What is fund regular investment?

Fund regular investment refers to the investment method in which investors regularly purchase fund shares at fixed time intervals and amounts. By regularly investing in funds, investors can avoid subjective judgments on market entry timing, diversify investment costs, and reduce overall risk. Fund regular investment is also known as "lazy man's financial management," as it involves purchasing fund shares in batches to spread investment costs and achieve long-term returns through the compounding effect of time.

Fund regular investment adopts the dollar-cost averaging method, which involves purchasing fund shares in the same amount under different market conditions to average investment costs. Persistently making fixed investments over the long term can enhance investment returns through the compounding effect of time. Fund regular investment is suitable for individual investors who lack professional knowledge or have limited funds, helping them avoid the challenges of stock selection and market timing and achieve long-term stable investment appreciation.

What are the advantages of fund regular investment?

1. Simple operation, time-saving

Regular investment only requires setting the investment amount, deduction time, and product at the beginning of the period. At fixed intervals, the fund sales institution will automatically deduct the investment through the system, reducing time costs.

2. Low initial investment threshold

Compared to purchasing individual stocks or other investment types, the transaction costs of fund regular investment are lower, as the handling fees and management fees for purchasing funds are relatively low. Moreover, many funds only require 10 or 100 yuan for regular investment, and the professional requirements for investors are not high, making it easy to get started.

3. Accumulate small amounts to form a large sum and force savings

Regular investment is similar to regular savings. Persisting in the long term can achieve the effect of accumulating small amounts to form a large sum, especially for those living from paycheck to paycheck, it offers an alternative way to save. Furthermore, regular investment allows for investing a small portion of funds, without causing significant economic and psychological pressure.

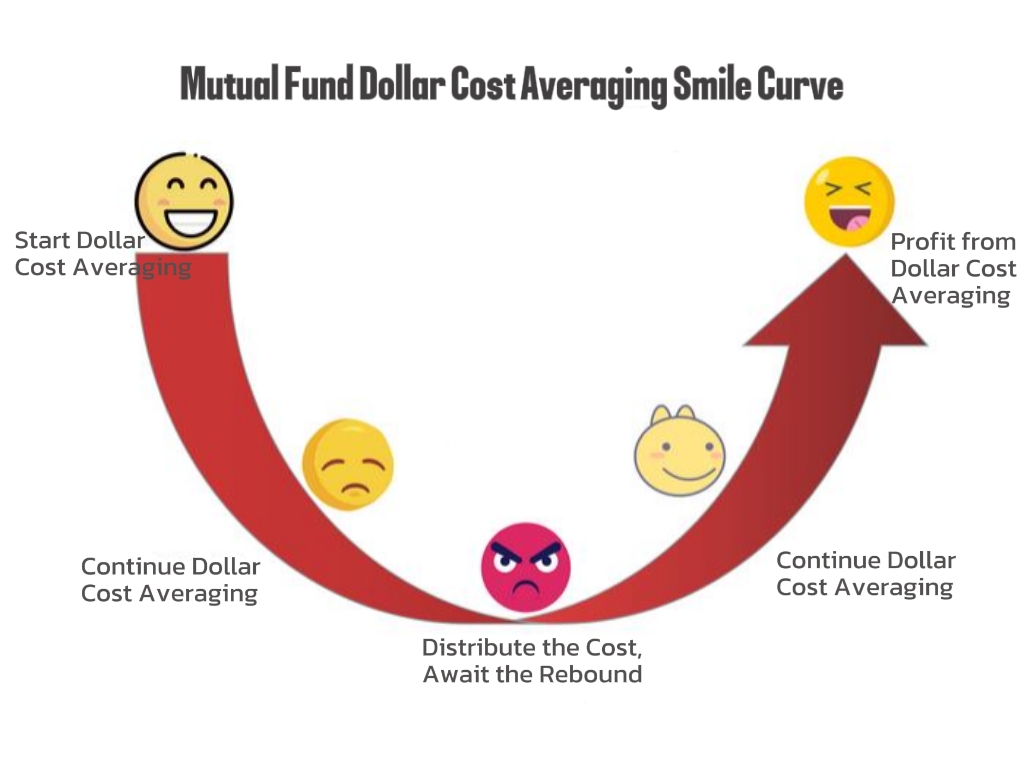

4. Spread costs and reduce investment risks

Since regular investment involves purchasing in batches, the difficulty of timing judgment is reduced. By lowering costs with each regular investment, even if buying at a high point, costs can be gradually averaged out; even in a bear market, only a small portion of funds will be lost. This is the "smile curve" of regular investment-accumulating more cheap chips at low points and realizing profits at high points.

(Source:Sina Finance)

Mutual Fund Dollar Cost Averaging Can Be Implemented in Various Ways

1. Regular Dollar Cost Averaging

Investing a fixed amount at regular intervals. The time period can be set according to your preferences, and this is the most common and effortless method, very useful for diversifying investment risk.

2. Market Value Dollar Cost Averaging

With this method, the fund's market value is guaranteed to grow by a fixed amount each month. For example, if you decide to invest in Fund A monthly, and use market value DCA, the fund's market value should double each month. If the market value increases faster than planned, you can invest less the following month, and if it decreases, you need to invest more.

3. Index Moving Average Method

By comparing the index closing price to its moving average, you can determine market highs and lows, and "buy more at lows, buy less at highs". You can use medium to short-term moving averages like 180-day, 250-day, 500-day as references to more timely reflect the index's trend changes.

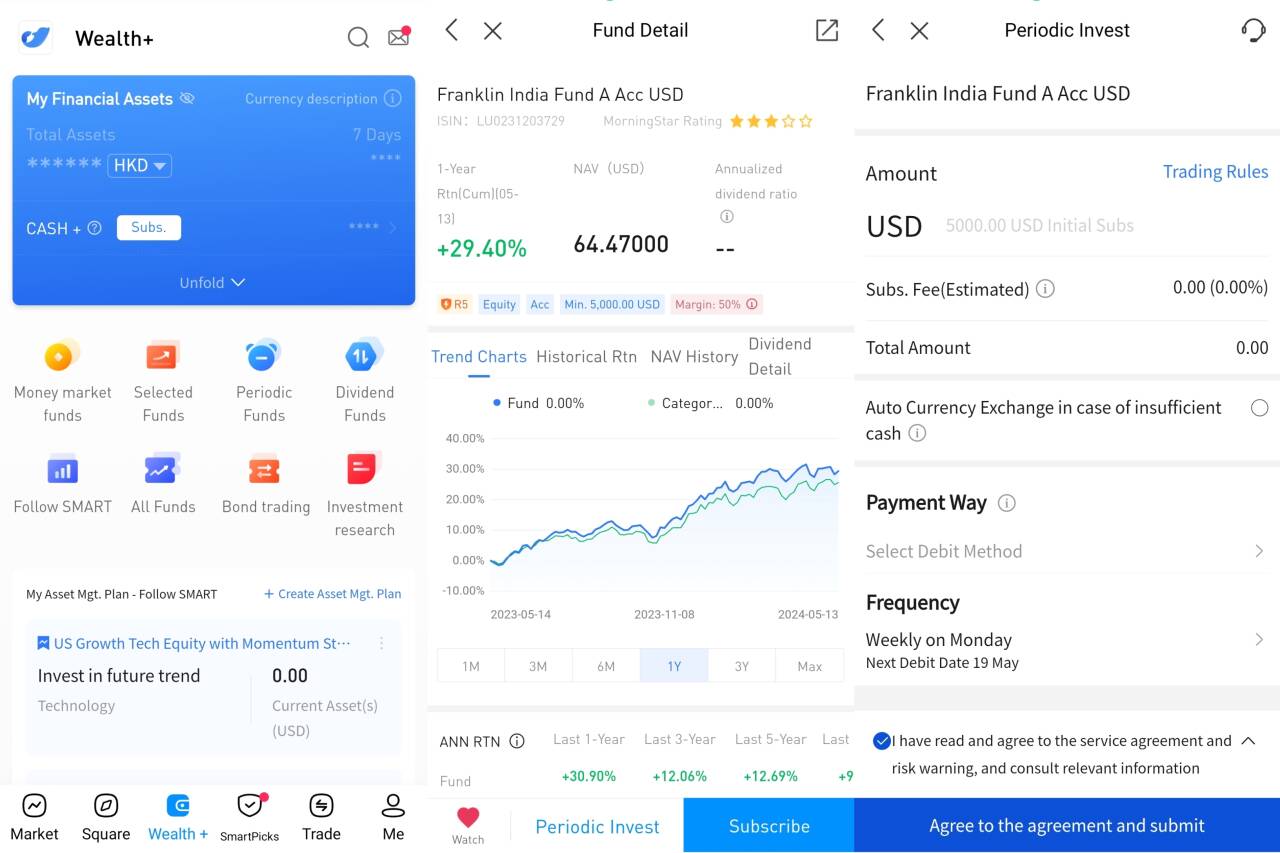

You can perform mutual fund DCA on the uSMART platform.

uSMART offers various fund types including money market, bond, equity and hybrid funds, from renowned fund managers globally to help you break geographical investment barriers.

3 Reasons to Choose uSMART for Mutual Fund Investment:

· Quality Funds: Carefully selected products from JP Morgan, Fidelity, PIMCO, Invesco and other renowned managers

· Safe and Reliable: Assets independently custodied, Hong Kong dual data centers with encrypted data transmission to protect assets and data

· Professional Team: Core members from world-class tech and financial institutions

After logging into the uSMART HK app, click on 'Wealth+' at the bottom of the page, select the fund you want to invest in, you can enter the details page to understand the transaction details and historical trends. Click on the 'Periodic Invest' at the bottom, then fill in the transaction details and submit the order. The step-by-step instructions are shown in the images below:

This diagram is provided for illustrative purposes exclusively

This diagram is provided for illustrative purposes exclusively