First, let's analyze the market trends. Recent data shows that due to lower-than-expected inflation in May, market confidence in the Federal Reserve's rate cut in September has been strengthened. This news has led to a continuous decline in US bond yields for the fourth consecutive trading day, reaching a two-month low. Among them, the yield on 2-year Treasury bonds, which is more sensitive to Fed rate policy, dropped slightly by 0.3 basis points to 4.683%, the yield on 10-year Treasury bonds dropped by 2.7 basis points to 4.212%, and the yield on 30-year Treasury bonds dropped by 5 basis points to 4.350%. This inverse trend indicates an upward trend in bond prices.

In addition, according to Dow Jones market data, over the past three weeks, the yield on 2-year Treasury bonds has cumulatively declined by 26.7 basis points, marking the largest three-week decline since December 29th of last year. The yields on 10-year and 30-year Treasury bonds have each dropped by 30 basis points and 30.2 basis points over the past two weeks, marking the largest two-week declines since December 22nd and December 15th of last year. This trend indicates a rebound in demand for US bonds in the recent bond market, mainly due to lower-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) in May. The market generally expects the Federal Reserve to launch rate cuts before the end of this year, and the auction activities of 10-year and 30-year Treasury bonds have been active, indicating strong investor demand for US Treasury bonds and driving the bullish market sentiment in the bond market.

These market trends provide investors with an excellent opportunity. Investing in US Treasury bonds not only offers fixed interest income but also allows participation in the stable growth of the US bond market.

Now, you can easily purchase US Treasury bonds on the uSMART App. The purchasing process is as follows:

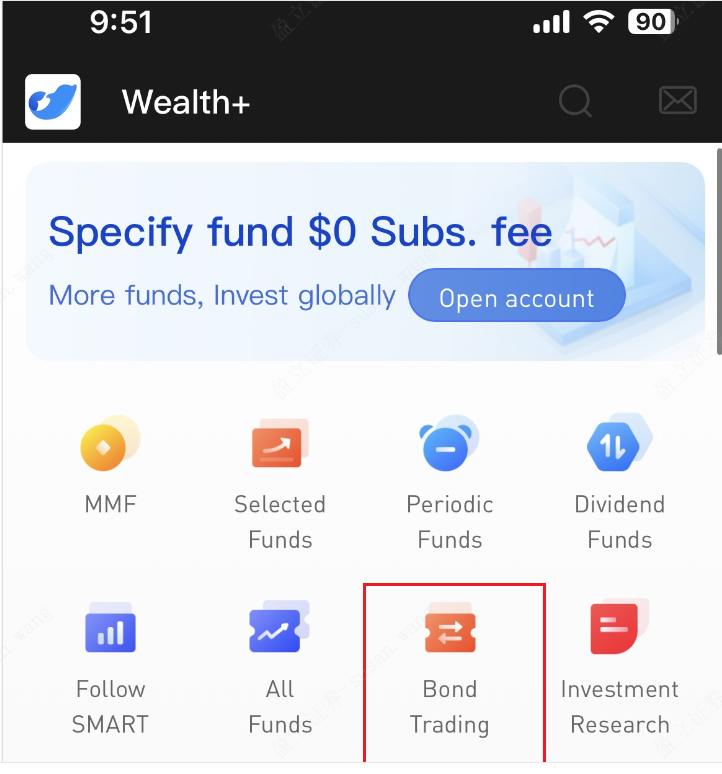

First, open the uSMART App and after entering the main screen, click on "Wealth+" in the lower section.

Next, you will see an option called "Bond Trading". Click on it to enter.

On this page, you can select the desired US Treasury bonds for purchase. You can enter a specific US Treasury bond code or name in the search box, or browse the list to choose the bonds you are interested in. Once you find the bond you want to purchase, click on it to enter the detailed page. On this page, you can view the basic information of the bond, including the maturity date, coupon rate, yield, and more.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.