder of BFR Research, said investors are generally reluctant to buy stocks with lower earnings expectations. While Tesla's earnings expectations haven't improved significantly yet, things are no longer that bad, and that's good enough for investors.

Currently, both profit expectations and vehicle delivery volumes are closely related to Tesla's automotive business. If Tesla's stock price wants to rise further, it will need to rely on the stable development of its artificial intelligence business.

On July 4, at the 2024 World Artificial Intelligence Conference (WAIC 2024), Tesla launched the second-generation humanoid robot Optimus. The relevant person in charge of Tesla introduced to a reporter from Shanghai Securities News that the second-generation Optimus can walk 30% faster based on upright walking; its fingers have also "evolved" to have sensing and tactile functions, and can gently hold eggs and carry heavy objects, performed with ease.

Tesla expects to start limited production of humanoid robots next year, and there will be more than 1,000 Optimus in Tesla factories to help humans complete production tasks. Musk said that humanoid robots will become the main force in industry in the future, and their number is expected to exceed that of humans, reaching 10 billion to 20 billion units. Tesla aims to produce 1 billion units annually and occupy more than 10% of the market. Its cost is controlled at around US$10,000, and its selling price is expected to be US$20,000, which will bring Tesla a market of US$25 trillion to US$30 trillion.

Wedbush analyst Dan Ives said Tesla is the most undervalued artificial intelligence company on the market, and the value of Tesla's AI business may increase by $1 trillion in the future.

Musk claimed on the X platform in April this year that Tesla would unveil a related "fully autonomous vehicle" product - Robotaxi - on August 8. Currently, people in the industry are generally looking forward to getting investment-worthy information when Robotaxi Day arrives - understanding how far Tesla is from "real autonomous driving."

Ives pointed out in a report on Friday that "the key to Tesla's stock prospects is whether Wall Street can realize that Tesla is the most undervalued AI company." Musk and Tesla will usher in the historic Robotaxi Day on August 8, which will pave the way for the future of FSD and autonomous driving. "If the event is a huge success, it may further push Tesla's stock price higher.